The quantum computing revolution isn't coming - it's already transforming labs into commercial battlegrounds where physics bends to human ambition. And as Wall Street debates AI's sustainability, there's real money quietly flowing into groundbreaking tech that makes today's supercomputers look like pocket calculators.

McKinsey's latest Quantum Technology Monitor paints a picture of the quantum market hitting US$100 billion within a decade.

The quantum Trinity - computing, communication, and sensing - collectively targets $97 billion in global revenue by 2035. Computing operations alone are projected to surge from today's $4 billion base to $72 billion over the next decade.

So will 2025 emerge as the year when experimental breakthroughs transition into market-ready solutions - and which stocks are attempting to make the quantum leap?

Blue chips with exposure

Alphabet (GOOGL) remains the institutional favourite among quantum investments, reflecting growing confidence in the company's quantum capabilities. Trading at $188.50, up 18% year-to-date.

Google's parent company maintains a war chest of $95.7 billion in available capital plus $19 billion in quarterly cash generation. This financial ammunition dwarfs the combined resources of every quantum specialist whilst enabling indefinite research funding.

While cash-strapped start-ups burn through venture capital at concerning rates, Alphabet can fund quantum research programs indefinitely. Core business operations remain uncompromised throughout this strategic investment phase.

Microsoft (MSFT) captures headlines with its Majorana 1 quantum chip breakthrough, underscoring investor confidence in the company's quantum strategy. Trading at $455.20, up 12% year-to-date.

MSFT's Azure Quantum platform and topological qubit approach could potentially solve quantum computing's biggest bottleneck - error correction. This makes the company analysts' top quantum pick for 2025.

IBM (IBM) brings something pure-play competitors fundamentally lack: substantial, proven revenue generation from quantum computing operations rather than research spending.

IBM distinguishes itself through the proven monetisation of its quantum operations, accumulating close to $1 billion in quantum-related revenue since launching commercial services in 2017. This evidence shows enterprise demand extends beyond government contracts into genuine business applications. Trading at $194.25, up 35% year-to-date.

While competitors chase lab milestones and qubit records, IBM consistently delivers functional quantum solutions to paying enterprise customers.

Qualcomm (QCOM) offers sophisticated backdoor quantum exposure through its dominant position in 5G infrastructure development. The company pioneers work on post-quantum cryptography standards that will secure future communications, with analysts projecting strong upside as 5G adoption accelerates quantum networking applications. Trading at $158.50, down 3% year-to-date.

Pure plays

Beyond the relative safety of diversified tech giants lies a battlefield where quantum specialists pursue computing's holy grail. Let's take a look at:

IonQ (IONQ) leads the pure-play category with its sophisticated trapped-ion tech approach, reflecting growing institutional confidence. Trading at $37.80, up 504% in a year.

Revenue is projected to reach $84.75 million in 2025, almost 100% growth as the company scales its quantum-as-a-service offerings.

Rigetti Computing (RGTI) is pursuing an ambitious full-stack quantum integration strategy that controls everything from chip fabrication to cloud access. Trading at $11.85, up 1,090% over the past 12 months.

Its superconducting approach puts it in direct competition with IBM and Google. In-house manufacturing capabilities provide crucial advantages.

D-Wave Quantum (QBTS) pioneered commercial quantum annealing tech decades before quantum computing entered mainstream consciousness. Trading at $15.80, up 1,220% over 12 months.

D-Wave's Advantage2 architecture operates with 4,400+ qubits, while supporting an enterprise client base spanning 132 organisations.

Nearly 30 Fortune Global 2000 entities have moved beyond pilot programs into operational deployment.

Arqit Quantum (ARQQ) specialises in quantum-safe encryption tech that addresses the looming cryptographic apocalypse. Trading at $36.50, up 93% over two weeks.

ARQQ's QuantumCloud platform addresses the threat posed when quantum computers inevitably shatter current encryption standards.

Quantum Computing Inc (QUBT) shows the extreme of pure-play quantum investments, reporting just $39,000 in quarterly revenue against $83 million in operational costs. Trading at $19.40, up 3,100% from 52-week lows.

SealsQ (LAES) provides quantum-resistant security solutions through innovative microcontroller tech, addressing cybersecurity vulnerabilities across rapidly expanding IoT and automotive applications. Trading at $4.20.

Could quantum crash?

Before mortgaging your assets for quantum exposure, there's a substantial counter-narrative to unpack.

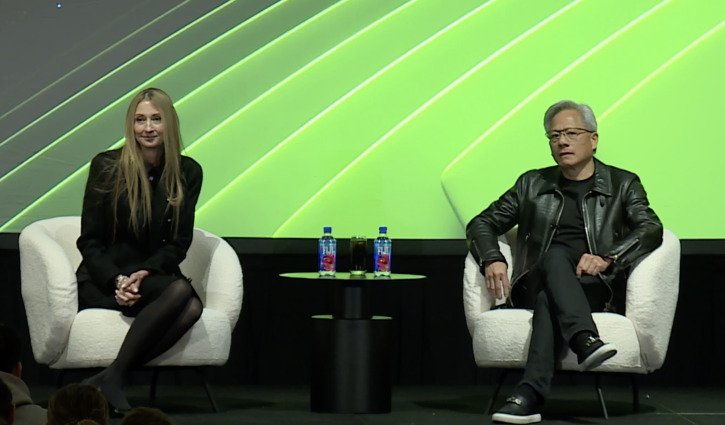

The volatility of quantum-focused publicly listed companies was exposed earlier this year when Nvidia's Jensen Huang sent stocks into freefall with his January prediction that practical quantum computers would remain decades away.

"If you said 15 years for very useful quantum computers, that would probably be on the early side," Huang told analysts at CES 2025.

"If you said 30, it's probably on the late side. But if you picked 20, I think a whole bunch of us would believe it."

Huang's critique stung because he emphasised that quantum systems excel at "small data problems" - but remain limited by microwave communication protocols.

Though Huang subsequently walked back his pessimistic timeline, the initial market damage exposed quantum investments' dangerous vulnerability to scepticism.

D-Wave CEO Alan Baratz fired back, arguing that Huang fundamentally misunderstands the quantum landscape.

"Jensen Huang has a misunderstanding of quantum," Baratz told CNBC's The Exchange.

“While he might be right about other quantum companies, he is dead wrong about D-Wave.

“We are not 30 years out, we're not 20 years out, we're not 15 years out. We are today. We are supporting businesses today with quantum compute to solve their hard problems.”

The sector's fundamental challenge is quantum "noise" - environmental interference that corrupts delicate quantum states faster than computations complete.

This creates a race between calculation speed and system decoherence which current technology struggles to win consistently.

Despite impressive quantum supremacy marketing claims, numerous analysts question whether current quantum systems can consistently outperform classical computers.

It's expected that just half of the workforce demand for the sector will be able to be filled this year.

Speculative fever has hit the market and several stocks have price to sales ratios exceeding 200x - despite generating revenue streams that barely cover basic operational expenses.

Governments make quantum leap of faith

Despite these legitimate concerns, governments are increasing public spending on quantum technologies too.

Tech giants provide quantum exposure with substantial downside protection, pure-plays offer lottery-ticket upside potential and governments fund grassroots research.

“Global governments’ $680 million worth of investments in QT start-ups in 2024 was only part of their commitment to the sector,” McKinsey says.

"Overall, governments announced $1.8 billion in funding for all types of QT endeavors in 2024.

"For example, the Australian government announced a $620 million financial package for PsiQuantum to build the world’s first utility-scale, fault-tolerant quantum computer in Brisbane.

"Meanwhile, the State of Illinois announced a $500 million investment in the development of a quantum park.2 Asian investments also rose in 2024, led by Singapore’s approximately $222 million investment in QT research and talent.

“Five of the 19 new QT start-ups founded in 2024 are based in Asia, underscoring the region’s emerging dominance in the field.”

As 2025 unfolds with increased quantum breakthroughs and commercial deployments, the critical question isn't whether quantum computing will transform industries. That outcome appears mathematically inevitable.

The quantum future belongs to investors bold enough to bet on computing's next paradigm shift.

This article does not constitute financial or product advice. You should consider independent advice before making financial decisions.