Last year, Rio Tinto (ASX : RIO) made an important strategic move to position itself further into the key and high-demand critical minerals of copper and lithium with its acquisition of Arcadium Lithium and developments around its copper business.

After a busy period of M&A, it would make sense that there's asset growth on the horizon. It just so happens that's exactly what Rio Tinto chief exec Jakob Stausholm says the business is going to do, with no plans for M&A and a pipeline of critical minerals projects to develop.

Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals supply chains - from pricing, production, refinement and mergers & acquisitions, to manufacturing and consumer products.

The purchase of Arcadium for US$6.7 billion last year has catapulted Rio to become the largest holder of lithium resources in the world and will add it to its existing portfolio under the business Rio Tinto Lithium.

It also owns the producing Rincon lithium operation which it bought for $825 million in 2021 and the greenfields Jadar project in Serbia which is being thwarted by environmental activism.

"Rincon, our first lithium mine, is producing right now, and we are focusing on a full-scale project,” Stausholm said.

The global miner is investing US$2.5 billion to scale up Rincon from a 3,000tpa lithium carbonate equivalent (LCE) operation to 60,000tpa LCE in Argentina's ‘Lithium Triangle,' where the battery metal is extracted from brine ponds in the Atacama desert.

That will add to the number of operating mines and projects it bought from Arcadium.

“We closed the deal [with] Arcadium in the first quarter, and now, under the leadership of Paul Graves, Arcadium Lithium is being integrated and we now are perhaps the world's largest, maybe second-largest holder of lithium,” Stausholm said.

“It is for us to develop that lithium - the world needs it.”

Rio’s red metal push

Earlier this week, Rio inked a farm-in deal with Japanese metals behemoth Sumitomo for its undeveloped Winu copper-gold project in Western Australia's Paterson Province.

Under the terms the miner will continue to develop and operate Winu and SMM will pay up to $430.4 million for a 30% equity share of the project based on milestones.

It's also looking again at its copper prospectivity in Chile, where it's had a small presence for decades.

“Except for our minority stake in Escondida, we have missed out for the better part of five decades in Chile, and we know every copper deposit," Stausholm said.

“I was honoured to be together with Codelco… and signing the agreement for Nuevo Cobre - this is very, very important for us, since we have been exploring in Chile for decades.”

The two companies will jointly aim to create a copper "mining district" around Nuevo Cobre in the Atacama region of northern Chile.

That's all well and good for one of the Americas, yet Stausholm says he's a bit bearish about North America. He says the U.S. isn't a top priority for the company, even though they have a big presence there and the new administration is incentivising mining activity.

“I think the U.S. and the U.S. government are very ambitious about creating more economic activity and for that, they need a lot of materials,” Stausholm said.

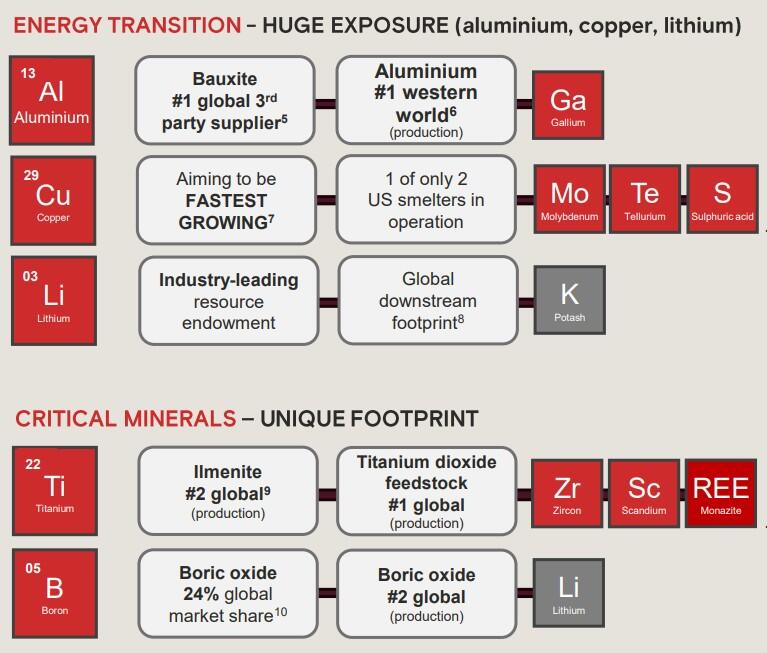

"Yes, we have a big footprint in the U.S. with mines and processing plants, and those assets are more important than ever. But the U.S. is not being prioritised - we are one out of two who [have built] smelters up in the U.S., and those assets have had a really difficult time.

“To be quite frank, we hadn't really made any money for a long period of time in the U.S., but actually, I hope and believe that we can get a much better business out of that.”

Resolution unresolved

The Resolution copper project in the U.S., a 55:45 JV with BHP, (ASX : BHP), has long been held up over environmental concerns about the landholding by First Nations people.

“We're not entirely there with Resolution yet, but the world is changing, and the U.S. is more and more realising that they need the copper from [there],": Stausholm remarked.

“We are making good progress in terms of working with the First Nations people and we now have a U.S. government that wants to see Resolution being developed.”

The spotlight was put back on Resolution when America declared copper as a critical mineral, yet Stausholm says there are still development barriers to tango with.

“It certainly doesn't mean that it changes anything in terms of the engagement with First Nations people, but we now actually have a government that's trying to push forward the project, and that's very helpful.

“What we really need—and what has been standing still for four years — is the land exchange, because only when we get the land exchange can we do the final drilling and understand the whole ore body, thereby finalising the project.

"So it takes step-by-step - it takes a long time, but it's worth waiting for because it's just one of the best ore bodies you can find in the world.

“We're making really good progress right now - the stumbling block is we are waiting, and we will be in the Supreme Court and if they decide to dismiss the case, the project can push forward.”

There's more copper on the way too, with production ramp up finally accelerating at its Oyu Tolgoi copper operation in Mongolia that had been held up by years of disputes with the government, cost overruns, delays, and challenging geology.

“Quite frankly, right now, we should just be happy that Oyu Tolgoi is producing extremely well,” Stausholm said.

“We have got all the key infrastructure in place [and] are following the schedule to the minute detail.”

The mine is on track to produce 50% more copper this year than last year.

“We are seeing growth not just in the 2020s but also in the 2030s of copper. So I actually feel very good about our copper portfolio.”