Almost 40% of homeowners have regrets about the house they bought, from not looking hard enough for faults before purchase, or sacrificing the number of bedrooms, to being told to “wait until prices come down” - just to be priced out of the market.

That’s the fresh data coming in from Compare the Market’s latest survey of Australian sentiment around the housing market, where median prices across the nation are still pricing homebuyers out of finding the right place.

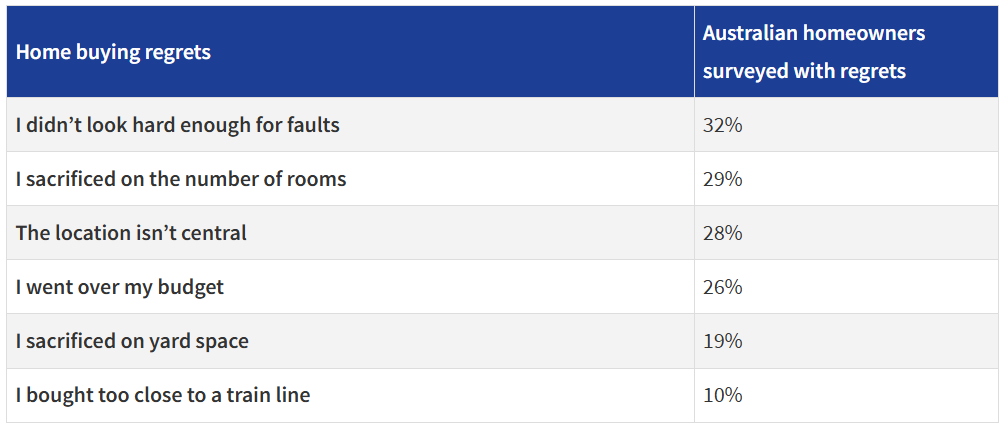

Homebuyers’ biggest regret - almost a third of all those surveyed at 32% - was not being vigilant enough when looking for faults in the home.

Sacrificing on the number of bedrooms to save money was a close second at 29%, while 28% of buyers wished they had bought in a more central location.

The least on homebuyers’ minds was buying too close to a train line, with only 10% of regretful homeowners raising it as an issue.

Yard space was another point of contention, with 19% of homeowners saying they regret sacrificing on backyard space to save money.

It also noted that the biggest regret for renters was not looking hard enough for problems with the building.

Over 11% of renters said they regretted their location, with going too-far over budget the second biggest at 9%.

Compare the Market General Manager of Money Stephen Zeller says there’s a lot of pressure on Australians to buy homes, but you should never skip on a building inspection report.

“It’s really interesting to see that overlooking home defects was the biggest regret for Aussie homeowners,” Zeller said.

“Sometimes they miss things that come up later, but usually inspectors are really good at finding issues with a building, particularly ones that could cause a lot of grief later on.

“You may decide to withdraw from buying to, buy due to the condition, you might want to negotiate some work being done on the home before you buy, or even to reduce the price as you’ll need to spend money to fix it.

“There’s rarely ever ‘the perfect house’, but it’s still important to take your time and figure out your top priorities for a home, your budget, and some preferred locations.”