Just as the sector is facing mounting regulatory headwinds and environmental opposition, perhaps the most significant endorsement yet of deep sea mining's commercial viability has been inked as Seoul-based Korea Zinc announced a strategic US$85.2 million equity injection into Canadian ocean minerals explorer The Metals Company (NASDAQ: TMC).

Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals supply chains - from pricing, production, refinement and mergers & acquisitions, to manufacturing and consumer products.

The investment is comprised of 19.6 million common shares at US$4.34 per share; with potential for an additional 6.9 million shares at $7, giving Korea Zinc a 5% stake in TMC and access to what may become one of the world's most strategic mineral reserves.

Two years ago, TMC completed its first nodule collection test at the Clarion-Clipperton Zone (CCZ) - a vast Pacific seabed region between Hawaii and Mexico.

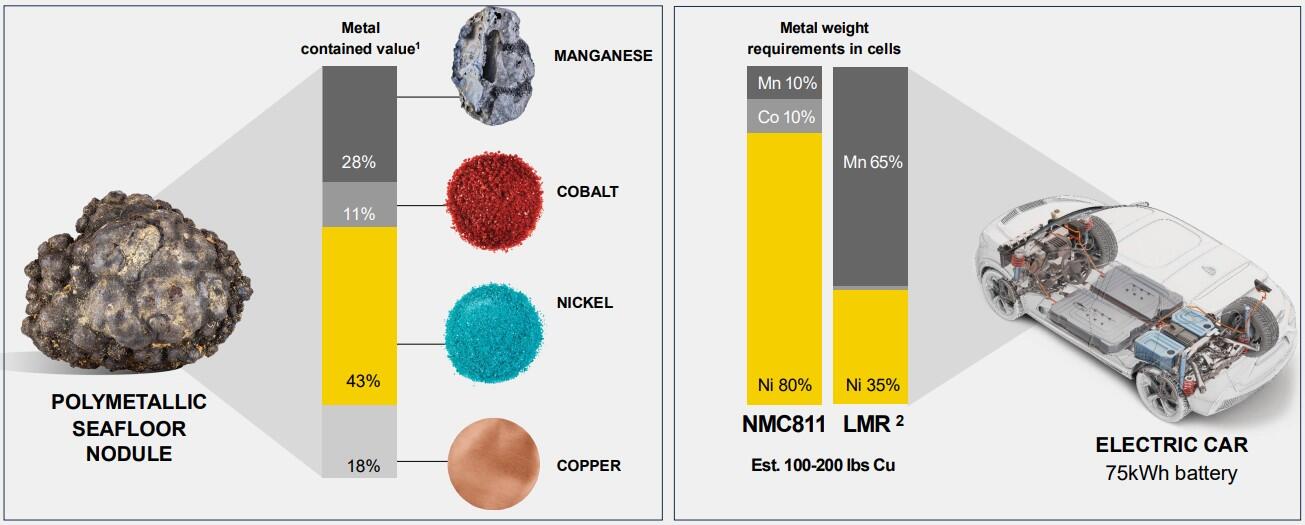

TMC's mining zones have estimated resources sufficient to electrify America's entire passenger car fleet; with enough manganese (456yrs), cobalt (165yrs), nickel (81yrs), and copper (4yrs) for annual industrial consumption.

Controversy around the environmental impacts of mining the seabed then led to a shareholder revolt and amid financial losses and regulatory delays, the stock price plummeted 85%.

Korea Zinc's lifeline investment comes as TMC pursues a controversial runaround of the United Nations' maritime governance, seeking United States' regulatory approval for what would be the world's first commercial deep sea mining operation.

It follows U.S. President Donald Trump's 24 April executive order that expedites permits under the Deep Seabed Hard Minerals Resource Act, while bypassing international frameworks entirely.

Seoul's strategy

Korea Zinc's involvement transformed TMC from a speculative Canadian resource play into something approaching industrial legitimacy with desperately needed capital.

Understanding Korea Zinc requires realising the scope of South Korea's broader critical minerals anxiety.

From Samsung's semiconductors to LG's batteries, the small Asian nation depends almost entirely on imported raw materials - creating dangerous supply chain vulnerabilities that Seoul is more than wary of having had a front row seat watching China exploit them systematically against the West across multiple sectors.

Korea Zinc itself is at the apex of Asian non-ferrous metal processing; evolving from a simple lead-zinc smelter into Asia's dominant processor of secondary metals, handling >800,000 tonnes per annum (tpa) through its Onsan complex.

The refiner's precursor cathode active material (pCAM) technology fits perfectly into TMC's nickel-cobalt-rich nodules - the metals required for lithium-ion battery manufacturing.

And the partnership solves TMC's most difficult challenge - finding processors capable of handling polymetallic nodules' unique metallurgical complexity.

Unlike terrestrial mining's single-metal concentrates, nodules contain nickel, cobalt, copper, and manganese in equal proportions, requiring integrated processing capabilities that few companies possess.

Executive order puts China in check

The timing of the deal is no mere coincidence.

Trump's executive order represents perhaps the most significant challenge to multilateral ocean governance since the 1982 UN Convention on the Law of the Sea - a treaty America never ratified mind you - creating the legal loophole TMC now exploits.

The administration projects that extracting >1 billion metric tonnes of polymetallic nodules from U.S. waters could boost GDP by US$300 billion over 10 years and create an eye-whopping 100,000+ jobs.

Industry advocates argue this represents a national security imperative - if America doesn't pursue seabed resources, China will get there instead.

And they more than likely have a very good point. Back in February, Beijing signed a memorandum with the Cook Islands to collaborate on seabed mineral extraction - making glaringly obvious the Chinese Communist Party's willingness to secure ocean resources as the West drags its feet deliberating over regulatory frameworks.

The Middle Kingdom has already developed dual-use technologies with both commercial mining and potential military applications - including autonomous underwater vehicles that could operate near Hawaii under commercial pretexts.

Environmental concerns

However, as could be predicted, Trump's order has triggered substantial opposition from environmental groups and marine scientists alike.

"This executive order is a life raft for an untested, opaque industry that science is telling us poses enormous threats to ocean ecosystems for little gain," argues Earthjustice's Addie Haughey.

The scientific community's concerns centre on the deep sea's fundamental unknowability.

Researchers estimate that the vast majority of the ocean's deep sea marine species remain undiscovered, making environmental impact assessments inherently speculative.

More of the moon has been mapped out than the Earth's seabed.

Over 35 countries have called for a moratorium on seabed mining until strong regulations exist, creating international opposition that Korea Zinc's 5% investment implicitly challenges.

"The United States government has no right to unilaterally allow an industry to destroy the common heritage of humankind," argue environmental groups.

The company's involvement provides TMC with processing expertise and addresses maritime security concerns embedded in Trump's executive order.

Rather than depending on Chinese processing capacity, TMC can offer U.S. policymakers a "trusted ally" narrative, encompassing both mineral security and strategic partnership.

It transforms the company from a resource exploration play with no money into a geopolitical asset with established downstream markets and allied government backing.

The US$85.2 million cash injection itself is projected to crucially provide TMC with roughly two years' operational runway.

Competitors - including Belgium's Global Sea Mineral Resources and UK Seabed Resources - now face fundamental questions: can they secure comparable downstream partnerships, or risk becoming resource providers to integrated competitors?

The International Seabed Authority has been seeking regulatory framework completion by the end of this year - though Trump's decision now effectively abandons multilateral approaches, potentially triggering what analysts describe as “unexpected country alliances in opposition”.

Navigating crosscurrents

TMC is now a chess piece on a geopolitical playing board with multiple outcomes that may occur simultaneously.

The bull case: Korea Zinc validates commercial viability while Trump's executive order provides the regulatory pathway.

Combined U.S.-South Korean strategic alignment creates powerful political momentum, potentially overwhelming environmental opposition through economic and security arguments.

The bear case: Environmental opposition may intensify precisely because of geopolitical backing, with international allies condemning unilateral action over seabed mining.

Legal challenges could invalidate licensing approaches, while South Korean political changes could affect strategic priorities.

The China variable: Beijing's response to a U.S.-South Korean deep-sea mining collaboration remains unpredictable.

China could accelerate seabed operations, challenge licensing through international forums, or even use its economic leverage over South Korea to disrupt partnerships.

The roll of the dice: Korea Zinc has now chosen the ‘America and its allies’ path - betting that industrial pragmatism overcomes environmental idealism…

…which may be either a strategic masterclass or a spectacular miscalculation on its part.