Glencore reported a decline in full-year profit as weaker commodity prices weighed on earnings, prompting the company to consider production cuts in key markets. The commodity giant also revealed it is reviewing its primary listing location, which has been in London since its 2011 initial public offering.

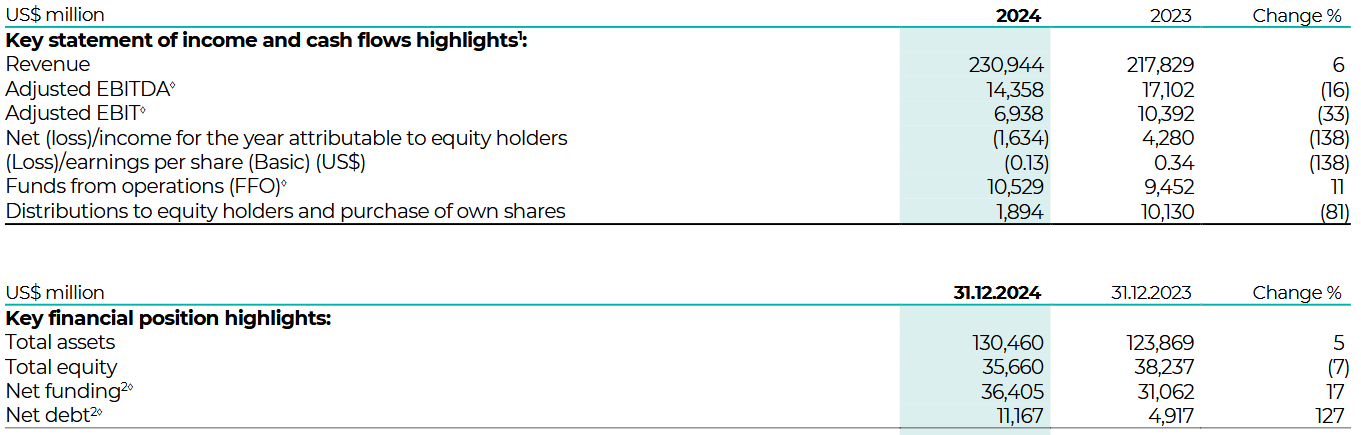

The company reported an adjusted EBITDA of US$14.4 billion for 2024, marking a 16% decline from the previous year. Despite the downturn, Glencore announced a $2.2 billion shareholder return, including a $1 billion share buyback.

Shares fell as much as 7.2% in London on Wednesday, closing at four-year lows and posting the steepest intraday drop in nearly two years.

Glencore’s debt increased to $11.2 billion, partly due to its acquisition of coal mines from Teck Resources Ltd.

Glencore’s earnings have declined sharply since its record profits in 2022, driven by falling prices for key commodities like coal and cobalt.

The company's commodity trading division also saw earnings decline, generating $3.2 billion in 2024, down from $3.5 billion the previous year.

The company took a $1.5 billion writedown on various smelting operations and is reassessing its long-term strategy for those assets.

Additionally, Glencore is weighing whether to shift its primary listing from the London Stock Exchange.

While it did not specify potential alternatives, Glencore Chief Executive Officer (CEO) Gary Nagle said on a call with reporters: “There have been questions raised previously around whether London is the right exchange.

“We want to ensure that our securities are traded on the right exchange, where we can get the right and optimal valuation.

“If there’s a better one, and those include the likes of the New York Stock Exchange, we have to consider that.”

At the time of writing, Glencore PLC (LSE: GLEN) stock was trading at £327.80, down 7.3% from Tuesday's close of £353.55. The stock reached a day low of £325.00 and a day high of £344.85. Glencore's market cap stands at £43.06 billion.