After experiencing an 8% fall from a recent high of $33,790 in February, following revelations production will recover in Myanmar, tin is back up over $36,160 per tonne on the London Metal Exchange (LME) – its highest level in nearly two years.

The price of the industrial metal - used in microchips and solar panels - soared by as much as 9% last Friday and 7.4% a day earlier on fears that the suspension of Mauritius-based Alphamin Resources’ Bisie mine in the Democratic Republic of the Congo (DRC) will further tighten global supply.

Global demand for tin is currently driven by AI-related demand for semiconductors and solar power spread.

DRC mine closures

Underscoring a 24% rise in the tin price since the start of the year are revelations that Alphamin - which accounted for around 6% of global tin supply in 2024 with 17,300 tonnes produced – is halting operations due to insurgent groups in North Kivu province.

Alphamin closed the Bisie tin mine due to unrest in the DRC’s North Kivu Province. It said: “This decision was made after insurgent militant groups have recently advanced westward in the direction of the mine’s location in the DRC.”

More than 17,000 tonnes of critical soldering metal used to make semiconductors were produced at Bisie last year.

Supply shortage

In response to supply issues, Macquarie estimates a supply shortage of 13,000 tonnes this year and tin usage for solder to grow an average of 2.5% annually from 2024 to 2028.

In response to recent events, Citi Research has raised its average tin price forecast for the first quarter of 2025 to $32,000 per metric ton from $29,000.

However, the broker expects prices to start easing in the second quarter.

Alphamin’s Toronto-listed shares fell 38% following last week’s announcement.

Metals X benefits from the supply squeeze

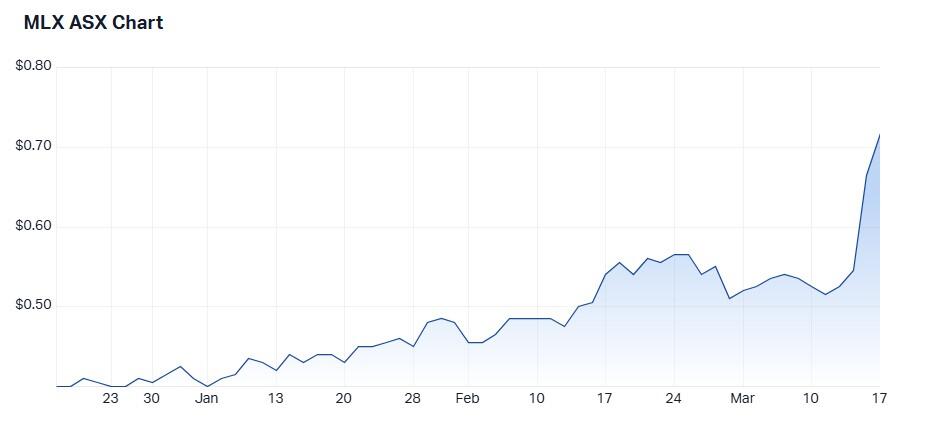

Meanwhile, Australian tin miner Metals X (ASX: MLX) saw its share price rally 22% last week to a three-year high.

The stock has directly benefited from the supply squeeze through its 50% interest in the Bluestone Mines Tasmania Joint Venture (BMTJV), which owns and operates the Renison Tin Mine (Renison) in Northwest Tasmania.

The miner reported a new quarterly production record in December for the Renison Tin Mine with total production of 3,329 tonnes of tin-in-concentrate.

The 50% share of Metals X equated to 1,664 tonnes of tin-in-concentrate, up from 1,449 tonnes in Q3 of 2024.

In FY24 total production was 11,006 tonnes with $101.8 million profit.

Despite the surge in tin prices, market observers fear recent gains may be short-lived if Alphamin resumes operations quickly, which could also stanch recent momentum experienced by Metals X.

Metals X has a market cap of $629 million; its share price is up 97% in one year and 71% year to date.