Earnings season: Azzet updates on three ASX stocks with noteable trading updates today.

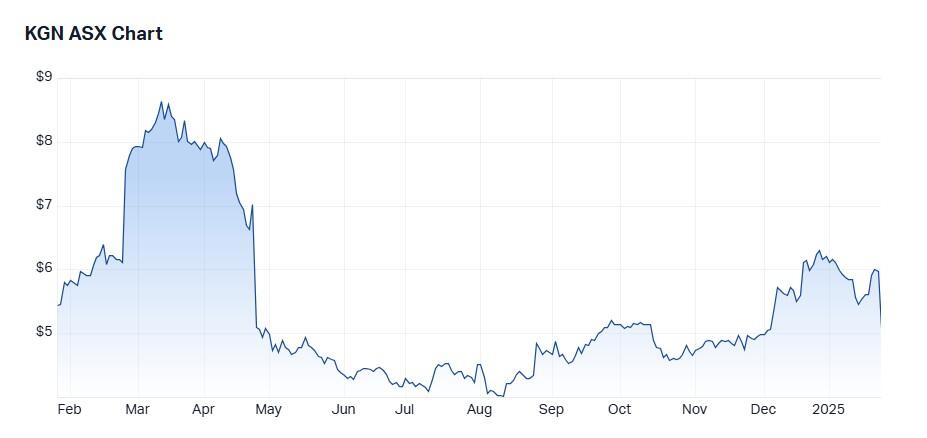

Kogan tanks after underwhelming trading update

Shares in Kogan.com (ASX: KGN) were down over 12% in early afternoon trading following the release of the online retailer’s trading update which missed consensus expectations by some distance.

Kogan’s trading update, which includes the critical Christmas trading period showed that gross sales were up 10.3% to $492.5 million for the first half of 2025, gross profit grew 18.3% to $106 million, while adjusted earnings rose 21.2% to $19 million.

However, where the first half result came undone was the adjusted earnings; While it increased 17.5% to $25.3 million, this number was 7% shy of the $28 million the market was expecting.

Throughout 2024, Kogan undertook a digital transformation for Mighty Ape, which successfully went live in late October 2024.

What appears to be concerning brokers is some underlying weakness in active customers and the gross margins, which is attributed to the growing cadre of competitors like Amazon, eBay, Kmart, and Temu.

Kogan’s share price is down around 6% in 12 months and the consensus on the stock is Hold.

Based on the current price of $5.24 Kogan has a market cap of $522 million.

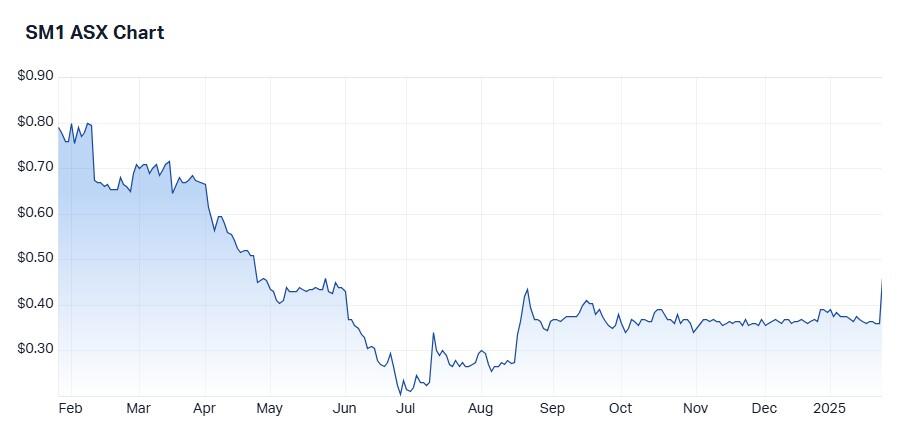

Synlait soars on new guidance

Shares in Synlait (ASX: SM1) were up around 24% in mid-afternoon trading after the Kiwi-based dairy processor released its financial guidance for the half year to 31 December.

Due to growth across all parts of its operation, Synlait now expects its earnings for the six months to be between NZ$58 million and NZ$63 million.

In an effort to maintain its relationship with farmers, the company committed to paying a 10c per kilogram of milk solids premium to South Island suppliers for three seasons beginning 2025/26.

Key specific that underscored today’s result were:

• New business development driving growth in advanced nutrition products

• Strong performance of its ingredients business driven by improved management of foreign exchange and an optimised product mix

• Continued cost control, driven by reduced consultancy spend, headcount reductions, and improved optimisation for the North Island assets

Accompanying today’s update, Synlait Milk acting CEO Tim Carter notes the company’s expected return to profitability which it releases its first-half FY25 result on 24 March.

Synlait’s share price is down 43% in one year and consensus on the stock is Moderate Sell.

Based on the current price of $0.445, the company has a market cap of $268 million.

The trading bullish sign is evidenced by a rising 20-day moving average. However, caution is warranted; the 5-day moving average still lies below the 50-day moving average and implies that investors with a medium to long-term time horizon are still selling.

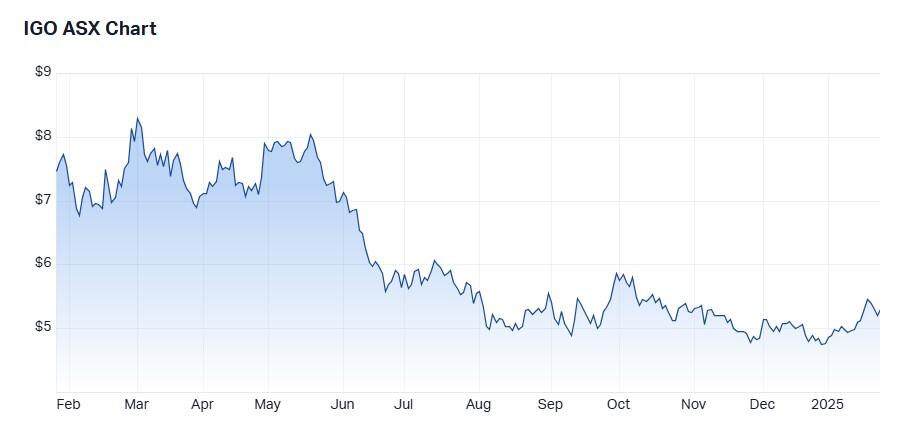

IGO up after putting the brakes on Kwinana

Shares in IGO (ASX: IGO) were up over 2% in late afternoon trade after the battery materials company released an update on the Kwinana Lithium Hydroxide Refinery.

Given where the lithium price is right now, investors appear to have responded favourably to the decision to put the brakes on its Kwinana refinery which IGO owns (49%) together with Tianqi Lithium Energy Australia (TLEA).

Today’s joint release by TLEA shareholders, IGO, and Tianqi Lithium Corporation (TLC) did not comment on the decision to cease all works and activities on Lithium Hydroxide Plant 2 (LHP2) at Kwinana.

Today’s announcement follows plans by IGO to book an impairment on the asset later this week.

Last year, Albemarle Corporation, 49% owner of the Greenbushes lithium mine has suspended work on three of its four 25,000 tonne trains a its Kemerton lithium refinery near Bunbury.

However, Tianqi and IGO, which collectively own the remaining 51% of Greenbushes continue to benefit from its profitability.

While the Kwinana facility, which began producing lithium hydroxide in 2021 has yet to reach capacity, this is unlikely while the price remains depressed.

IGO’s share price is down around 28% in 12 months and the consensus on the stock is Hold.

Based on the current price of $5.31 IGO has a market cap of around $4 billion, putting it well inside the ASX200.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.