Texas Instruments tumbled 11.2% in after-hours trading on Tuesday (Wednesday AEST) after the semiconductor giant delivered a weaker-than-expected revenue forecast for the third quarter, overshadowing stronger-than-anticipated second-quarter results.

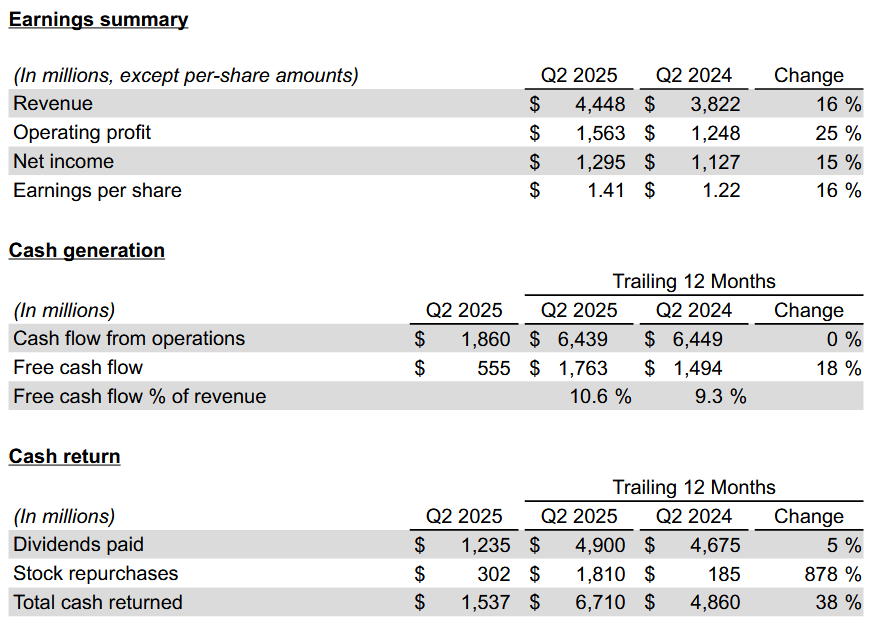

For the June quarter, Texas Instruments reported revenue of US$4.45 billion and net income of $1.30 billion, with earnings per share (EPS) of $1.41 - all ahead of analyst forecasts.

Markets had anticipated EPS of $1.36 and revenue of $4.36 billion.

However, shares were sold off as the company issued a cautious outlook for the current quarter.

Haviv Ilan, TI's president and CEO noted, “TI's third quarter outlook is for revenue in the range of $4.45 billion to $4.80 billion and earnings per share between $1.36 and $1.60, which does not include changes related to recently enacted U.S. tax legislation,” the company said.

Analysts had expected third-quarter revenue to reach $4.59 billion and earnings per share to come in at $1.50.

The company’s second-quarter revenue increased 16% year-on-year from $3.82 billion, while net income rose 15% from $1.13 billion, or $1.22 per share, a year ago.

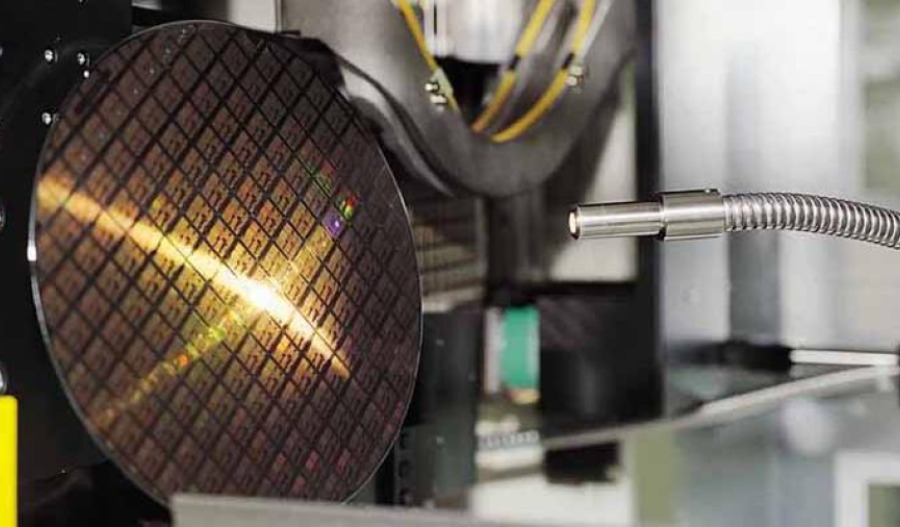

The analog semiconductor segment, its largest business, generated $3.5 billion in revenue, up 18% and beating estimates of $3.39 billion.

Texas Instruments remains a critical supplier of legacy chips used in automotive and industrial applications.

As of Tuesday’s close, the stock had gained 15% year-to-date, buoyed by broader investor optimism surrounding the semiconductor industry.

In June, the company announced plans to invest US$60 billion to expand chip production capacity in Texas and Utah. The initiative drew praise from the Trump administration as part of its broader push to bolster domestic technology manufacturing.

At the time of writing, shares of Texas Instruments were trading at US$190.94, down 11.2% from Tuesday’s closing price of US$214.92, giving the company a market capitalisation of US$195.25 billion.