Azzet reports on three ASX stocks with notable trading updates today

Major revenue miss for Zip Co

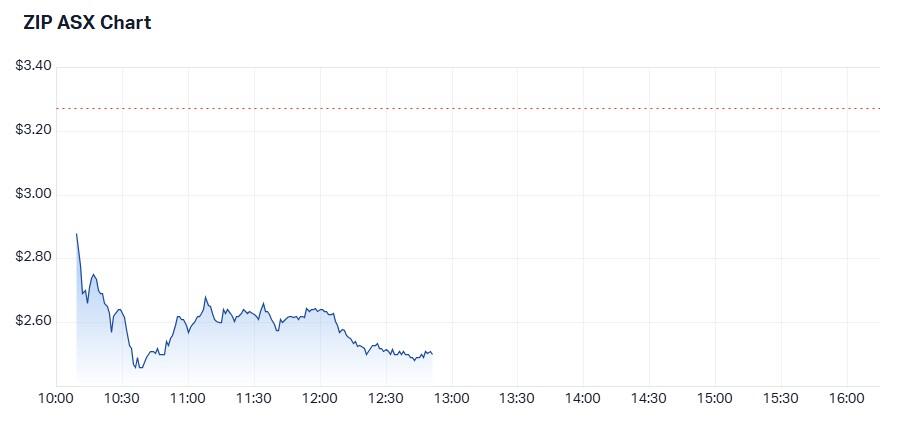

The share price of Zip Co (ASX: ZIP) was down as much as 20% in early morning trading after the buy-now-pay-later stock released its second quarter (FY25) results for the three months to 31 December (2Q FY 2025).

Despite what looked like a reasonably good result, the market did not respond favourably to revelations that the stock had missed its forecast cash earnings by 20% due to seasonality and higher costs.

Cash transaction margins also dipped slightly to 3.6% from 3.5% in the previous period.

However, there’s lots to like about Zip Co’s update today including:

- Cash earnings of $35.3 million, up 50.2% from 2Q FY 2024.

- Total Transaction Volume (TTV) was a record $3.4 billion, up 24.8% year on year.

- Revenue was up 20.5% to $269.4 million.

- Net bad debts of 1.5% of TTV (total transaction value), down from 1.7% of TTV in 2Q FY 2024.

- Active customers grew to 6.3 million, up 1.5% year on year.

- Merchants on its platforms increased by 7.6%.

Cynthia Scott Zip Co CEO attributed strong growth and momentum during 2Q to outstanding U.S. growth, with year-on-year TTV and revenue growth of 38.3% and 41.0% respectively.

“ANZ TTV returned to growth year on year, driven by a strong increase in transaction numbers,” Scott said.

“Our focus on margin improvement and the rollout of Zip Plus has delivered an increase in the Australian portfolio yield, up 110 basis points year on year to 18.6%, another strong result in a high interest rate environment.”

Zip Co’s market cap is $3.4 billion which puts it well inside the ASX200; the stock is up 253% in one year.

ZIP Co's 200-day moving average is trending upwards and highlights long-term investor interest in the stock.

Consensus is Moderate Buy.

Karoon rises on record production numbers

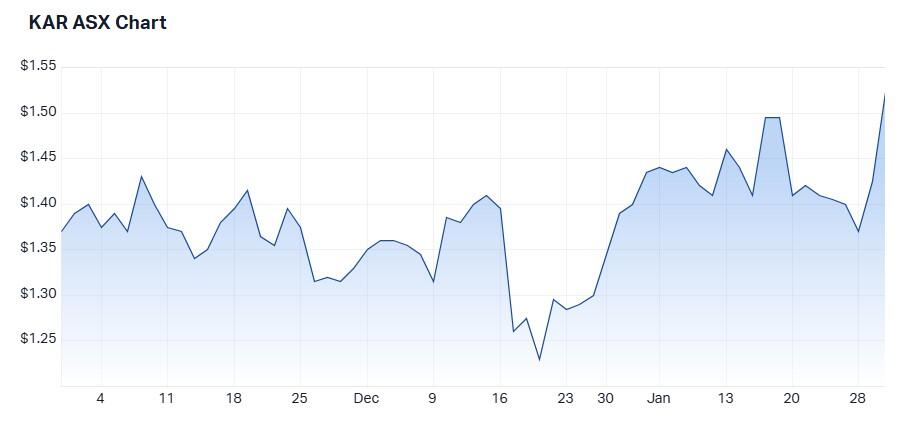

Shareholders in Karoon Energy (ASX; KAR) had lots to smile about this morning with the stock’s share price up as much as 6% following a strong quarterly result which also updated on the company’s buyback activity.

Due to the timing of Bauna liftings in Brazil, the ASX 300 energy stock’s 4Q sales volumes of 3.14 MMboe were 53% higher quarter on quarter, resulting in sales revenue of US$222.2 million. Overall, sales revenue for the calendar year was US$776.5 million, up 14% compared to 2023.

This was an especially pleasing result given that net revenue interest (NRI) was 2.59 MMboe, 3% lower than in the third quarter. However, it helped take calendar-year production to 10.4 MMboe, a record for the company.

Karoon attributed the decline in Q4 production to "a number of operational challenges" during the quarter, including a 12-day shut-in to repair two floating production storage and offloading anchor chains at Baúna plus an active hurricane season in the US Gulf of Mexico.

Karoon also revealed plans to undertake a further US$75 million of on-market share buybacks during the 2025 calendar year.

The company also successfully completed its exploration program in the U.S. Gulf of Mexico, which resulted in increased resources at Who Dat East where there are plans for future development.

In an effort to enhance operational efficiency, the oil producer is also looking into the potential acquisition of the Baúna FPSO and aims to tackle production declines by focusing on organic growth opportunities.

Karoon’s market cap is $1.1 billion which puts it just outside the ASX300; the stock share price, which reflects the price of oil, is down 23% in one year.

Karoon’s share price appears to be in a near-term rally within a long-term bearish trend.

Consensus is Moderate Buy.

Alterity Therapeutics soars following trial results update

The share price of Alterity Therapeutics Ltd (ASX: ATH NASDAQ: ATHE) more than doubled today after the clinical-stage biotech stock and ASX minnow released the results of its Phase 2 trial resulting in multiple system atrophy.

Given that there are no approved treatments that slow the progression of MSA, the biotech’s CEO David Stamler was elated by signs that ATH434 has demonstrated significant slowing of clinical progression and an excellent safety profile in this rare, rapidly progressive disease.

“The fact that we achieved statistical significance on the UMSARS is extremely meaningful because it assesses the functional areas affected in MSA and is the endpoint needed to support drug approval by the U.S. Food and Drug Administration (FDA),” Stamler noted.

The biotech stock's market cap is $96 million; the stock's share price is up 125% today and 300% over one year.

The stock is in a strong bullish trend confirmed by multiple indicators. Specifically, the 5-day moving average of the stock price is above the 50-day moving average.

Consensus is Strong Buy.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.