With businesses leaving to list elsewhere and a drying up of fresh capital across its trading floor, the London Stock Exchange (LSE) seems to be in a period of flux. Now, rumours are that global miners Rio Tinto and Glencore - with a combined worth of ~$210 billion - are looking to leave the LSE and/or raise capital elsewhere.

You'd have to rewind the clock 17 years to 2008's global financial meltdown to find more companies have left one of the world’s oldest trading houses more than it did last year.

An eye-whopping 88 listed businesses left their exposure to trading regulatory laws and offices in the UK and just a fifth of that number onboarded to the colloquially known ‘footsie’, or FTSE, exchange, through initial public offerings (IPOs).

Companies worth ~14% of the total value of the FTSE have ditched London for overseas listings since 2020.

But why?

One reason cited is London’s Stamp Duty Reserve Tax (or Robin Hood tax, or Tobin tax), which requires investors to pay a 0.5% tax on transactions when buying UK shares in a company.

In a less globalised world, 20 years ago, they could have gotten away with it. Now, it's a veritable noose around the neck of UK trade, as investors can list elsewhere without incurring those fees.

Another is that the U.S. has outperformed the Eurozone since the global financial crisis in 2008, when both jurisdictions had virtually identical GDPs of US$14.8 trillion and US$14.2 trillion respectively.

15 years later, America doubled its GDP to US$26.9 trillion, while the Eurozone stagnated to US$15 trillion in 2023. If you adjust for inflation over that time, the needle has barely moved.

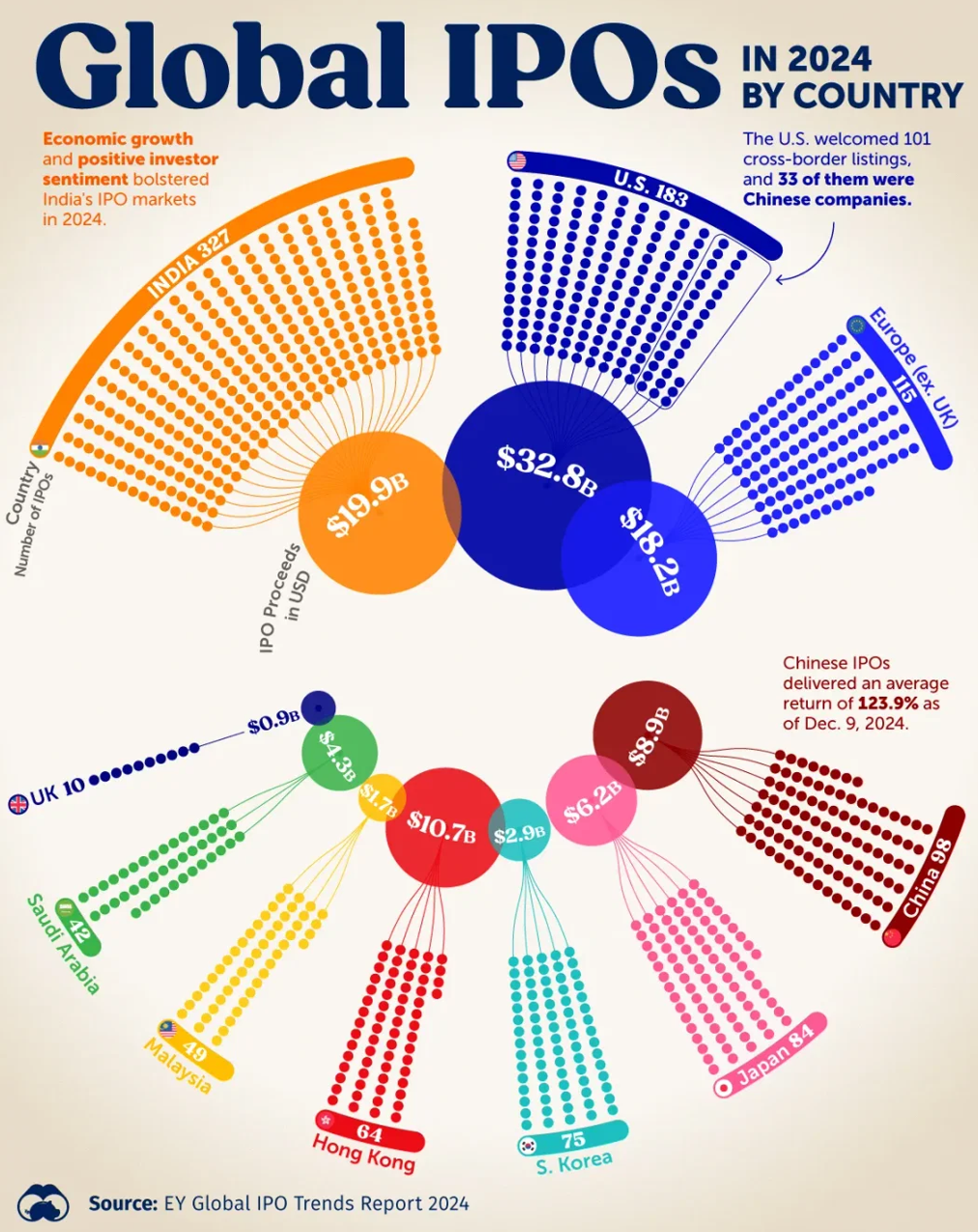

Machinations elsewhere, including a growing Indian investment scene through the flagship NSE exchange (most IPOs, more incoming capital than the U.S.), attractive operating and tax benefits and larger investor markets are adding to the LSE’s stagnation.

The UK stock market now trails the fledgling exchanges of Oman and Malaysia in IPO rankings; and in 2023, the NASDAQ raised US$13 billion from company floats - more than 13X that of the LSE's US$972 million.

Global top four consultancy EY says factors for the delisting or transfer of listings away from London's Main Market are primarily related to the advantages the U.S. is currently perceived to have over the UK. These advantages are mainly:

- i) growth in operations in North America for the companies seeking to transfer,

- ii) better liquidity for shares

- iii) a deeper pool of investors

- iv) a perceived valuation gap

The aggregate market capitalisation of LSE-listed equities went down to US$3 trillion in February 2024, from US$4.3 trillion in 2007, whereas the U.S. market grew threefold to US$53 trillion.

Those out the door

The latest blow to trade in London came as Euro giant Unilever spun out Ben & Jerry's just listed in Amsterdam and snubbed both the LSE and New York.

Biotech firm Abcam, plumbing supplier Ferguson and packaging company Smurfit Kappa Group, have all recently moved to the U.S.

So has takeaway behemoth Just Eat, gambling business Flutter and equipment multinational Ashtead.

The LSE is also now seen as a place to spin-out non-core assets - if you go by South African mining major Anglo American's decision to list its Amplats platinum business in London for what it says is to “lessen flow-back”.

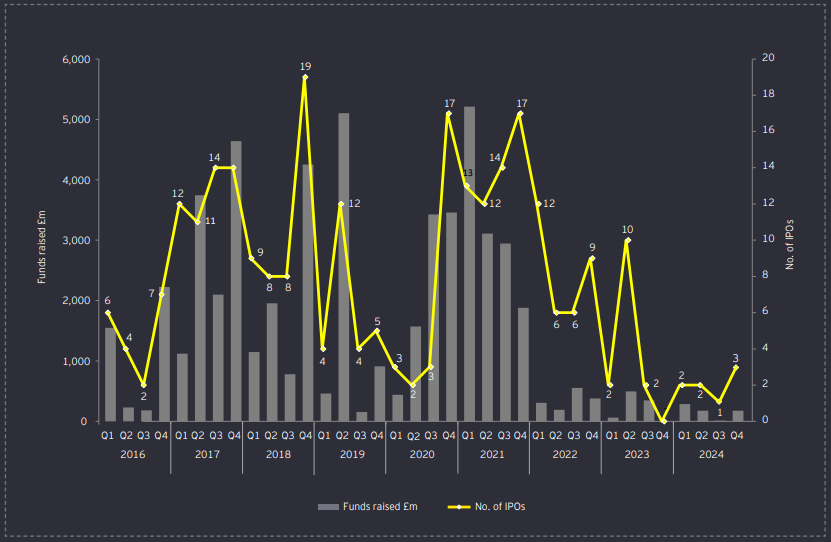

18 companies still listed in the U.K. last year, the highest value IPO going to French TV network Canal+ which raised £2.6 billion - its largest listing in two years.

A spokesman for the UK Treasury said IPOs like that of Canal+ “demonstrate confidence in our capital markets”.

“We want to continue attracting exciting businesses to the UK. That's why we are creating pension megafunds to unlock billions of pounds of potential investment for businesses, as well as backing the largest overhaul of UK listings rules in decades,” he added.

Nail in the coffin?

In what could signal a death knell of faith in the LSE, global mining heavyweights Rio Tinto (ASX : RIO) and Glencore (combined US$210 billion value) are mulling their growth plans and considering raising billions in capital for acquisitions in a hot M&A market that has seen a swathe of takeover bids both accepted and rejected at the top end of the resources sector in the past few years.

According to the Australian Financial Review, Rio boss Jacob Stausholm is mulling a capital raise and potential small move away from the LSE to better balance Rio’s corporate structure.

Rio currently has a weighted 77% of its capital listed in the UK, as opposed to 23% on the ASX.

Glencore, which holds the record for the LSE's largest ever float, could also be the largest to depart, as it mulls decoupling from UK markets to more attractive camps across the pond.

“Ultimately, what we want to ensure is that our securities are traded on the right exchange where we can get the right and optimal valuation for our stock,” Glencore CEO Gary Nagle told reporters.

“There have been questions raised previously around whether London is the right exchange. If there’s a better one, and those include the likes of the New York Stock Exchange, we have to consider that.”