Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Telstra bests estimates

- Wesfarmers profits up across sectors

- Fortescue, Rio Tinto profits drop

- Etsy's gross merchandise sales fall, but net income grows

- Analog Devices still passes estimates amid declines

- Garmin extends estimate-smashing streak

- Plus more to come

_______________________________________________________________________________________

8:41 am (AEDT):

Hello, everyone! Harlan Ockey here to walk you through this morning's earnings. We have companies like Telstra, Wesfarmers, Fortescue, Etsy, and Crown Castle reporting results today.

Kicking things off at the ASX, Transurban (TCL) has plunged to an A$47 million loss in the first half of the 2025 financial year (H1 FY25), down 123.3% on a year ago, despite an increase in traffic on its roads in Australia, the United States and Canada.

The company said the statutory net loss after tax was $15 million in the six months to 31 December 2024, a drop of 106.5% from H1 FY24, as revenue fell 13.7% to $1.833 billion, although average daily traffic rose 2.4% to 2.5 million trips.

Proportional operating earnings before interest, tax, depreciation and amortisation (EBITDA) increased 9.4% to $1.452 billion, supported by growth in proportional toll revenue of 6.2% to $1.872 billion and improved cost control.

The company announced an interim distribution of 32 cents per stapled security, up from 30 cents a year earlier, to be paid on 25 February to security holders registered on 31 December 2024, and reaffirmed FY25 distribution guidance of 65 cents per share, up from 62 cents in FY24.

Transurban (ASX: TCL) securities closed at $13.20 on Wednesday, down one cent (0.75%), capitalising the company at $40.9 billion.

(Thank you to Garry West for the write-up! Read Garry's full report here.)

9:04 am (AEDT):

Still at the ASX, Telstra (TLS) saw strong gains last half, beating estimates on EBITDA.

EBITDA was A$4.25 billion, rising 6% year-over-year and surpassing analyst estimates of $4.19 billion. Its net profit last half was $1.12 billion, up 7.1% year-over-year.

Revenue increased by 1.5% year-over-year, reaching A$11.6 billion. Earnings per share rose by 6% to 8.9 cents.

Telstra will pay an interim dividend of 9.5 cents per share, fully franked. Its free cash flow at the end of the half was A$1.29 billion.

“These are a strong set of results, delivering a fourth consecutive year of first half underlying growth, reflecting momentum across our business, strong cost control and disciplined capital management,” said CEO Vicki Brady.

The company's full FY2025 guidance includes an underlying EBITDA of $8.5-8.7 billion, unchanged from its previous forecasts.

Telstra also announced a A$750 million share buyback.

Read Mark Story's report here.

9:26 am (AEDT):

And at the ASX again, Wesfarmers (WES) reported increases in revenue and net profit last half. Revenue was A$23.5 billion, up 3.6% year-over-year.

Its net profit was A$1.47 billion, above analyst estimates of $1.45 billion. EBITDA was $2.3 billion, increasing 4.7% year-over-year.

Adjusted basic earnings per share were A$1.29, up year-over-year from $1.26. The company will pay an interim dividend of 95 cents per share, up from last year's 91 cents.

Sales at Bunnings, Kmart, and Officeworks all rose last half, up 3.1%, 2%, and 4.7% year-over-year respectively. Bunnings sales were the highest, at A$10.26 billion.

Its Chemicals, Energy and Fertilisers division saw revenue grow by 9.5% year-over-year to reach A$1.21 billion. Chemicals and Fertilisers posted 12.1% and 14.4% increases in revenue, respectively, while Energy's revenue fell by 0.8%.

“Wesfarmers remains focused on long-term value creation and continues to invest to strengthen its existing divisions and develop platforms for growth,” the company said.

"The retail divisions are expected to continue to benefit from their strong value credentials and by expanding their addressable markets," according to Wesfarmers. "The performance of the Group’s industrial businesses remains subject to international commodity prices, foreign exchange rates, competitive factors and seasonal outcomes."

Its full FY2025 outlook includes net capital expenditure of A$1.1-1.3 billion.

Mark Story has the full report.

9: 30 am (AEDT):

Continuing with the ASX, lower iron ore prices and higher production costs have seen Rio Tinto (RIO) profits drop 8% year-on-year to US$10.86 billion — close to market expectations.

Profit compared to 2023 has been attributed to an 11% lower iron ore sales which the company says is primarily attributed to weakened demand for steelmaking in China.

Higher net cash generated from operating activities of $15.6 billion was achieved, driven by what Rio says is a portfolio mix and effective working capital management.

The miner paid out a 60% full year dividend of $4.02 for $6.5 billion, marking a nine-year track record at the top end of the payout range, yet its lowest payout since 2017.

(Thank you to Cameron Drummond for the write-up. See Cameron's full story here.)

9:35 am (AEDT):

At the ASX, supply chain and logistics company Brambles (BXB) has announced a 10% lift in net profit after tax (NPAT) to US$445.7 (A$707.5) million for the first half of the 2025 financial year (H1 FY25).

Brambles, which is best known for its CHEP pallets business, said the improved result was struck on a 3% rise in revenue to $3.37 billion in the six months ended 31 December 2024.

Directors declared an interim dividend of US 19 cents per share, up 27% on the comparative period, to be paid on 10 April to shareholders registered on 13 March. Brambles also reaffirmed FY25 guidance of underlying profit growth of between 8-11% at constant currency rates.

Brambles (ASX: BXB) shares closed on Wednesday at $19.62, up 33 cents (1.71%), capitalising the company at $27.13 billion.

(Write-up courtesy of Garry West. Read Garry's full report here.)

9:53 am (AEDT):

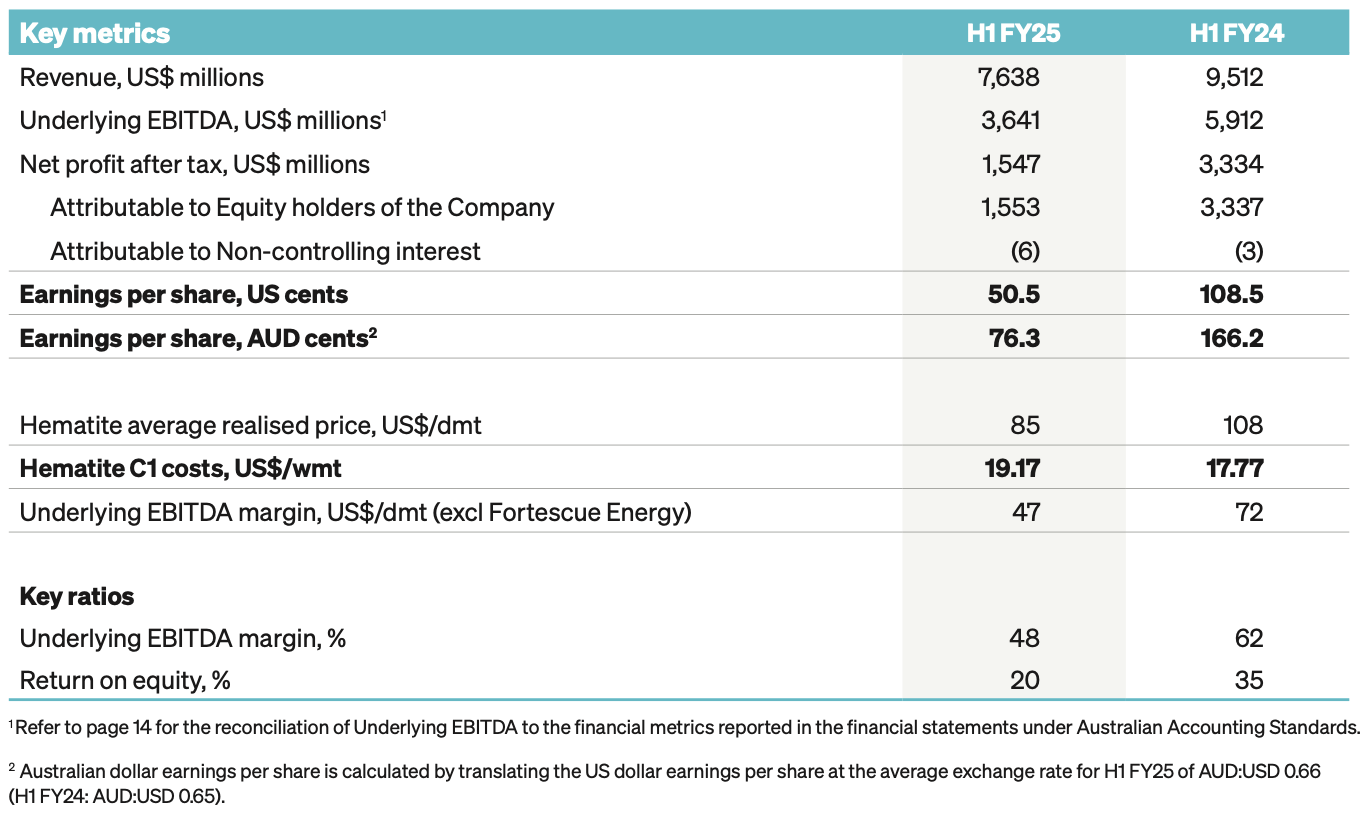

Still with the ASX, Fortescue (FMG) posted major declines in revenue and earnings per share last half.

Revenue was US$7.64 billion, down from $9.51 billion year-over-year. Earnings per share were $0.505, falling from last fiscal year's $1.085.

Its net profit after tax was US$1.55 billion, down 53% from the prior fiscal year's $3.33 billion.

While the company reported record iron ore shipments of 97 million tons, prices have remained weak. Total iron ore revenue was US$6.75 billion, down from $8.71 billion year-over-year.

Fortescue's Metals division saw revenue drop to US$7.59 billion, from H1 FY2024's $9.49 billion. Its Energy division, meanwhile, saw revenue increase to $53 million, up from last year's $26 million.

The company's full-year FY2025 guidance includes 190-200 million tons of iron ore shipments.

10:19 am (AEDT):

Turning to the NASDAQ, Etsy (ETSY) reported mixed results last quarter. Revenue grew by 1.2% year-over-year to US$852.2 million, but slid below analyst estimates of $862.8 million.

Gross profit was US$634.5 million, up 8.2% year-over-year. Gross merchandise sales fell to $3.74 billion, down 6.8%.

Diluted earnings per share were US$1.03, above estimates of $0.94. Net income grew 56% year-over-year to $129.9 million.

“Despite facing significant GMS headwinds in 2024, we are proud to have delivered year-over-year revenue growth and very strong profitability, while simultaneously investing in our future,” said CEOJosh Silverman.

“Foundational improvements in the Etsy marketplace, particularly in quality, reliability, and in making our app a place for discovery, are already enhancing customer experiences — which we believe will further differentiate the Etsy experience, driving consideration and purchase frequency as we work to get back to GMS growth,” Silverman said.

Its guidance for Q1 2025 expects gross merchandise sales to continue dropping at a rate similar to the 6.8% year-over-year drop seen this quarter.

Etsy's share price fell by 8.5% in after-hours trading.

10:25 am (AEDT):

In an ASX trading update, the S&P/ASX 200 is set to open lower, sending Australian share prices down for a fourth consecutive day.

Meanwhile, the United States saw the S&P 500 and Dow Jones add 0.2% each, while the Nasdaq Composite rose by 0.1%.

Garry West has the full story.

10:53 am (AEDT):

Turning to the LSE, Glencore (GLEN) reported a slump in full-year profit, with a net loss of US$1.63 billion across 2024.

Net income in 2023 was US$4.28 billion.

The company also posted an adjusted EBITDA of US$14.36 billion in 2024, down 16% year-over-year. Revenue increased by 6% to $230.94 billion, however.

Glencore's share price fell by 7.2% to close at a four-year low. The company is considering transferring its primary listing away from the London Stock Exchange, with CEO Gary Nagle saying: “There have been questions raised previously around whether London is the right exchange.”

Oliver Gray has the full report.

11:32 am (AEDT):

Back to the NASDAQ, Analog Devices (ADI) posted a decline in revenue and earnings per share, but beat analyst estimates.

Revenue fell by 4% year-over-year to US$2.42 billion, above LSEG estimates of $2.36 billion. Earnings per share were $0.78, down 16%.

Its Industrial division represented 44% of Analog Devices' revenue. Industrial revenue fell by 10% to US$1.07 billion.

Automotive and Communications revenue fell by 2% and 4% year-over-year, respectively. Consumer revenue grew by 19% to reach US$322.9 million, driven by greater demand for consumer electronics..

The company's guidance this quarter expects revenue of US$2.5 billion, plus or minus $100 million. It projects adjusted earnings per share will be $1.68, plus or minus $0.10.

"While we continue to operate in a challenging macro and geopolitical environment, our first quarter results and outlook for double-digit year-over-year growth in our second quarter builds my confidence that 2025 will be a year of growth," said CEO Vincent Roche.

Analog Devices has lifted its quarterly dividend by 8% to US$0.99, and the company will buy back $10 billion of common stock.

The U.S. Department of Commerce signed four non-binding memoranda in January that would provide Analog Devices with US$105 million in proposed direct funding. The company also agreed to partner with Teradyne Robotics last month to develop advanced robots, artificial intelligence features, and software.

11:36 am (AEDT):

In a U.S. futures update, Dow futures, S&P 500 futures, and Nasdaq-100 futures all fell by 0.1% each. The S&P 500 reached record highs during regular trade today.

Share prices for Herbalife, Nerdwallet, and BioMarin Pharmaceutical all rose in extended trading after strong earnings reports, while Carvana fell.

Oliver Gray has the full story.

12:03 pm (AEDT):

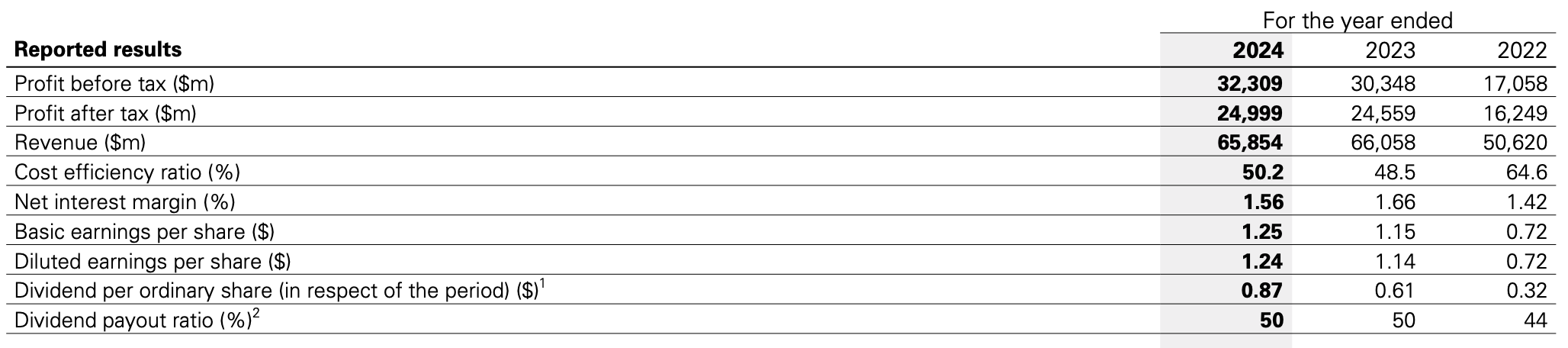

Returning to the LSE, HSBC (HSBA) saw full-year revenue miss analyst estimates, though net profit after tax continued to grow.

Revenue was US$65.85 billion last year, down from 2023's $66.06 billion and below LSEG estimates of $66.52 billion.

Net profit after tax was US$25 billion, up from 2023's $24.56 billion. Diluted earnings per share was $1.24, rising from the prior year's $1.14.

Wealth and Personal Banking, its largest division, posted constant currency profit before tax of US$12.18 billion, above 2023's $11.63 billion.

Commercial Banking, its second-largest, saw profit before tax fall to US$11.86 billion, down from 2023's $13.16 billion.

“Our strong 2024 performance provides firm financial foundations upon which to build for the future, as we prioritise delivering sustainable

strategic growth and the best outcomes for our customers," said CEO Georges Elhedery.

“We are creating a simple, more agile, focused bank built on our core strengths,” said Elhedery. “This includes creating four complementary, clearly differentiated businesses, aligning our structure to our strategy and reshaping our portfolio at pace and with purpose.”

HSBC plans to cut US$1.5 billion from its annual cost base by the end of 2026.

The company has been scaling back in several regions, with the company reportedly considering a sale of its Australian consumer operations. HSBC also sold its German private banking arm in September and its Canadian operations last March. It agreed to sell its retail banking operations in Bahrain to the Bank of Bahrain and Kuwait today.

12:29 pm (AEDT):

At the NYSE, Garmin (GRMN) surpassed estimates on revenue and earnings per share. Revenue last quarter was US$1.82 billion, up from $1.48 billion year-over-year and besting Zacks estimates by 8.39%.

Pro forma diluted earnings per share were US$2.41, up from $1.72 year-over-year. Garmin has beat consensus earnings per share estimates four times in the last four quarters.

“2024 was a year of remarkable growth and achievement for Garmin, resulting in record full-year consolidated revenue and record full-year revenue in all five of our segments, as well as record full-year consolidated operating income. We are entering 2025 with continued strong momentum from our robust product lineup and have many product launches planned during the year," said CEO Cliff Pemble.

Its Outdoor division, the company's largest, saw revenue grow by 29% year-over-year last quarter to reach US$629.4 million. Fitness, its second-largest division, posted a sales increase of 31% to $539.3 billion.

The Auto OEM division also reported a high growth rate of 30%, while Aviation and Marine rose by 9% and 5% respectively.

Full-year guidance for FY2025 projects revenue of around US$6.8 billion, which would be an 8% increase over 2024.

Garmin released its new ComingUp app this week. The app acts as a to-do list for Garmin watches, and can interface with task managers like Google Tasks and Microsoft To Do.

12:48 pm (AEDT):

Trading update: Australia's S&P 500 has dropped by 0.9% in its fourth consecutive day of decline.

The Nikkei 225 also fell by 0.9%, while the Kospi 200 was down 0.6%. The Shanghai Composite Index increased by 0.8%, and the Hang Seng lowered by 0.1%. India's BSE SENSEX remained flat.

The S&P 500 rose by 0.2% to notch its second consecutive record close.

Oliver Gray has the full story.

1:16 pm (AEDT):

Good afternoon! It’s Chloe Jaenicke here for the rest of the day.

E-commerce platform for buying and selling Carvana Co (NYSE: CVNA) reported revenue of US$13.67 billion, a 27% increase from the same time last year.

“In 2024, Carvana became the most profitable public automotive retailer in US history as measured by Adjusted EBITDA margin while also resuming industry-leading growth,” founder and CEO, Ernie Garcia said.

In a press release, the company said the 2024 results have positioned them well for 2025.

1:25 pm (AEDT):

Turning the ASX, Sonic Healthcare (SHL) reported an 8.4% increase in revenue to A$4.6 billion from $4.3 billion last year.

The company’s net profit also jumped 17% to $237 million.

Organic revenue for Sonic in the half year was 6.1%, with particularly strong growth in Australian, German and UK lab businesses.

1:40 pm (AEDT):

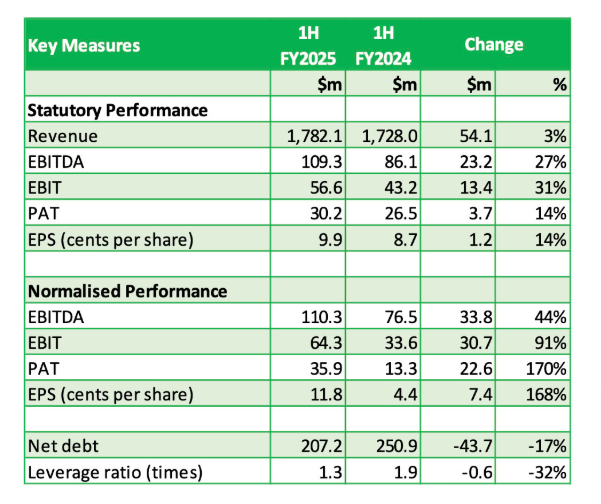

Staying on the ASX, Bega Cheese’s (BGA) normalised 1H FY2025 EBITDA of 110.3 million skyrocketed by 44% when compared to the prior comparative period.

The company also saw a 3% increase in revenue to $1.8 billion following the recovery of the Bulk segment.

Bega Cheese has also announced an interim dividend of 6.0 cents per share for 1HFY2025 that will be paid on 3 April.

1:53 pm (AEDT):

Over to NASDAQ, Hotels and Resorts, Inc. (HST) reported revenue of US$5,684 million for the full year, exceeding the annual estimate of $5,628.10 million and growing 7% from 2023.

For the Q4 2024, revenues increased 7.9% from the same period in 2023 to $1,428 million.

“Host delivered comparable hotel Total RevPAR growth of 3.3% over the fourth quarter of 2023, and full year growth of 2.1% driven by improvements in food and beverage revenues from group business. Comparable hotel RevPAR increased 3.0% for the quarter and 0.9% for the full year as a result of higher rates, improving leisure transient trends in Maui and strong group demand,” CEO and president, James Risoleo said.

2:09 pm (AEDT):

Remity (NASDAQ: RELY), a digital finance service, reported “exceptional” full-year and fourth-quarter results, according to co-founder and CEO Matt Oppenheimer.

“Our product experience continues to resonate with customers as we deliver simplicity, convenience, and trust,” Oppenheimer said.

“As we look ahead to 2025 and beyond, I am excited about the growth opportunities and innovation that will enable us to deliver on our vision.”

In the fourth quarter, their revenue grew 33% to US$351.9 million, compared to $268.8 million in the same quarter in 2023, and their adjusted EBITDA for the quarter skyrocketed 434% from Q4 2023 at $43.7 million.

A possible explanation for the increase in the fourth quarter is their active user base growing 32% from 5.9 million in Q4 2023 users to 7.8 million users in Q4 2024.

As for the full year, they experienced a 34% rise in revenue from $944.3 million in 2023 to $1,264.0 million. Their EBITDA also increased by 203% from $44.5 million to $134.8 million.

They are currently expecting a 24 to 25% growth rate in revenue for the 2025 fiscal year.

2:23 pm (AEDT):

Restaurant sales at The Cheesecake Factory (NASDAQ: CAKE) grew 1.7% year-over-year in the fourth quarter of 2024.

Alongside this, their total revenues rose from US$877.0 million in Q4 2023 to $921.0 million in Q4 2024.

The company reported net income per share of $0.83 in the fourth quarter.

“Our fourth quarter performance capped off an excellent year, with solid revenue and earnings contributing to record annual revenue and substantially improved profitability for 2024,” chairman and CEO, David Overton said.

2:41 pm (AEDT):

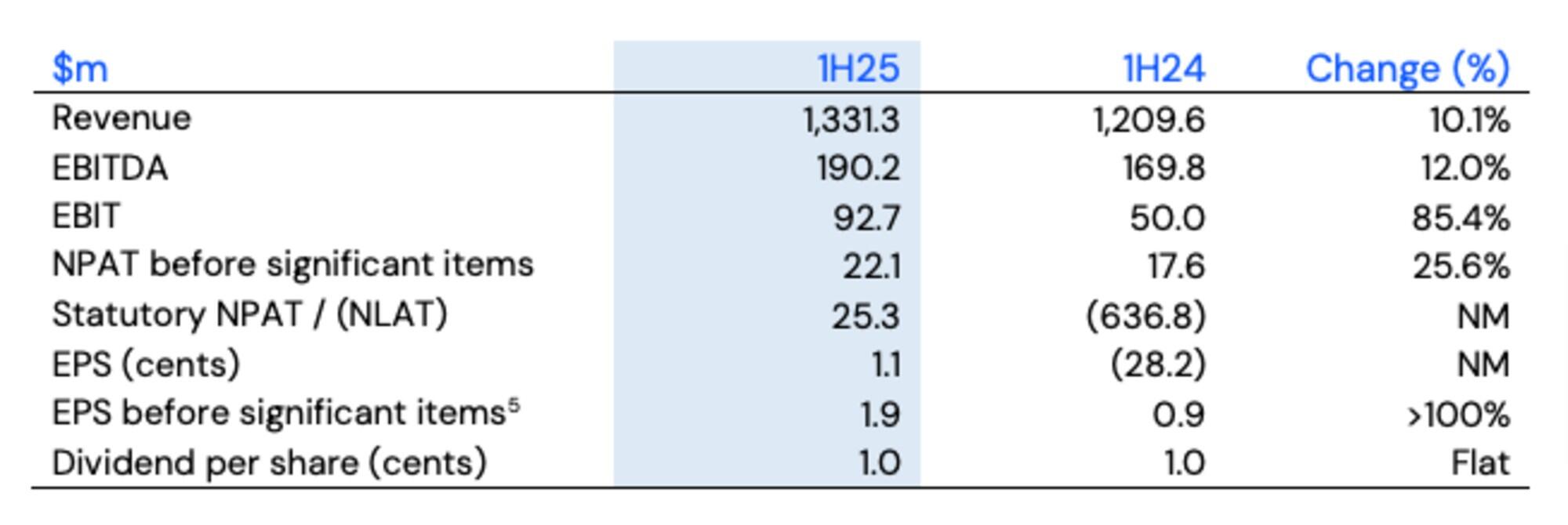

Moving back to the ASX, Tabcorp (TAH) reported a 10.1% increase in revenues of A$1,331.3 million and EBITDA of $190.2 million, an increase of 12.0% from 1H24.

Managing director and CEO, Gillon McLachlan said Tabcorp is getting fitter and are expecting to grow in the rest of 2025.

“We have increased our wagering and media capability at the leadership level, developed a simpler, more cost-effective operating model, and are operating with a bias for action and increased accountability,” McLachlan said.

“We are executing with a more aggressive cost and capital discipline, targeting opex savings in FY25 of $30m, 50% more than our previous target. Capex is expected to be $110m-$120m, around $25m lower than previous guidance.”

3:06 pm (AEDT):

Group sales for Universal Store Holdings Limited (ASX: UNI) grew 16.1% from the same time last year to A$183.5 million in 1H2025.

Universal Store sales grew 17.2% to $156.1 million and Perfect Stranger store sales increased 92.3% to $12.6 million from the same period last year. Meanwhile, CTC (THRILLS) sales went down by 12.4% from the same time last year to $22.2 million.

“The Group has delivered a very pleasing H1 FY25 result with strong sales growth and robust gross margins,” group CEO Alice Barbery said.

“This performance reflects the team’s commitment to connecting with our customers with ontrend, occasion for wear apparel, communicating with our customers in the channels relevant to them and strong operational execution.”

3:15 pm (AEDT)

Shares in Fortescue Metals (ASX: FMG) dropped more than 7% on trade today with a barrage of bad news hit the market.

The miner revealed an H1 FY25 profit of just US$1.55 billion - less than half that of H1 2024, compounded with a $1.8 billion legal action over its Solomon iron ore hub and the Trump administration pausing grant payments for its American green energy initiatives.

Depressed iron ore prices and production costs are - as they have been with both BHP (ASX : BHP) and Rio Tinto (ASX: RIO) - to blame for lower profit margins for iron ore producers - of which, and unlike the other two, is a much more dominant revenue creator for FMG (ASX : FMG).

(Thank you to Cameron Drummond for the write-up. Read Cameron’s full report here)

3:33 pm (AEDT):

The Reject Shop (ASX: TRS) reported total sales of $471.7 million for 1H25, reflecting a 2.5% from the same period last year and their EBITDA increased by 13.9% to $29.1 million.

In the first half of the financial year, The Reject Shop opened nine new stores bringing their total to 393 stores across Australia with a further seven stores set to open in the second half of the fiscal year.

3:55 pm (AEDT):

Pilbara Minerals (ASX: PLS) revenue fell 44% from the same period last year to A$426 million. According to the company, this was likely driven by the 58% decrease in the average realised price and partly offset by a 37% increase in sales volumes.

In the release, the company said they are in a strong balance sheet position with cash of $1.2 billion and an additional $635 of liquidity available from undrawn loan facilities.

“PLS delivered a strong half year, achieving new production and sales records at our Pilgangoora Operation,” managing director and CEO, Dale Henderson said.

4:25 pm (AEDT):

Looking forward to tomorrow, Airbus's (EPA: AIR) net profit is expected to come in at around 2.10 billion euros, which is 1.46 euros more than a year earlier. The company's revenue is expected to be around 24.68 billion euros for Q4 based on the estimates of 22 analysts.

Airbus stocks are currently trading at 168.98 euros, down 2.36% from the previous close of 173 euros. It reached a high of 173.46 euros and low if 168.82 euros. The company's market cap is 133.46 billion euros.

That's all for today! Come back tomorrow for more earnings coverage.