Azzet reports on three ASX stocks with notable trading updates today

Domino’s soars on plans to slash its aggressive store rollout strategy

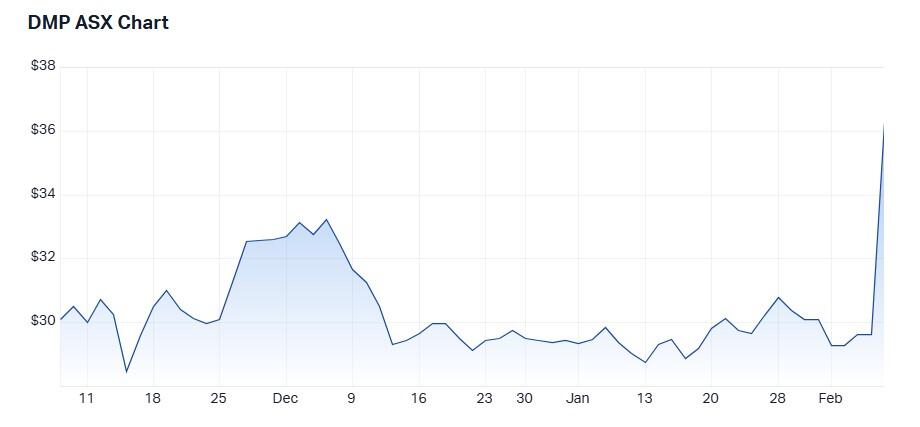

Shareholders in Domino’s Pizza Enterprises (ASX: DMP) were all grins this morning after the share price soared 22% following the pizza chains' market update.

While today’s result was scratchy at best, the market appears to have rewarded the company for taking necessary remedial action to its questionable roll out strategy which has cost the group dearly.

Within its spontaneous market update, only three weeks out from its half-year announcement were revelations that plans to curb its aggressive store rollout plans would be a net positive for the balance sheet.

While plans to close 205 loss-making stores in 4Q FY25 – 172 in Japan alone – are expected to trigger around $97 million in near-term costs, management expects $15.5 million in estimated annualised savings.

Overall, these closures are expected to generate $10-12 million annualised earnings uplift while incurring one-off restructuring costs of $61.8 million.

Underlying net profit before tax is expected to be between $84 million and $86 million, down from $89.6 million in the previous period but within the guidance range.

Net debt increased by $15 million to $705.1 million at the end of the December half.

The group plans to pay a 55 cents per share (CPS) interim dividend, well below consensus of 63.9 CSP.

Other milestones with Domino’s first half update today include:

- Same-store sales were down 0.6%.

- Same-store sales for the first five weeks of 2H FY25 were up 4.3%.

- Strategic review to deliver $18.6 million in annualised network savings.

Today’s store closure revelations herald the end to the group's decade-long new store roll-out program which led to new stores cannibalising the sales of nearby stores, especially in France and Japan.

Despite major store closures in Japan, management is said to be committed to this market, albeit with a more disciplined approach to expansion.

Today’s market update follows recently announced plans by recently appointed CEO Mark van Dyck to reshape the business in the interests of customers, franchise owners and investors.

Domino’s market cap is $3.3bn making it the 151st largest stock on the ASX.

The share price is down 46% over five years following numerous profit downgrades but is up 23% year to date.

Domino’s shares appear to be weak with little demand from investors.

The 200-day moving average is downward sloping and recent price action is weak.

Consensus does not cover this stock.

Nick Scali rises on patchy 1H result

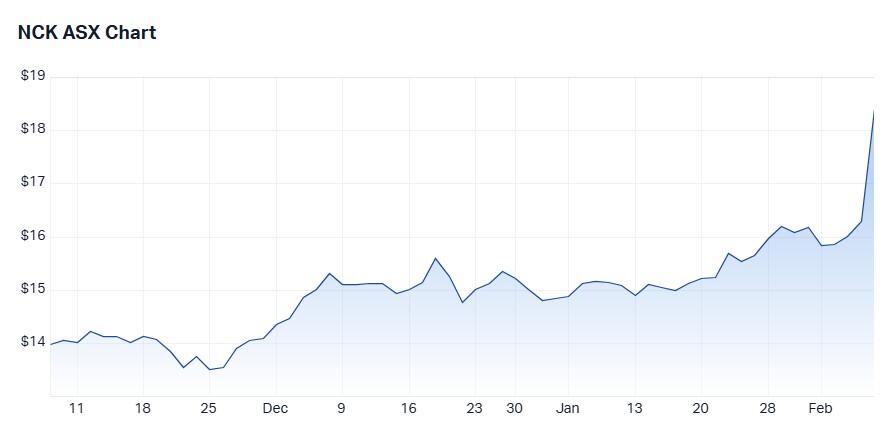

The market appears to have overlooked a 16.3% slide in Nick Scali’s (ASX: NCK) underlying first half profit after tax of $33.2 million, with the share price up around 22% - to a 52-week high of $18.30 - on the back of good news surrounding the UK business segment acquired in May 2024.

Immediate improvements in the UK business – as Fabb stores transition to the Nick Scali brand – are evident in the notable improvement in gross margins, which increased to 45.1% from 41% pre-acquisition.

Management also flagged that post-acquisition restructuring had already led to annualised cost savings of approximately $2 million.

Within today’s update, management also noted that re-branded Nick Scali UK stores were the top three performing UK stores in January 2025 for written sales orders. The top selling Nick Scali sofa in Australia and NZ is now the top selling sofa in the group’s UK stores.

The group plans to complete the refurbishment of an additional eight stores by 30 June this year.

While sales orders in Australia and NZ were up 8.5% in January and 5% in the first week of February, management warned that trading conditions locally remain unpredictable.

Nevertheless, the underlying net profit for Australia and NZ was $36 million - despite being 16% down on last year - and above the $30 million to $33 million profit guidance.

Highlights in today’s trading update include:

- A&NZ group revenue was $222.5 million, down 1.8%.

- 10.8% lift in HY group revenue to $251.07 million.

- Interim dividend of 30 cents per share, down from 35c.

- UK underlying net loss of $2.8 million was lower than guidance.

- UK sales orders of $19.4 million were impacted by store closures during refurbishment.

In the second half, one Plush store will open in Melton, Victoria and further stores are expected to open in 2H FY25.

Nick Scali’s market cap is $1.6 billion making it the 254th largest stock on the ASX.

The share price is up 25% over 1 year and up 16% in the last week.

The stock is in a strong bullish trend confirmed by multiple indicators. Specifically, the 5-day moving average of the stock price is above the 50-day moving average.

Consensus is Moderate Buy.

Charter Hall Long WALE REIT falls on lower 1H revenue

Shares Charter Hall Long WALE REIT (ASX: CLW) are trading lower today after revealing within its 1H FY25 update that revenue from ordinary activities of $94.5 million, down 14.8% from H1 FY 2024.

Operating earnings of $89.8 million and operating earnings per share of 12.5 cents were down 3.8% and 4.4% year-on-year respectively.

Other core financial metrics reported by the REIT today include:

- Statutory earnings of $51.3 million for six months.

- 3.5% like-for-like net property income (NPI) growth.

- Net tangible assets (NTA) were reported at $4.62 per share.

- Portfolio weighted average lease expiry (WALE) stood at 9.7 years, with portfolio occupancy at 99.8%.

- Gearing is 31.8% with a stable portfolio valuation.

During the half

During the half, the REIT completed a $50 million buy-back, divested $300.4 million, and acquired $11.5 million in assets.

As part of the deals of the half year, the REIT signed agreements with Coles Group Ltd (ASX: COL) for an expansion and lease extension at its Perth Airport Distribution Centre in WA.

The board declared an unfranked quarterly dividend of 6.25 cents per share, which brings the half-year dividend payout to 12.5 cents per share.

Management reaffirmed its FY25 operating earnings per security guidance of 25.0 cents and distributions per security guidance of 25.0 cents, which gives the REIT an unfranked trailing dividend yield of 6.6%.

The REIT’s market cap is $2.7 billion making it the 177th largest stock on the ASX; the share price is up 0.52% over one year and up 4% year to date.

The 200-day moving average trends upwards and highlights long-term investor interest in the stock.

Consensus is Hold.

This article does not constitute financial product advice. You should consider independent advice before making financial decisions.