Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

-----------------------------------------------------------------------------------------------------------------------------------------------------

Summary

- Amazon reports strong net income

- Eli Lilly results mixed; AstraZeneca keeps climbing

- Expedia excels in booking and revenue

- Nippon Steel slumps amid weak demand and US Steel deal uncertainty

- Pinterest soars, smashes estimates

8:49 am (AEDT):

Good morning, everyone! I'm Harlan Ockey, here to walk you through earnings season on Azzet's live blog today. It's another big day, with major companies like Amazon, Eli Lilly, and Expedia releasing their results overnight — and there'll be plenty more to come later in the day.

Starting off with Amazon (NASDAQ: AMZN), the company has reported an 89% surge in net income to US$20.0 billion in the fourth quarter of the 2024 financial year, as net sales rose 10% to $187.8 billion.

The global technology giant said diluted earnings (EPS) per share jumped 86% to US$1.86 in the final three months of the financial year ending 31 December. Over the full year, net income increased 95% to $59.2 billion and diluted EPS by 91% to $5.53, as net sales rose 11% to $638.0 billion.

“The holiday shopping season was the most successful yet for Amazon and we appreciate the support of our customers, selling partners, and employees who helped make it so,” President and CEO Andy Jassy said in an earnings release.

Amazon shares (NASDAQ: AMZN) added US$2.66 (1.13%) on the day to close at $238.83, after ranging between $236.01 and $239.66, capitalising the company at $2.50 trillion, before settling back in after-hours trading to $235.89. (Thank you Garry West for the write-up!)

We also have a preview of what to expect this earnings season, courtesy of our own Mark Story. The ASX is close to record highs, but the market is likely to be impacted more by structural shifts rather than its standard cycle.

8:59 am (AEDT):

Looking to the NYSE, Eli Lilly (LLY) posted mixed results. Its earnings per share grew to US$5.32, beating estimates of $5.01. Revenue, meanwhile, was $13.53 billion, matching market estimates.

Demand for weight-loss medications Mounjaro and Zepbound continued to grow. Mounjaro saw US$3.53 billion in sales last quarter, a 60% year-over-year increase.

The company's 2025 guidance included earnings per share from US$22.05 to $23.55, and sales between $58 billion and $61 billion.

Eli Lilly's share price rose by 3.4% across the day.

9:17 am (AEDT):

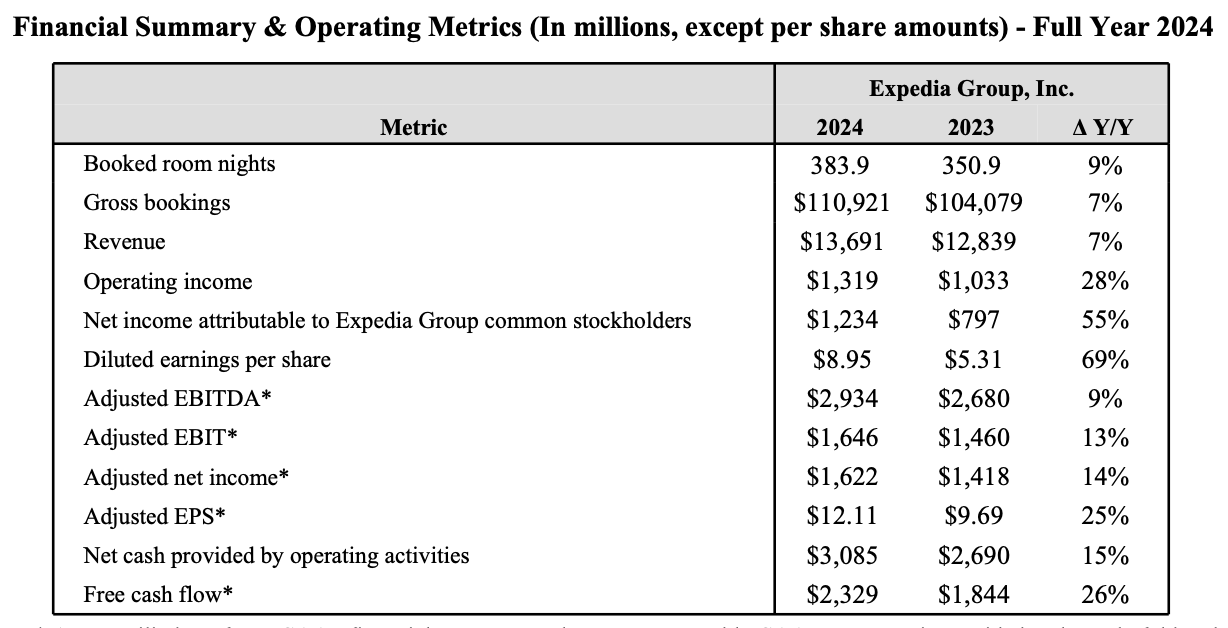

Returning to the NASDAQ, Expedia (EXPE) reported strong bookings and revenue increases. The company's gross bookings were up 13% year-over-year. Revenue rose 10% to US$3.18 billion, beating analyst estimates of $3.07 billion.

Across 2024, both gross bookings and revenue grew 7% over 2023.

The company's operating income was US$216 million in Q4, an increase of 109% over Q4 2023's $104 million., Its diluted earnings per share reached $2.20, compared with $0.92 year-over-year.

“Our fourth quarter results exceeded our expectations and reflect continued strong execution and better-than-expected travel demand. All three of our core consumer brands achieved bookings growth and we further accelerated growth in our B2B business," said CEO Ariane Gorin.

9:51 am (AEDT):

Over in Denmark at the CPS — or the NASDAQ, if you prefer — Maersk reported its third-best ever financial year. Its full-year revenue was US$51.1 billion, while its EBITDA rose 26% to $12.13 billion.

In Q4, its EBITDA was US$3.6 billion, above estimates of $3 billion.

“We saw growth across all three of our segments. We saw also a pretty strong price environment on the back of that growth and some shortages of capacity, so global trade continuing to be strong allowed us to deliver a very strong quarter," said CEO Vincent Clerc.

Its free cash flow at the end of the year was US$5.1 billion, compared with $4.0 billion in 2023.

Meanwhile on the TYO, Nippon Steel (5401) reported a slump in revenue. Its nine-month revenue last quarter was JP¥6.55 trillion, down 1.3% year-over-year.

Its net profit also dropped by 17.6% year-over-year, reaching JP¥386 billion.

The company's revenue guidance this fiscal year is JP¥8.6 trillion, which would be a 3.0% decline from the prior fiscal year.

Nippon Steel's acquisition of US Steel was blocked by the United States last month over national security concerns. The companies have filed several lawsuits, and Nippon Steel vice chair Takahiro Mori said today that he hopes a meeting between U.S. President Donald Trump and Japanese Prime Minister Shigeru Ishiba will help advance the deal. US Steel's CEO will also meet with Trump today to discuss the acquisition.

10:14 am (AEDT):

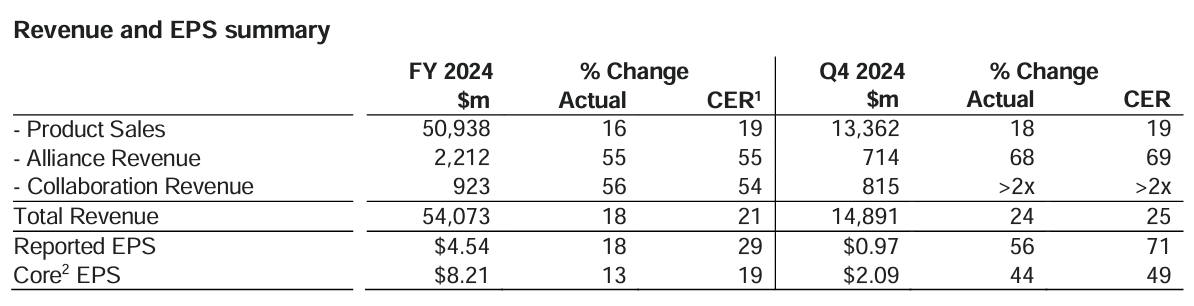

At the LSE, AstraZeneca (AZN) posted strong revenue growth. Its revenue in Q4 was US$13.36 billion, up 18% year-over-year.

Core earnings per share were US$2.09 last quarter, compared with $1.45 year-over-year. Estimates were $2.07.

Oncology led revenue growth, representing 24% of the increase. AstraZeneca expects total revenue to grow by a high single digit percentage in the 2025 financial year.

“This year marks the beginning of an unprecedented, catalyst-rich period for our company, an important step on our Ambition 2030 journey to deliver $80 billion Total Revenue by the end of the decade. In 2025 alone, we anticipate the first Phase III data for seven new medicines, along with several important new indication opportunities for our existing medicines,” said CEO Pascal Soriot.

11:20 am (AEDT):

On the TSX, Thomson Reuters (TRI) saw revenue improve, although earnings per share sunk. Revenue last quarter was US$1.91 billion, up 5% year-over-year.

Operating profits also grew by 29% from Q4 2023 to reach US$722 million. Diluted earnings per share fell to US$1.30, down 13% year-over-year.

"We had several important product launches last year featuring generative AI capabilities, including CoCounsel 2.0, CoCounsel Drafting and Checkpoint Edge with CoCounsel," said CEO Steve Hasker on an earnings call. "We also had dozens of other enhancements across the portfolio, and we're progressing with efforts to drive more seamless integration between our products."

Over at the NYSE, Equifax (EFX) posted revenue below estimates. While revenue grew by 7%, it was below LSEG analysts' projection of US$1.44 billion.

Its earnings per share were US$2.12, just above estimates of $2.11. Workforce solutions, the company's largest division, saw revenue grow by 7% to $598.1 million.

Equifax expects 2025 revenue will be dented by weakened U.S. hiring and mortgage markets, but projects revenue in Q1 will be US$1.39-1.42 billion.

11:58 am (AEDT):

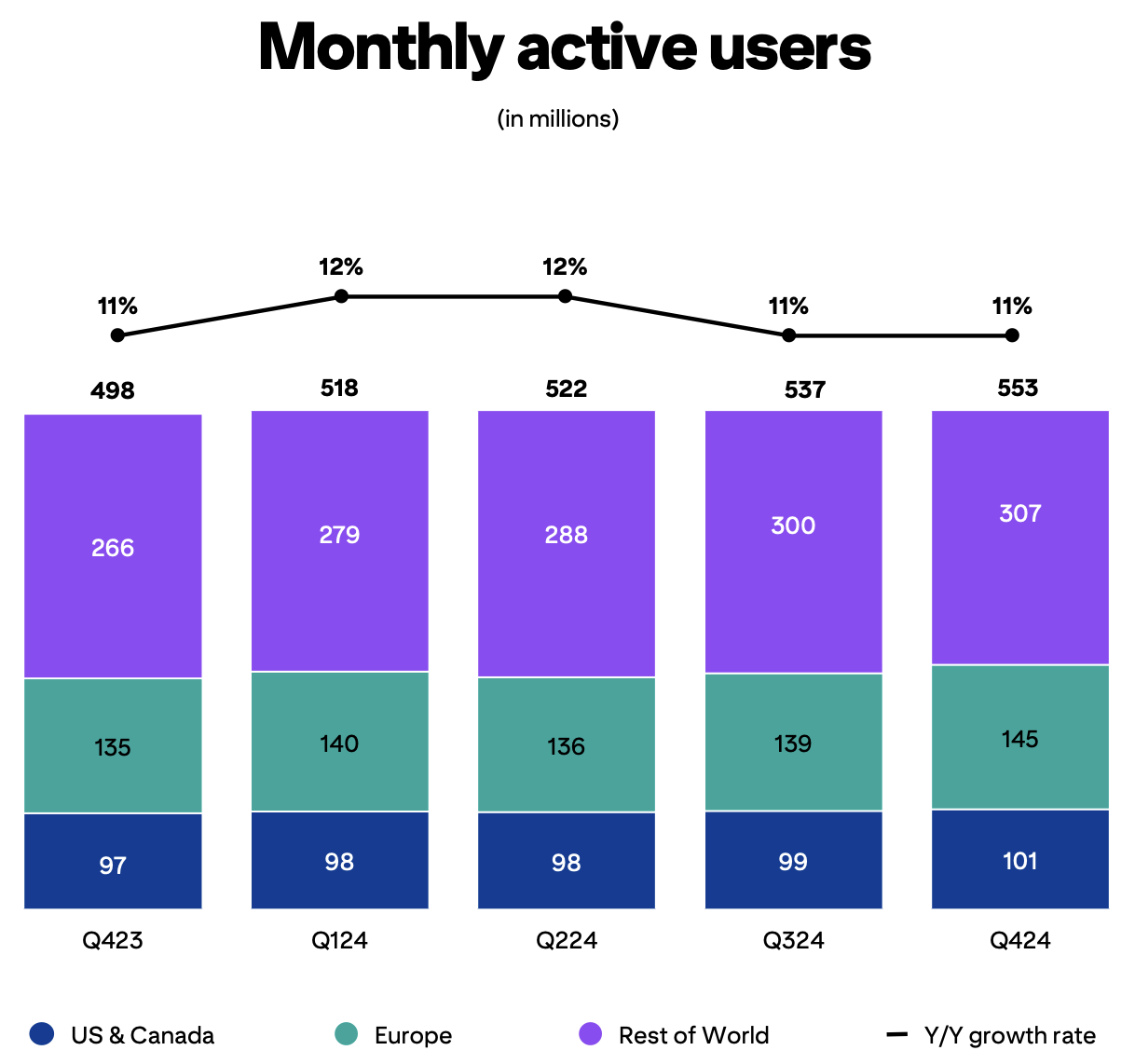

Still at the NYSE, Pinterest (PINS) bested expectations in revenue. Its revenue last quarter was US$1.15 billion, above LSEG estimates of $1.14 billion.

Its EBITDA in Q4 was US$470.9 million, beating analysts' projected $444.8 million. Pinterest's monthly active user numbers grew by 11% year-over-year to reach 553 million.

Shares soared by 20% following the release. The company's revenue guidance for Q1 2025 is US$837-852 million, which would be 13-15% growth year-over-year.

And at the NYSE again, Cloudflare (NET) also posted strong revenue. Revenue last quarter was US$459.9 million, representing 27% year-over-year growth and surpassing analyst estimates of $452 million.

Adjusted earnings per share were US$0.19, slightly above estimates of $0.18.

“We had a very strong end of 2024. We saw record growth in our largest customers, those that spend more than $1 million with Cloudflare per year — closing the year with 173," said CEO Matthew Prince.

Cloudflare's full-year revenue was US$1.67 billion, up 29% over 2023. It projects revenue in 2025's Q1 will be from $468 million to $469 million.

12:26 pm (AEDT):

Moving to the NASDAQ, Warner Music Group (WMG) posted a decline in revenue and operating income. Its revenue fell by 5% year-over-year to US$1.67 billion, while its operating income dropped by 40% year-over-year to $214 million.

Its net income and free cash flow both rose, however. Net income grew to 241 million, up 25% year-over-year, while free cash flow climbed by 12% to $296 million.

Earnings per share were US$0.45, above analyst estimates of $0.38.

“Our results this quarter were driven by artists and songwriters of all stages of their careers and from all corners of the world, across new releases and reinvigorated catalog,” said CEO Robert Kyncl. “Warner Music Group's engine is strong.”

Warner Music Group also announced a new multi-year agreement with Spotify. This would add new audio and visual content to Spotify's platform, the companies said, and additional paid Spotify subscription tiers that could include higher-quality audio. Spotify inked a similar deal with Universal Music Group last week.

12:56 pm (AEDT):

Returning to the TYO, Fujifilm (4901) reported strong revenue and income growth, which it credited partly to favourable exchange rates.

Revenue was up 8% year-over-year to reach JP¥2.33 trillion. Operating income increased by 9% and stands at ¥223.3 billion, while net income was up by 4.5% to ¥181.5 billion.

Its Business Innovation division saw the highest revenue, increasing by 4.7% year-over-year to JP¥294.4 billion. Fujifilm reaffirmed its previous full-year revenue forecast of ¥3.15 trillion, with operating income at ¥315 billion.

“Fujifilm has delivered strong financial results for the first nine months, driven by robust performance in our Electronics and Imaging segments, resulting in unprecedented sales and operating profit for this period,” said CEO Teiichi Goto. “We aim to achieve record-high sales and profit for the fiscal year ending March 2025."

The company aims to invest JP¥170 billion into capital expenditure and research and development up to March 2027, with the goal of strengthening its global supply chains.

That's all from me today — Sienna will be here for the rest of the afternoon. See you next time!

1:10 pm (AEDT):

Thank you Harlan for that great coverage this morning. Sienna Martyn here to take you through this Friday afternoon.

To kick us off, we will take a look at Domino's Pizza, with more to come from Mark Story.

While Domino’s Pizza Enterprises’ (ASX: DMP) update was scratchy at best, the market appears to have rewarded the company for taking necessary remedial action to its questionable rollout strategy which has cost the group dearly.

While plans to close 205 loss-making stores in 4Q FY25 – 172 in Japan alone – are expected to trigger around $97m in near-term costs, management expects $15.5m in estimated annualised savings.

Overall, these closures are expected to generate $10-12m annualised earnings uplift while incurring one-off restructuring costs of $61.8m.

The group plans to pay a 55 cents per share (CPS) interim dividend, well below the consensus of 63.9 CSP.

The share price was trading 21% higher at midday.

1:23 pm (AEDT):

Now let's turn to major US confectionery and snack maker Hershey's Co (NYSE: HSY).

Shares in the company were up 4.40% at the time of writing this trading at US$152.34 after easily beating quarterly earnings estimates.

Hershey’s reported adjusted earnings of US$2.69 per share, beating Wall Street’s estimate of $2.37.

Revenue came in at $2.9 million, beating forecasts and increasing from $2.7 million in the previous year.

However, the company issued disappointing guidance for 2025 as a result of rising cocoa prices.

“While we continue to expect the surge in cocoa prices to put significant pressure on 2025 earnings, we will focus on driving top-line and share momentum, executing our transformation and productivity programs, and positioning ourselves to deliver peer-leading performance over the long term,” said CEO Michele Buck.

1:55 pm (AEDT):

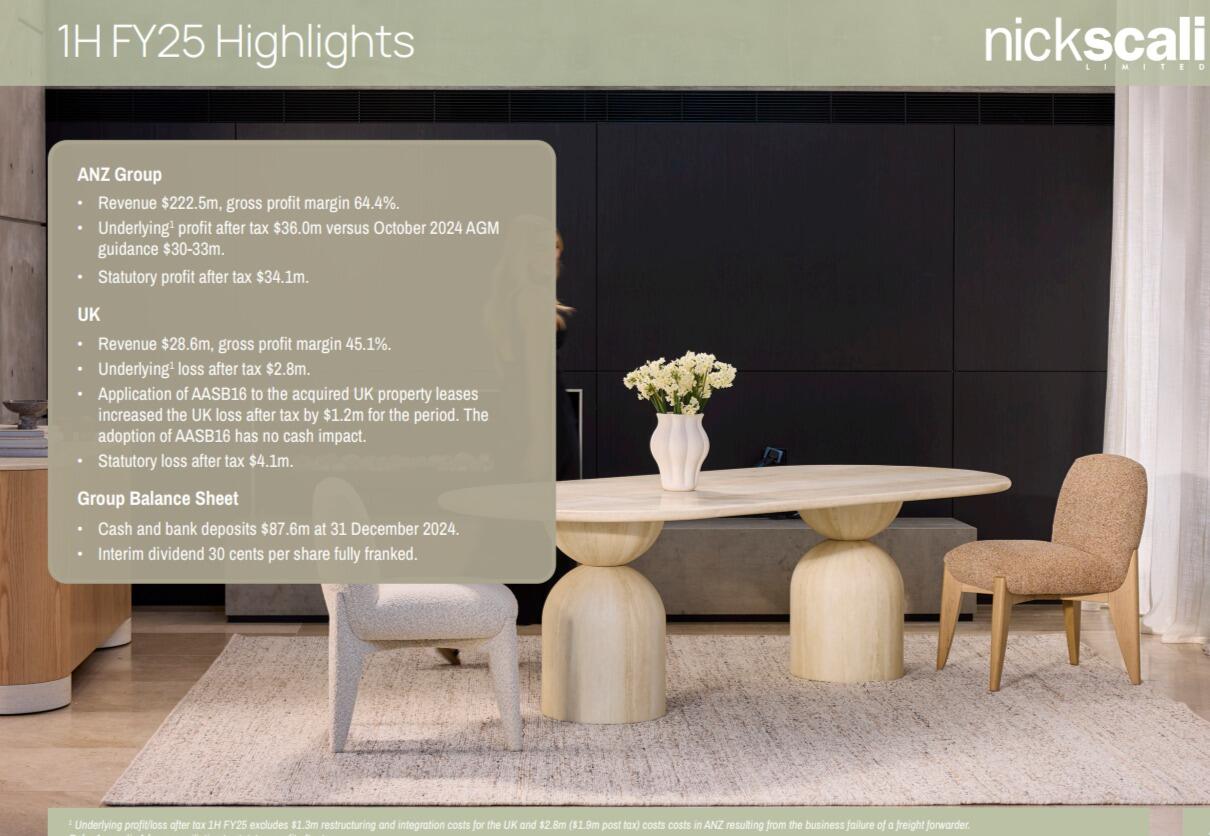

Also on the ASX today, Nick Scali Limited (ASX: NCK) shares rose to a record high after the Australian furniture company’s reported earnings came in better than expected.

Underlying profit after tax from its Australian market was A$36 million, higher than its guidance of A$30-33 million.

The company’s revenue rose 10.8% to A$251.1 million in the last half of 2024.

At the time of writing this, stocks were trading at A$18.42 up 13.11%. So far stocks have reached a day high of A$18.72.

To learn more check out Mark Story's wrap on 3 notable ASX from the day.

2:15 pm (AEDT):

Heading over to Europe now with Danish brewers Carlsberg A/S (CBGC-FF: Frankfurt Stock Exchange) who reported earnings that were just short of expectations for the quarter.

The company reported Q4 sales of 15.7 billion Danish kroner (US$2.18 billion), coming in just below the 15.8 billion Danish kroner estimated by analysts.

Full-year sales totalled 75.01 billion Danish kroner, up 1.9% year-on-year on a reported basis and in line with the anticipated 74.91 billion Danish kroner.

Earnings per share (EPS) were significantly higher up 123% to 68.7 Danish kroner since 2023.

“Given the challenging environment in some of our major markets, which impacted the volume development, we’re satisfied with our solid 2024 results, " said CEO Jacob Aarup-Andersen.

2:46 pm (AEDT):

Heading back to the New York Stock Exchange again now to take a look at Philip Morris International Inc.(NYSE: PM).

The international cigarette giant forecasts better-than-expected profit growth for 2025, with estimations for its nicotine pouch brand ZYN also ahead of forecasts.

The smoke-free business for the first time accounted for 40% of the company’s total net revenues.

The company reported revenue growth of 7.3% year-on-year to US$9.71 billion, beating the analyst consensus estimate of $9.44 billion.

Adjusted EPS of $1.55 also beat the consensus estimate of $1.50.

Shares in the company were up 11% today following the positive earnings announcement.

3:15 pm (AEDT):

In the world of cosmetics, this earnings season has been tough amid continued weakness in the Chinese beauty market and a slowdown in demand in the U.S.

The world's largest beauty brand L'Oreal SA (EPA: OR) joins Estee Lauder Companies Inc (NYSE: EL) reporting lower-than-expected fourth-quarter sales.

The brand posted sales of 11.08 billion euros (US$11.49 billion) in the three months to December, up 2.5% and just shy of the 11.1 billion euros estimated.

While earlier in the week, Estee Lauder also reported a 6% drop in net sales in the quarter, citing similar reasons.

However, full-year sales for Loreal came in positive at 43.48 billion euros versus the 43.33 billion euros forecast.

Loreal’s earnings per share were up 4.8% at 12.66 euros which was reflected in stocks today trading at 353.10 euros up 2.17%.

3:57 pm (AEDT):

Now let's have a look at 2 major retailers that reported today from the New York Stock Exchange.

First up we have Ralph Lauren Corp (NYSE: RL) who reported sales and profits above expectations with the retailer's revenue forecasts also coming in above projections.

Sales rose 11% year-over-year to $2.14 billion, above the $2.01 billion analysts had expected.

Shares surged following the results announcement. At the time of writing this, stocks were up 9.7% from the following close trading at US$273.14.

Ralph Lauren also said it expects revenue to grow by about 6% to 7% year-over-year in 2025.

We also have Skechers USA Inc (NYSE: SKX) who reported revenue of $2.21 billion, up 12.8% over the same period last year.

EPS came in at $0.65, compared to $0.56 in the year-ago quarter.

As a result, stocks were trading at US$75.62 up 1.63%.

4:28 pm (AEST):

To finish up today we look to the NASDAQ where we have Honeywell International Inc (NASDAQ: HON) whose stocks were down 5.6% today following the announcement of plans to split into three independent companies.

Following a strategic review early last year, the company said it is planning to separate its aerospace division from its automation business and would proceed with plans to spin off its advanced materials arm.

Honeywell reported mixed results for Q4 with a revenue of US$10.1 billion, up 7% year-over-year.

Adjusted earnings per share (EPS) of $2.47 topped estimates while EPS of $1.96 undershot forecasts.

The company expects an adjusted EPS in 2025 anywhere between $10.10 and $10.50, up between 2% and 6%.

4:33 pm (AEST):

That's a wrap on earnings for this week here at Azzet!

Thank you for tuning in with us - we enjoyed bringing you the latest updates on this earning season so far.

Join us again next Tuesday, 11 February, where will continue to bring you live updates throughout the day, with earnings expected from McDonalds, Monday.com, JBHifi and many more!

From the Azzet team, have a happy weekend everyone!