Energy generator and supplier AGL Energy has unveiled an 83% plunge in statutory net profit after tax (NPAT) to A$97 million for the first half of the 2025 financial year (FY25).

AGL said the result was marred by $245 million of significant items, including a $165 million increase in onerous contract provisions, $45 million in retail transformation costs, and a $31 million negative movement in the fair value of financial instruments.

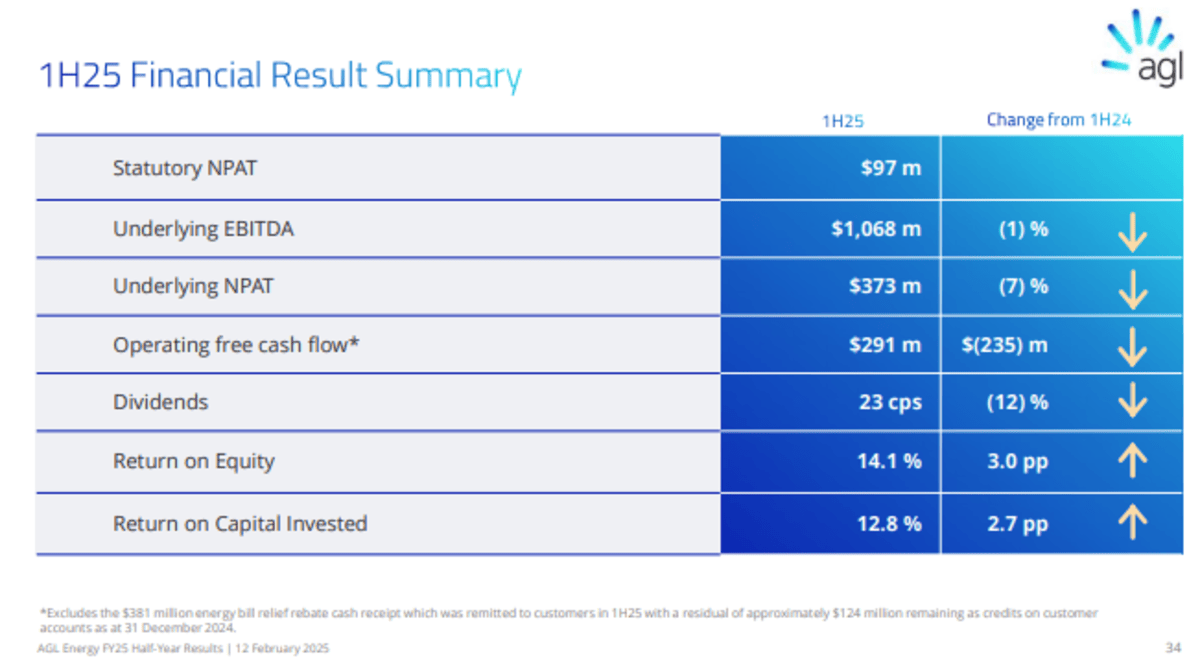

The company said underlying earnings before interest, tax, depreciation and amortisation (EBITDA) eased 1% to $1.068 billion and underlying net profit fell 7% to $373 million on revenue which rose 15.3% to $7.132 billion in the six months to 31 December 2024.

Directors declared a fully franked interim dividend of 23 cents per share, compared with 26 cents in the prior corresponding period, to be paid on 27 March to shareholders registered on 26 February.

AGL also narrowed its profit guidance for FY25 to underlying EBITDA of between $1.935 billion and $2.135 billion (previously $1,870-$2,170 billion) and underlying NPAT of between $580 million and $710 million (previously $530 million-$730 million).

This reflected an expected moderation in second half earnings due to lower customer gas and electricity demand compared to the first half, ongoing customer competition, and increases in depreciation, amortisation and finance costs.

Managing Director and CEO Damien Nicks, said AGL delivered a strong first half result in line with expectations, driven by the flexibility of its generation fleet and ability to capture higher realised electricity pricing, and including continued strong earnings from its growing battery portfolio.

He said that as expected, the result was affected by increased consumer and customer margin compression due to lower customer pricing and heightened market competition.

The company’s increased investment in the growth of the business and the reliability and flexibility of its assets, combined with the impact of inflation, led to higher operating costs and depreciation and amortisation.

“Importantly, these results mean we are on track to deliver full-year earnings in line with our FY25 guidance range, and the reinstatement of a fully franked dividend for our shareholders,” Nicks said in a media statement.

By 12.15pm AEDT (1.15am GMT) AGL Energy (ASX: AGL) shares had risen 35 cents (2.99%) to $12.06, after ranging between $11.59 and $12.14, capitalising the company at $8.11 billion.

The author owns shares in AGL Energy.