Blue or red – the political colour of the party running the Federal Government in Canberra has little impact on the Australian sharemarket performance, depending on how far you go back.

That much is clear from analysis of the performance of the Australian Securities Exchange and its predecessors in the wake of elections, firstly since 1975 and then dating back to the end of the Second World War.

“At a high level, data spanning the last 45 years suggest it really doesn’t matter which party is in power,” Morningstar market strategist Lochlan Halloway said in a note to clients.

He has published data showing returns under Liberal and Labor governments have been level pegging, unlike their performance on 3 May when Prime Minister Anthony Albanese retained power with an increased majority.

“Labor’s election victory is historic....This is an extraordinary majority, the likes of which Labor has not enjoyed since Bob Hawke’s first term in 1983,” Halloway said.

“I won’t dwell on the raw politics of the election. What matters for us is whether political affiliation affects the stock market. After all, this is a thumping victory for a party generally perceived as the less ‘market-friendly’ of the two majors.

“But let‘s scrutinise this a little more closely. Does the political stripe of the government actually matter for equity market returns?”

Not much between them

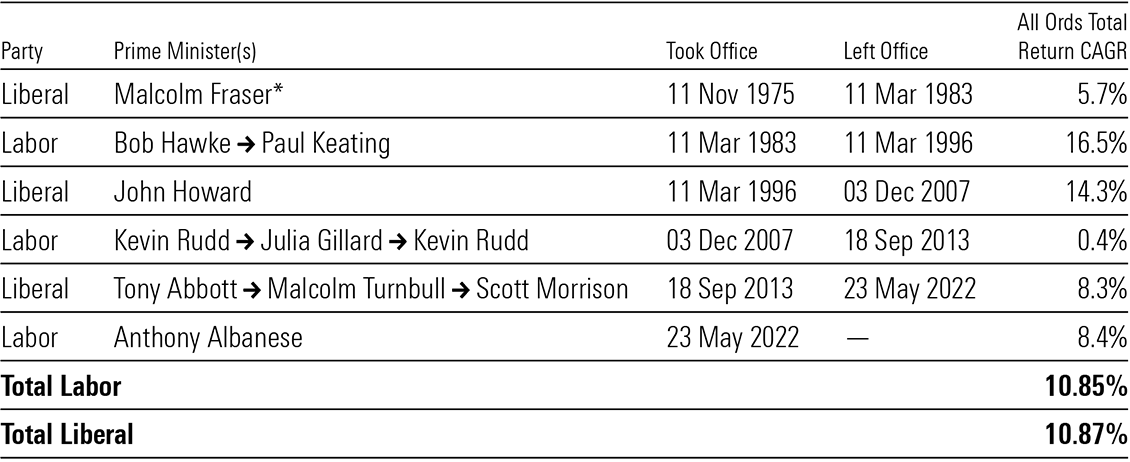

Although the Liberal/National Party (LNP) coalition has a reputation as more pro-business, the compound annual total returns from the All Ordinaries index have been 10.87% under LNP coalition governments and 10.85% under Labor since 1975.

Halloway said although the two major parties had similar equity market track records over this term, returns varied widely during individual prime ministers' terms.

Labor governments oversaw annualised returns ranging from 0.4% (Kevin Rudd-Julia Gillard-Rudd 2007 to 2013) to 16.5% (Bob Hawke-Paul Keating 1983 to 1996) but domestic policy mattered less than global events in explaining the differences.

The Australian market closely tracked global benchmarks and this was expected to continue.

“Australia is a small, open economy with stable political and legal institutions, making it an attractive home for global capital,” Halloway said.

“Despite accounting for about 2% of global market capitalisation, Australian equities have delivered near-identical returns to global peers, largely because of our exposure to global cycles, particularly China’s rise.”

Time in the market matters most, with investors who remained fully invested in the sharemarket earning returns about double that of those who invested only when one party was in power and sold out when the opposition returned to the government benches.

Starting with $1,000 in 1980, the Coalition-only investor would have $11,426, a Labor-only investor would have $9,419 and the investor who stayed fully invested would have amassed $107,624,all at Tuesday 6 May 2025.

“It‘s an unrealistic example, but nonetheless, a powerful reminder of the miracle of compounding. If you step in and out of the market on political shifts, you risk missing out on the long-term gains that matter most,” Halloway said.

More of the same

AMP Chief Economist & Head of Investment Strategy Shane Oliver delved further back to learn that Australian shares had performed better under the Coalition (12.9% annual return) than Labor (9.7%) since World War Two.

But he also found the strongest returns were under the reformist Hawke/Keating Labor Governments. In contrast, the Whitlam and Rudd/Gillard Labor governments were in power during global bear markets.

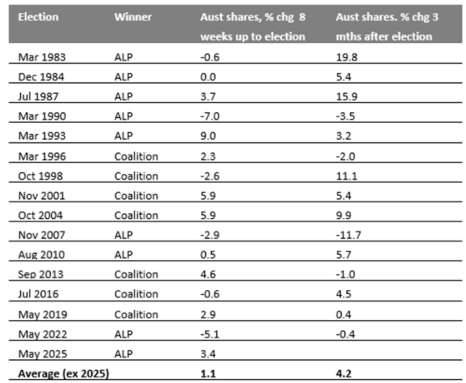

He also said shares had tended to rise after elections as uncertainty lifted with prices rising an average of 4.2% in the three months after a poll in 10 of the 15 elections since 1983.

“Once in government, political parties are usually forced to adopt at least half sensible policies if they wish to ensure rising living standards,” Oliver said in his Oliver’s Insights note.

In the case of the last election, the return of Labor with an increased majority basically meant “more of the same” in terms of key economic policies.

The key challenges were to boost productivity, improve housing supply and affordability, get the budget under better control and strengthen the economy in the face of global trade challenges posed by United States President Donald Trump.

“The impact on investment markets is likely to be minor,” Oliver said.

Goldman Sachs said it had not changed its economic forecasts given the election outcome was not surprising, the Budget announcements had been legislated and the post-Budget policy announcements had been fairly modest.