Azzet reports on three ASX stocks with notable trading updates today

Resmed’s soft update fails to inspire market

Shares in Resmed (ASX:RMD) were trading around 2% lower after the sleep disorder treatment company posted a 10% increase in 2Q revenue to US$1.3 billion, which was 1% above consensus and was a beat on Goldman Sachs forecasted US$1.265 billion.

While ResMed's gross margin increase of 300 basis points was softer than expected, America and rest-of-the-world (RoW) devices revenue was also a beat, which partially offset weaker numbers in RoW masks and SaaS.

Key updates released today include:

• Revenue in the Americas, exc Residential Care Software (RCS) up 12%.

• Revenue in Europe, Asia, and other markets, (excluding RCS), up 8% on a constant currency basis (CCB).

• RCS revenue increased by 8% on a constant currency basis.

Overall, ResMed reported a 52% jump in income from operation to US$417.2 million and a 29% jump in non-GAAP net income to US$358.3 million - which was a beat on Goldman's estimate of US$349 million.

ResMed's Chairman and CEO, Mick Farrell attributed the strong second quarter result to the continuation of the company’s commitment to creating a clear market-leading value proposition in connected digital health.

“Our second quarter fiscal year 2025 top-line growth, margin expansion, and double-digit EPS growth were the result of increased demand for our sleep health and breathing health products and digital health solutions,” said Farrell.

Looking forward, Farrell expects the company’s unrivaled ecosystem to position the company well to capitalise on the once-in-a-generation opportunities with the recent introduction and adoption of consumer wearables that track sleep health, as well as use of GLP-1 therapies.

“We believe these developments will drive increased patient flow as we continue to educate people on the benefits of healthy sleep and breathing, with care delivered right in their own home.”

Redmed declared a quarterly cash dividend of $0.53 per share.

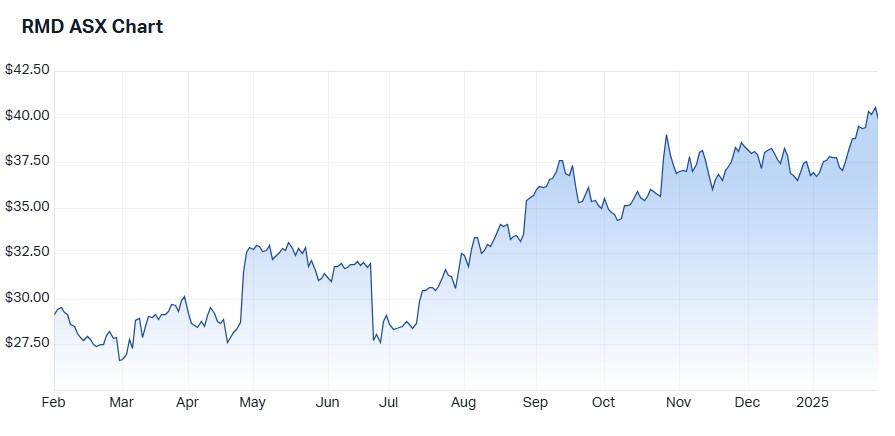

Resmed’s market cap is $24.4 billion, putting it well inside the ASX50 and the stock is up 38% over the last 12 months.

The stock’s share price appears to be in a long-term uptrend confirmed by multiple indicators.

Consensus is Moderate Buy.

Origin falls on production cuts

The market took little time to let Origin Energy (ASX: ORG) know what it thought of today’s quarterly update with the share price down 6% following announced cuts to output expectations.

Due to lower-than-expected benefits from its well optimisation program, the energy retailer reduced its Australia Pacific (APAC) LNG FY25 production forecasts by 2-3% to 670-690 petajoules (PJ).

However, due to higher LNG volumes and prices, APAC LNG revenue for the December quarter was up 3% on the previous period to $2.71 billion.

Lower than expected benefits from well optimisation activities at Condabri, Talinga and Orana, plus lower field performance and unplanned maintenance saw the Origin revise its previous guidance of 685-710 PJ.

However, due to cost savings, partially offset by well optimisation activities in the quarter, unit capex and opex were unchanged at $3.9-$4.3/gigajoule.

Overall, Origin’s LNG trading earnings were up 270% to $85 million in the first half which puts it on track to deliver on FY25 guidance of $400-450 million.

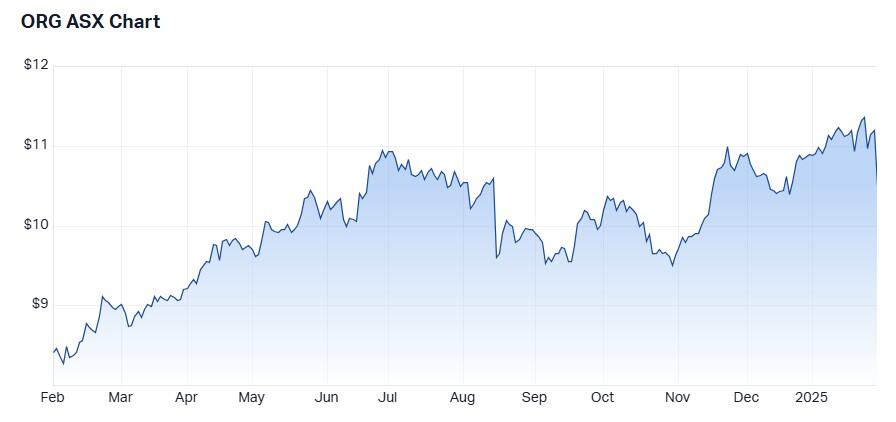

Origin’s market cap is $18.2 billion which puts it well inside the ASX50; the stock is up 26% in the past 12 months.

The stock’s share price appears to be in a long-term uptrend confirmed by multiple indicators.

Consensus is Moderate Buy.

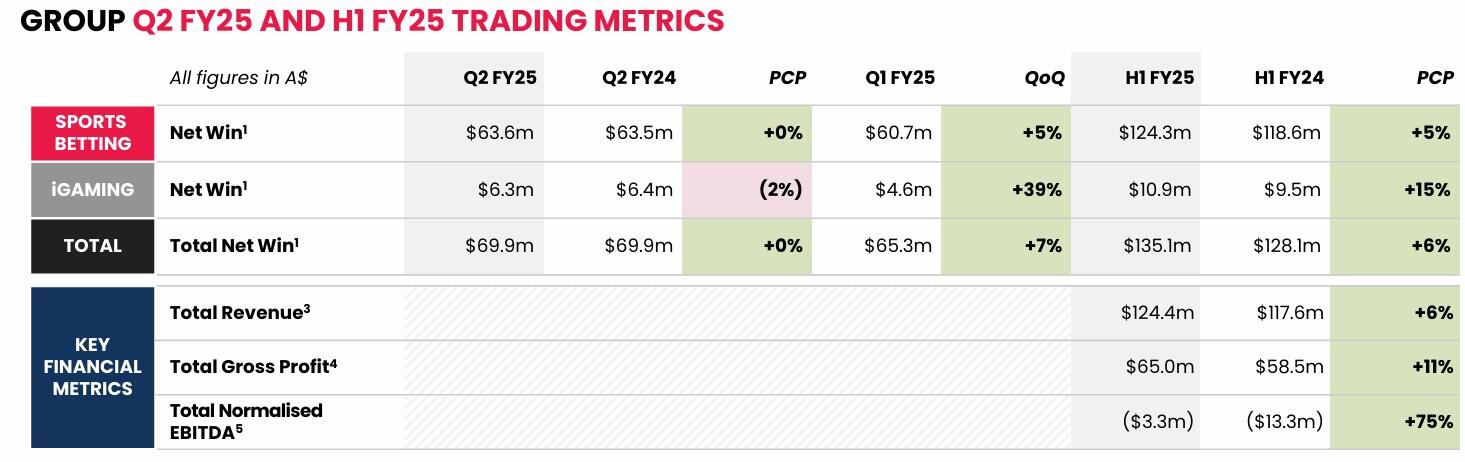

Pointsbet tumbles on dismal 2Q update

Shareholders in Pointsbet (ASX: PBH) had little to crow about today with shares in the sports betting company down 16%, marking its worst trading day in nearly 21 months.

What the market didn't like were revelations that FY25 revenue and earnings forecasts had been cut 7% at the midpoints to $260-270 million and $11-14 million respectively.

The company’s cautious guidance reflects a major stumble in Canada, where Pointsbet’s first-half net win was $18.1 million, well down on analyst expectations of $23.9 million.

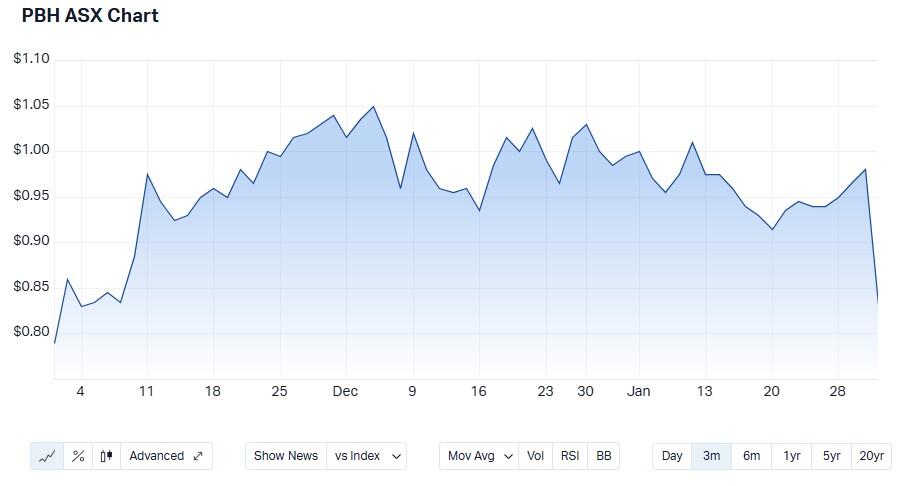

Pointsbet’s market cap is $275 million; the stock is down 6% in one year.

The stock appears to be in a long-term uptrend; its 200-day moving average is upward-sloping and shows that there has been investor demand for the stock over the long term.

Consensus is Strong Buy.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.