Our global silver market is currently in a perfect storm of supply constraints, surging industrial demand, and escalating geopolitical tensions that threaten to reshape commodity trading patterns for years to come.

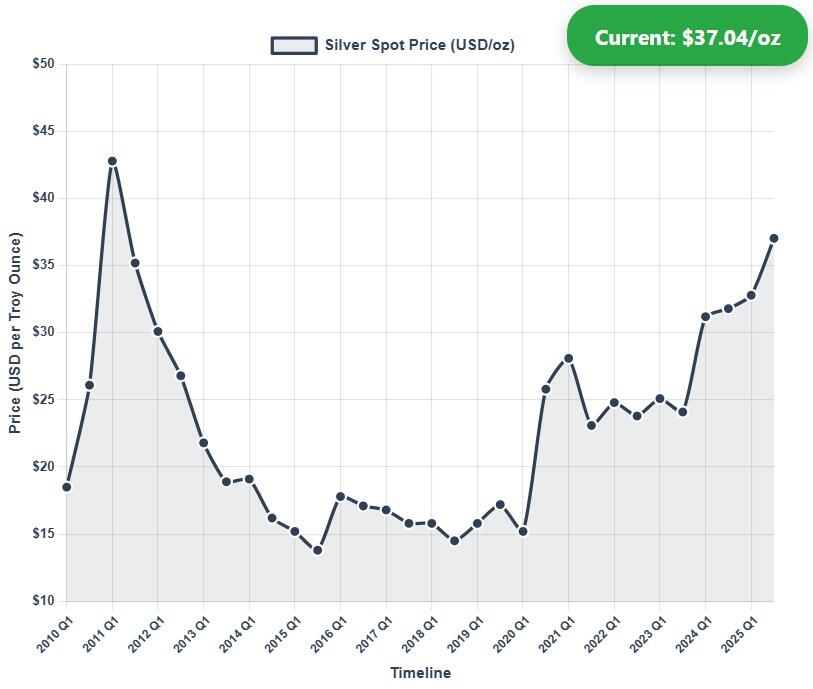

The metal's surge to US$37.04/oz this week - a fresh 13-year peak - reflects far more than conventional flight-to-safety dynamics.

It's also a 168% recovery from its 2015 cyclical low, yet remains 24% below the 2011 monetary crisis peak - suggesting markets are still waking up to its strategic value.

For instance, an escalating conflict such as the current one in the Middle East carries systemic implications for the markets - where equity shifts into safe haven commodities such as gold and silver.

And the world's most industrially versatile precious metal is navigating its fifth consecutive year of structural deficit, according to the Silver Institute, as market dynamics show a shifting of gears between East and West in critical mineral supply chains.

In 2024, global demand hit 1.21 billion ounces (oz) as supply managed a meagre 1.03 billion oz - creating a staggering deficit of 182Moz which is equivalent to ~18% of total supply.

There's also been a systematically draining of above-ground inventories which industry experts warn could be exhausted within 12-24 months.

Silver Institute projects the 2025 deficit will moderate to 149Moz, yet says it remains historically elevated and “continues the pattern of chronic undersupply that has defined the market over the past five years”.

Green economy's silver lining

Unlike its monetary cousin gold, silver's destiny is increasingly intertwined with the global energy transition.

Industrial demand, which comprises approximately 60% of total consumption, shows no signs of abating.

The solar PV sector alone consumed record quantities in 2024, with global solar installations reaching another all-time high despite mounting pressure on U.S. renewable energy projects from the Trump administration.

Silver is unmatched in electrical conductivity, thermal characteristics, and resistance to corrosion - making it indispensable for emerging technologies such as EV charging infrastructure and AI hardware - and the metal's industrial applications continue to expand.

Consumer electronics manufacturers - buoyed by AI system development - are driving additional demand as automotive electrification proceeds despite the slowing growth of battery EV adoption.

India, the world's largest silver fabricator, imported more silver in the first four months of 2024 than in all of 2023 - a flex of the relentless appetite from emerging economies to build out electrical and renewable energy infrastructure.

Demand, meet underinvestment

The supply side presents an even more troubling narrative.

Global mine production fell by 1% to 830.5 million ounces in 2023, with output declining from 1.07 billion ounces in 2010 to an estimated 1.03 billion ounces in 2024.

This decade-long stagnation reflects years of underinvestment triggered by silver's prolonged price depression between 2011 and 2020.

Mexico, the world's largest silver producer, is the poster-child for the sector's challenges.

Output declined by 5% to 202.2Moz in 2023, impacted by Newmont's four-month labour strike at the massive Peñasquito operation.

While the nation produced 6,300Moz in 2024 - up slightly from 2023 - the country's mining sector faces ongoing labour tensions and regulatory uncertainties.

Peru, holder of 21.8% of global silver reserves, saw production decline to 3,100Moz in 2024 from 3,200 metric tonnes the previous year.

Despite holding the world's largest silver reserves, political instability and environmental regulations continue constraining output growth.

China, meanwhile, represents both opportunity and threat.

Whilst Chinese mine production has shown resilience, the country's escalating trade tensions with Western nations introduce new supply chain vulnerabilities for global silver markets.

Silver supply chain shakeup

President Trump's aggressive trade policies have introduced unprecedented volatility into silver markets and threaten to dramatically alter global commodity flows.

The tariff regime has created remarkable regional price dislocations, with COMEX-registered silver inventories surging to their highest level since 1992, and jumping a whopping 40% in Q1 2025 as arbitrage opportunities emerged.

Meanwhile, London's silver reserves have depleted to record lows - as much of the remaining metal is tied up to exchange-traded products.

And the CBOE Silver ETF Volatility Index increased by over 45% since January 2025.

Tariff policies

Perhaps nowhere is the contradiction of Trump's policies more apparent than in solar photovoltaics (PV).

The administration's announcement of tariffs up to 271% on solar panel components from Cambodia, Malaysia, Thailand, and Vietnam directly impacts silver demand, given its critical role in manufacturing PV cells.

The global solar industry's continued expansion - projected to reach another all-time high in 2025 - will likely proceed with or without American participation, yet tariff-induced supply chain disruptions could create temporary demand volatility.

Citigroup analysts reckon current models may be "underpricing the scale and impact" of recent tariff policies, pointing to a target range of $42-45 per ounce by Q3 this year, roughly 25-30% upside from current levels.

More conservatively, Morgan Stanley predicts prices may stabilise between $36-38 per ounce once shipping logistics adjust to new trade patterns.

Outlook

The silver market's trajectory over the coming years will likely be determined by three key factors: the persistence of supply deficits, the pace of green technology adoption, and the evolution of U.S.-China trade relations.

Unlike previous commodity cycles driven primarily by speculation, this tightening appears fundamentally rooted in structural demand growth outpacing supply responsiveness.

As Western nations grapple with their dependence on Chinese-controlled supply chains for critical materials, silver's role as a strategic metal may become increasingly apparent.

The European Union's acknowledgment of discussions with the U.S. on "balanced trade" suggests recognition that current arrangements desperately need restructuring.

Silver's unique properties - both physical and monetary - may prove more valuable than many currently appreciate.

The question facing the market is not whether silver will reach new highs, but how quickly the market will recognise the structural forces reshaping the ancient metal's modern destiny.