During the mining boom, speculative investors would often buy a handful of penny-hopeful stocks in the expectation that one would be a ‘10-bagger’ and make sufficient returns to handsomely compensate for the remainder that crashed and burned.

Displaying similar long-tail trajectories to commercialisation, while often requiring similarly large and regular amounts of capital expenditure along the way, biotech stocks display characteristics similar to their resource stocks' counterparts.

However, while mining stocks have suffered from the rotation into the financials, with commodity prices wallowing in the doldrums, biotech stocks appear to be having their day in the sun.

Never far from the 24-hour news cycle, the broader healthcare sector was again thrust into the limelight last week due to United States President Donald Trump’s threats to impose a 200% tariff on pharmaceuticals imported into the U.S. from 2027.

As it currently stands, pharmaceuticals remain exempt from U.S. tariffs, while reciprocal tariffs announced prior have also been delayed by a month until 1 August 2025.

While the media has been quick to assess the likely fallout for the sector’s big-end-of-town players – notably CSL (ASX: CSL) and Telix Pharmaceuticals (ASX: TLX) – which incidentally have flagged Trump’s threats as somewhat delusional - there’s any army of smaller cap biotech stocks with their eyes squarely focused on long-term horizons.

The listed biotech landscape

Not unlike the mining sector, listed biotechs are equally top-heavy with CSL alone accounting for around half the [healthcare] sector’s market cap estimated at north of $233 billion - where there are no fewer than 170 listed stocks in the broader healthcare space.

While this is only the tip of Australia’s biotech iceberg, with another 1,200-plus companies operating as private companies, there are 83 'biotechs’ listed on the ASX operating within the broader gamut of pharmaceutical, biotech and life sciences.

However, with companies leaving and entering every six months, the listed universe of ASX-listed pure-play biotech stocks is a constantly moving feast.

Drill down below the sector’s top 15 players by market cap, and it becomes apparent that this is a sector dominated by small-cap battlers trying to get ahead.

Adding the myriad headwinds facing biotech stocks is the realisation that less than 10% of drug candidates typically make it from clinical trials to approval.

While the sector delivers in excess of $8 billion in annual revenue, over two thirds of the [biotech] sector (72%) is dominated by stocks with market caps well under $100 million, with close to half (44%) having a market cap well under $50 million.

While many of the stocks may never turn a dollar, let alone a profit, true believers in the sector are constantly on the outlook for stocks with the potential to morph into the next CSL, Telix or Mesoblast (ASX: MSB).

Filtering for future winners

However, sifting through early-stage biotech hopefuls – with a strong IP competitive advantage (aka moat) and sufficient cash to go in hitting milestones - to find tomorrow’s champions isn’t easy for insiders, let alone layman investors.

With an enviable record of repeatedly delivering strong performance over the past decade, Morgans expects the broader life science ecosystem to continue growing at an annual rate of around 3% up to 2026.

One of the drivers for this growth is the total address market (TAM) for biotech stocks that end up having their product trials approved by regulatory gatekeepers globally; none the least of which is the U.S. Food and Drug Administration (FDA) – typically regarded as the holy grail for large scale commercialisation.

As CSL shareholders can attest, tapping into biotech's veins of global scale brings mouthwatering rewards.

For the uninitiated, CSL was established in 1916 as Commonwealth Serum Laboratories and was wholly owned by the Australian federal government until privatisation in 1994.

Since 1 December 2011, CSL’s share price has catapulted over sevenfold from $31.85 to $241.60.

According to Grand View Research, the global scale of the biotech market was estimated to be around US$1.55 trillion in 2023 and is projected to reach US$3.88 trillion by 2030.

It’s inevitable that a sizable portion of listed biotechs will fall by the wayside.

However, the ASX is often seen as an incubator before the sector's true winners progress to a listing on NASDAQ - where they’ll receive investment exposure before major clinical or regulatory milestones are reached.

What to look for

Biotech stocks are bit like struggling performing artists, it can take 10 years to be recognised as an overnight success. While actors can be catapulted into the limelight on just one outstanding role, so too the outcome of a single trial can send valuations soaring or crashing overnight.

For example, Neuron Pharmaceuticals (ASX: NEU) bolted 17% higher in April after flagging “productive discussions” with the U.S. FDA about a clinical trial linked to a drug candidate.

However, earlier this year, another aspiring biotech, Opthea’s (ASX: NASDAQ) share price tumbled after revealing that late stage trials for its OPT-302 eye treatment had failed.

Meanwhile, following the subsequent resignation of four directors, it now remains unclear whether Opthea – which is currently suspended – has the ability to continue as a going concern.

Given that investing in biotech can be a rollercoaster ride, investors need to remember what they’ve signed up for.

Lior Ronen, founder and CEO of Finro Financial Consulting reminds investors that within this sector, every stage — from preclinical to Phase III — serves as a potential [good or bad] value inflection point.

While a single therapy focus can be riskier business than a platform addressing multiple indications or mechanisms – offering built-in diversification – Finro also reminds investors that Robust IP is critical to future commercial success.

While prudent capital management is another key consideration, it is possible for cash-poor stocks with no revenue to combine non-dilutive funding, such as grants, with cash-tight operations to extend their runway while also reducing [share price] dilution for existing shareholders.

Clearly, if you’re going to play in this investing sand-pit, Finro recommends mastering the significance of upcoming catalysts, from external validation derived from partnerships with research institutions or global pharmaceuticals, through to clinical data releases or regulatory updates.

Understand the de-risk process

Given that every stage, from preclinical to Phase III, serves as a potential value inflection point, investors could arguably ascribe greater value to biotechs with greater pipeline diversity.

According to global research and development of the photosoft technology, Invion Limited (ASX: IVX), investors should regard the three phases of clinical trials as progressive stages of de-risking, with success at any point potentially triggering partnerships, licensing discussions or share price run ups.

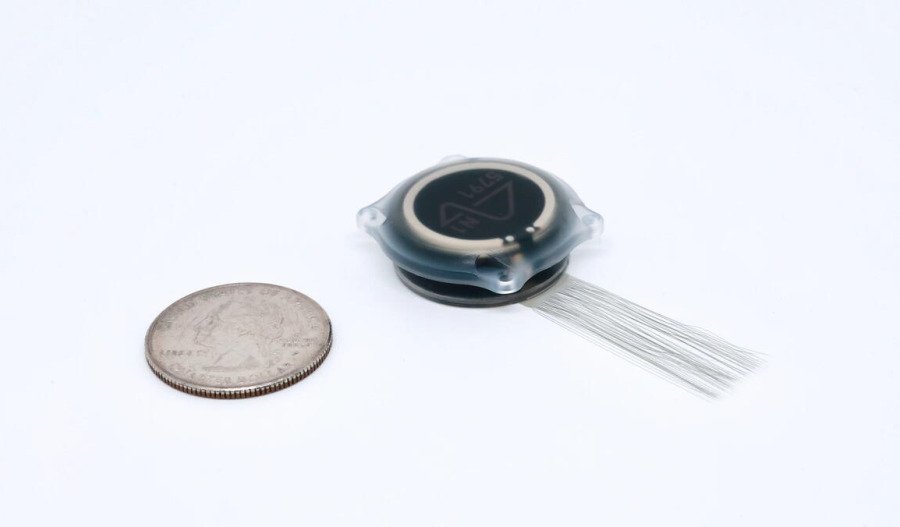

“Understanding both where a company sits in this sequence, and whether it’s sufficiently funded to reach its next milestone, [is] essential for well-timed entry and exit strategies,” explains Invion which is emerging as a standout in the ASX biotech landscape, advancing a novel, IP-protected photodynamic therapy (PDT) platform with strong early clinical momentum.

Similarly, while CSL grew from a government vaccine lab to a global biotech powerhouse worth around $117 billion, Mesoblast has navigated multiple clinical programs and regulatory reviews and demonstrated how IP-protected assets and global licensing deals can foster long-term growth despite inevitable setbacks.

How to identify the next breakout

The following traits should help lay investors kick the tyre on biotech companies before buying:

• A platform technology with multiple therapeutic or diagnostic uses

• Strong IP protection, preferably with international reach

• Active clinical relevance and small-scale data or early trial feedback

• Clear, upcoming regulatory or clinical milestones

• A capital-efficient model, supported by non-dilutive finance

• Strategic validation through partnerships or collaborations

• A confident commercial or licensing roadmap

While investing in biotech stocks is inherently high risk, the sector can deliver in spades when approached with informed timing, strategic insight and rigorous scientific evaluation.

Knowing how to make sense of each successive biotech stock announcement and understanding why the market responds the way it does is half the battle.

This article does not constitute financial or product advice. You should consider independent advice before making financial decisions.