Re-live today's live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Disney beats on earnings per share, raises guidance

- McDonald's sales grow worldwide

- Uber trip numbers surge, Lyft hits new bookings record

- Honda, Toyota profits crash amid tariffs

- DoorDash, Shopify smash expectations on earnings per share and revenue

- Sony lifts guidance on strong gaming income

_______________________________________________________________________________________

8:51 am (AEST):

Good morning, everyone! Harlan Ockey here to walk you through today's earnings.

Starting off on the NYSE with Disney (DIS), the company beat expectations on earnings per share last quarter and has raised its full-year guidance, though it missed estimates on revenue.

Adjusted earnings per share were US$1.61, up from $1.39 year-over-year and beating LSEG estimates of $1.47. Revenue was $23.65 billion, rising 2% but under estimates of $23.73 billion.

Total operating income was up 8%, reaching US$4.6 billion.

Its Entertainment segment saw operating income fall by US$179 million to $1.0 billion, driven by a decline in Linear Networks and in Content Sales/Licensing. Disney+ and Hulu subscriptions were up 2.6 million from last quarter.

Its Sports segment posted a US$235 million increase in operating income to $1.0 billion, while Experiences operating income grew by $294 million to $2.5 billion.

“The company is taking major steps forward in streaming with the upcoming launch of ESPN’s direct-to-consumer service, our just-announced plans with the NFL, and our forthcoming integration of Hulu into Disney+, creating a truly differentiated streaming proposition that harnesses the highest-caliber brands and franchises, general entertainment, family programming, news, and industry-leading sports content. And we have more expansions underway around the world in our parks and experiences than at any other time in our history," said CEO Bob Iger.

Disney's guidance for next quarter projects a quarterly increase of more than 10 million Disney+ and Hulu subscriptions. Across fiscal 2025, it expects adjusted earnings per share of US$5.85, compared with its May guidance of $5.75.

Garry West has the full story.

9:06 am (AEST):

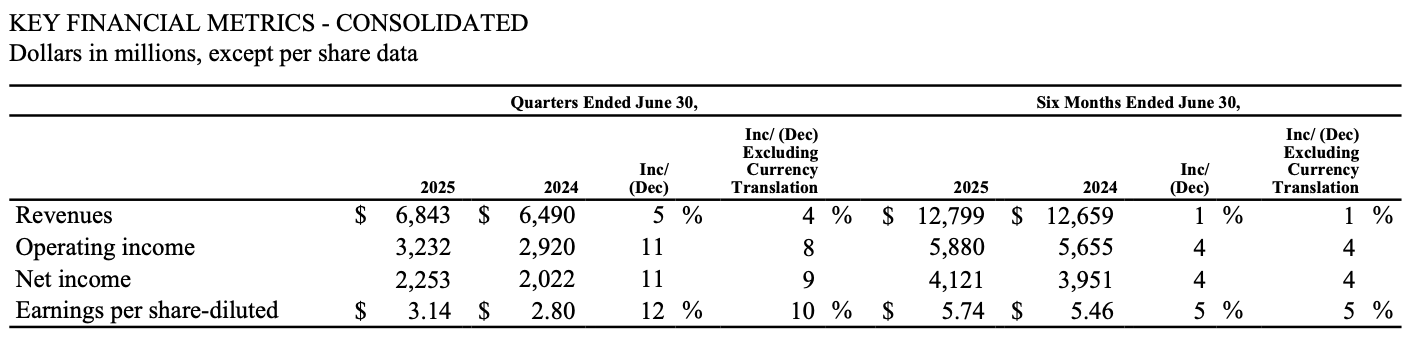

At the NYSE again, McDonald's (MCD) surged past estimates, driven by an increase in sales worldwide.

Revenue was US$6.84 billion, up 5% year-over-year and above LSEG estimates of $6.7 billion. Earnings per diluted share were $3.14, rising 12%.

Operating income was US$3.23 billion, up 11%.

Global comparable sales increased by 3.8%, with 2.5% growth in the United States, 4.0% in International Operated Markets, and 5.6% in International Developmental Licensed Markets. All markets within these regions saw positive comparable sales, the company said.

Our 6% global Systemwide sales growth this quarter is a testament to the power of compelling value, standout marketing, and menu innovation — proving again that when we stay focused on executing what matters most to our customers, we grow,” said CEO Chris Kempczinski. “Our technology investments and ability to scale digital solutions at speed will continue to elevate the McDonald’s experience for customers, crew, and our global System.”

Read Mark Story's report here.

9:25 am (AEST):

And at the NYSE again, Uber (UBER) reported an 18% year-over-year rise in trips last quarter, with double digit percentage increases across both its Mobility and Delivery segments.

Uber trips reached US$3.3 billion, with gross bookings up 17% to $46.8 billion. Monthly active platform consumers grew by 15% to reach 180 million.

Revenue was US$12.65 billion, up 18% and beating LSEG estimates of $12.46 billion. Earnings per share were $0.63, in line with estimates.

Net income rose 33% to US$1.36 billion. Income from operations soared by 82% to $1.45 billion.

Its Mobility segment saw a 16% increase in gross bookings to US$23.76 billion, while Delivery gross bookings were up 20% to $21.73 billion. Freight gross bookings declined by 1% to $1.26 billion.

While the company did not disclose the percentage of trips in self-driving vehicles, it now operates robotaxi services in 12 cities in partnership with companies like Waymo.

“Our platform strategy is working, with record audience, frequency, and profitability across Mobility and Delivery,” said CEO Dara Khosrowshahi. “But we’re still only beginning to unlock the platform’s full potential, now with 20 autonomous partners around the world.”

Uber's guidance next quarter expects gross bookings of US$48.25-49.75 billion.

9:39 am (AEST):

Over to the NASDAQ, Airbnb (ABNB) saw double digit percentage growth in both revenue and income.

Revenue was US$3.1 billion, up 12% year-over-year. Net income grew by 16% to $642 million.

Nights and seats booked through Airbnb reached 134.4 million last quarter, rising by 7%. Gross booking value was up 11% to US$23.5 billion.

Adjusted EBITDA was up 17% to US$1.0 billion.

"Airbnb had a strong Q2, exceeding expectations across key metrics including bookings, revenue, and margins. Despite global economic uncertainty early in the quarter, travel demand picked up, and nights booked on Airbnb accelerated from April to July," the company wrote.

North America, its largest market, reported low single digit growth in nights and seats booked. While growth was seen across regions, Latin America led with an increase of nearly 20%, the company said.

Airbnb introduced Airbnb Services and Airbnb Experiences in May, allowing users to book services like meals and spa treatments and travel activities. It also redesigned its app, which the company said would “put experiences and services front and centre”.

The company's guidance next quarter expects revenue of US$4.02-4.10 billion.

9:56 am (AEST):

At the NASDAQ, Thomson Reuters (TRI) posted mixed results, surpassing estimates on adjusted earnings per share while revenue growth lagged.

The company delivered an adjusted earnings per share of US$0.87, beating analyst estimates of $0.83. Diluted earnings per share plummeted 63% to $0.69, which Thomson Reuters credited to currency losses.

The information giant's "Big Three" segments — Legal, Tax & Accounting, and Corporates — managed 9% organic revenue growth. These segments represent 82% of total revenues.

Total revenues only crept up 3% to US$1.79 billion, just meeting Wall Street's expectations.

“We saw good momentum continue in the second quarter, with revenue in-line and margins modestly ahead of our expectations”, said CEO Steve Hasker.

"We remain focused on delivering product innovation across our portfolio, as exemplified by the launch of CoCounsel Legal, including Deep Research on Westlaw and guided workflows, and CoCounsel for tax, audit and accounting. With these advanced agentic AI offerings, we continue to leverage our authoritative content and deep expertise to bring transformative professional-grade AI solutions to our markets.”

Thank you to Cameron Drummond for that write-up. Read the full report here.

10:16 am (AEST):

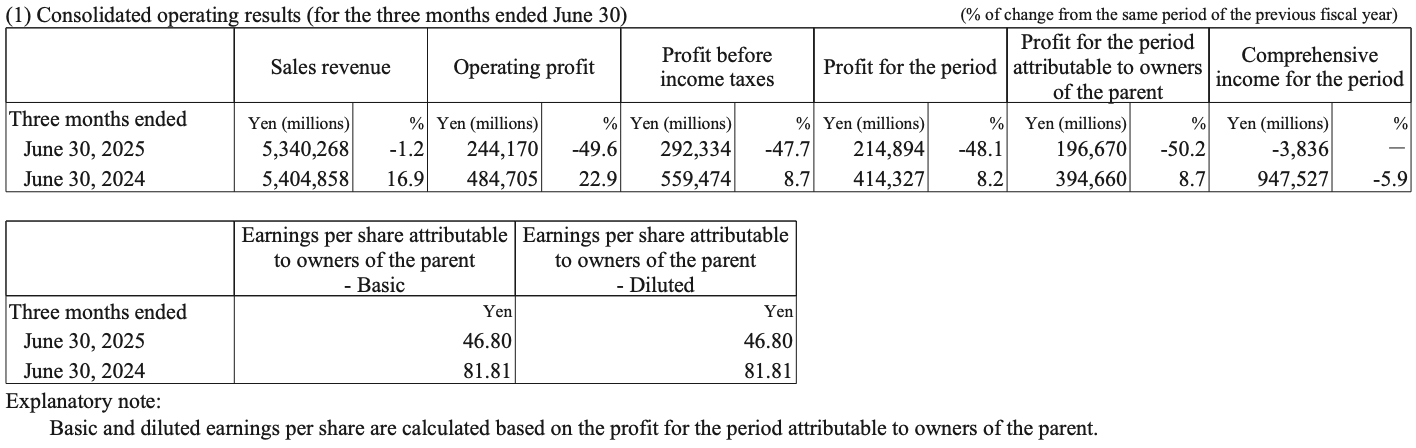

Over to the TYO, Honda Motor (7267) saw operating profit crash last quarter amid U.S. auto industry tariffs, although its revenue beat estimates.

Operating profit was JP¥244.17 billion, down 49.6% year-over-year and below LSEG estimates of ¥323.48 billion. Revenue was ¥5.34 trillion, dropping 1.2% but passing estimates of ¥5.25 trillion.

Earnings per share were JP¥46.80, a collapse from the ¥81.81 one year ago.

Its Automobile segment posted a loss of JP¥29.63 billion last quarter, compared with a profit of ¥222.84 billion one year ago.Its Motorcycle, Financial Services, and Power Products & Other segments all saw profits grow, though Power Products & Other continued to report a loss.

The company raised its full-year forecast, however, and now projects revenue of JP¥21.10 trillion and operating profit of ¥700 billion. Its previous guidance included revenue of ¥20.30 trillion and profit of ¥500 billion.

“As a result of analyzing the impact of tariffs and reassessing our foreign exchange assumptions in light of the latest conditions, the Company upwardly revises its forecast for operating profit, profit before income taxes, profit for the year, and profit for the year attributable to owners of the parent for the fiscal year ending March 31, 2026,” Honda wrote.

Honda plans to increase production volume in the U.S. to avoid the impact of tariffs, including potentially for its electric vehicles, executives said on an earnings call.

10:52 am (AEST):

Back at the NASDAQ, DoorDash (DASH) beat expectations on earnings and revenue, reaching new quarterly records.

Revenue was US$3.28 billion, up 25% year-over-year and above LSEG estimates of $3.16 billion. Earnings per share were $0.65, beating estimates of $0.44.

“In Q2 2025, we generated new quarterly records for Total Orders, Marketplace GOV, Revenue, and GAAP net income. In Q2 2025, we also celebrated passing 10 billion lifetime orders globally,” the company wrote. “Our progress reflects our team’s innovation, operational excellence, and hard work, and we intend to continue investing to expand the scale, scope, and capabilities of our business going forward.”

Total orders were 761 million, growing 20%. Marketplace gross order volume was US$24.2 billion, up 23%.

GAAP net income was US$285 million, rising from a loss of $157 million one year ago. Adjusted EBITDA was $655 million, compared with $430 million in 2024's second quarter.

Its guidance next quarter projects marketplace gross order volume of US$24.2-24.7 billion, with adjusted EBITDA or $680-780 million.

11:26 am (AEST):

Now to the CPH, Novo Nordisk (NOVO) saw double digit percentage growth in sales and profit last half, but has cut its guidance.

Net sales were DK154.94 billion kr (US$24.2 billion, A$37.2 billion), up 16% year-over-year. Its net profit was 55.54 billion kr, rising 22%.

Operating profit increased by 25% to DK72.24 billion kr. Diluted earnings per share were up 23% to 12.49 kr.

“While delivering 18% sales growth in the first half of 2025, we have lowered our full-year outlook due to lower growth expectations for our GLP-1 treatments in the second half of 2025. As a result, we are taking measures to sharpen our commercial execution further, and ensure efficiencies in our cost base while continuing to invest in future growth,” said CEO Lars Fruergaard Jørgensen.

The company announced last week that it would lower its full-year guidance, and now projects sales growth of 8-14%, down from 13-21%. Novo Nordisk credited this to lower growth expectations for the year's second half, driven by slow market expansion and competition for Ozempic and Wegovy in the weight loss drug market.

11:54 am (AEST):

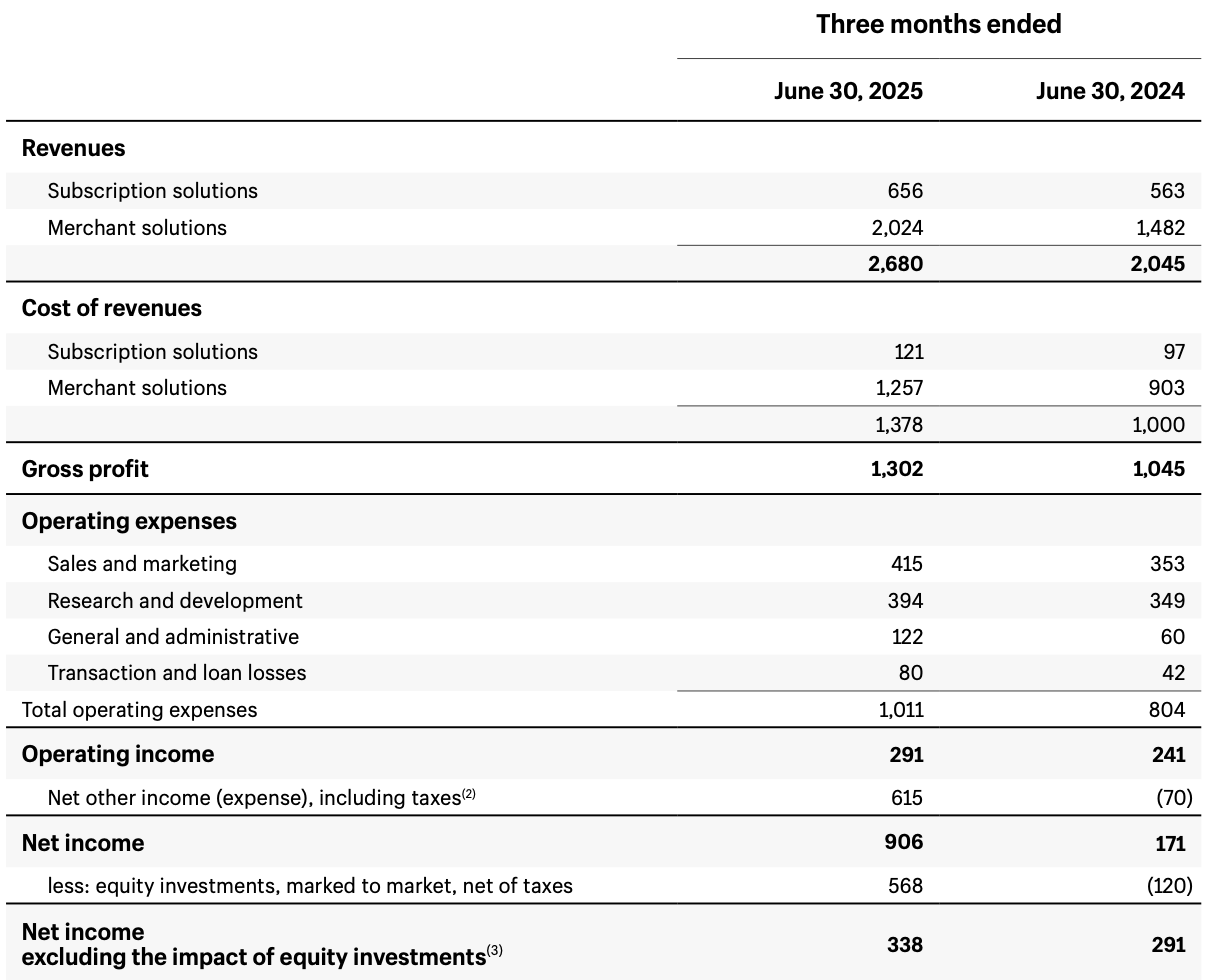

And back to the NASDAQ, Shopify (SHOP) passed estimates on earnings per share and revenue last quarter, sending shares up 22%.

Revenue was US$2.68 billion, rising from $2.05 billion one year ago and above LSEG estimates of $2.55 billion. Earnings per share were $0.35, beating estimates of $0.29.

Shopify's revenues rose across both its Subscription Solutions and Merchant Solutions segments. Subscription segment revenue grew from US$563 million to $656 million, while Merchant segment revenue increased from $1.48 billion to $2.02 billion.

Gross merchandise volume was US$78.84 billion, up from $67.25 billion one year ago.

Net income was US$906 million, up from $171 million last year. Operating income rose from $241 million to $291 million.

“Shopify delivered another outstanding quarter, with both GMV and revenue growth rates accelerating in North America, Europe, and Asia Pacific, quarter over quarter. Europe was a particular source of strength, where GMV grew 42% on a constant currency basis,” said CFO Jeff Hoffmeister.

Its guidance next quarter projects mid-to-high twenties year-over-year percentage growth in revenue.

Shopify's share price surged to US$154.90 after the earnings release, following its previous close at $127.00

12:23 pm (AEST):

At the NYSE, MetLife (MET) reported a major fall in profits alongside a drop in premiums last quarter.

Its adjusted earnings were US$1.36 billion, down 16% year-over-year. This was "due to less favourable underwriting and lower investment margins," the company wrote.

Premiums, fees, and other revenues declined by 6% to $12.75 billion. Net income plummeted by 23% to US$698 million.

The company's net investment income was up 9% to $5.7 billion, however. Variable investment income dropped by 35% to $195 million.

MetLife's Group Benefits segment saw adjusted earnings sink by 25% year-over-year, while its Retirement and Income Solutions earnings dropped by 10%. Adjusted earnings in Asia fell by 22%, though Europe, the Middle East, and Africa posted 30% growth.

"This quarter, we continued to execute our New Frontier strategy to create value for our customers and shareholders. While the quarter didn’t demonstrate the full earnings power of MetLife, we saw clear momentum across several of our market-leading businesses, coupled with solid underlying fundamentals," said CEO Michel Khalaf.

12:54 pm (AEST):

Good afternoon, Chloe Jaenicke here to take you through some lunchtime earnings.

The FTSI 100 miner Glencore (LON: GLEN) has abandoned plans to join the New York exchange, opting for the London exchange.

This comes as the company reports a net loss of US$655 million in the first half of 2025, which was almost triple the US$233 million loss in the same period last year.

The net loss was primarily due to lower coal prices, copper production problems and uncertainty caused by Donald Trump’s tariffs.

“While there is much uncertainty around the impacts of geopolitics and trade in the shorter term, we remain of the view that, in certain commodities, the scale and pace of required resource development will struggle to meet the demand projections for such materials into the future,” Glencore CEO Gary Nagle said.

“We are well placed to participate in bridging this gap, through the flexibility embedded in both our Marketing and Industrial businesses to respond to global needs.”

Revenue for the company came in at US$117.396 billion and it reported a loss per share of US$0.05.

1:06 pm (AEST):

On the NASDAQ, cybersecurity company Fortinet (FTNT) reported a 14% growth in revenue year-over-year to US$1.63 billion in Q2 of 2025.

This was pushed by a 22% increase in unified SASE ARR and 35% rise in security operations.

“Our strong second quarter performance and consistent track record of growth are a direct result of our continued innovation and customer-first strategy, enabling us to beat our billings guidance for the quarter and raise our full year billings outlook,” Ken Xie, Founder, Chairman and Chief Executive Officer of Fortinet, said.

Due to the successful second quarter, Fortinet has raised 2025 full-year guidance midpoint by US$100 million and expects revenues between US$6.7 billion and US$6.8 billion.

1:27 pm (AEST):

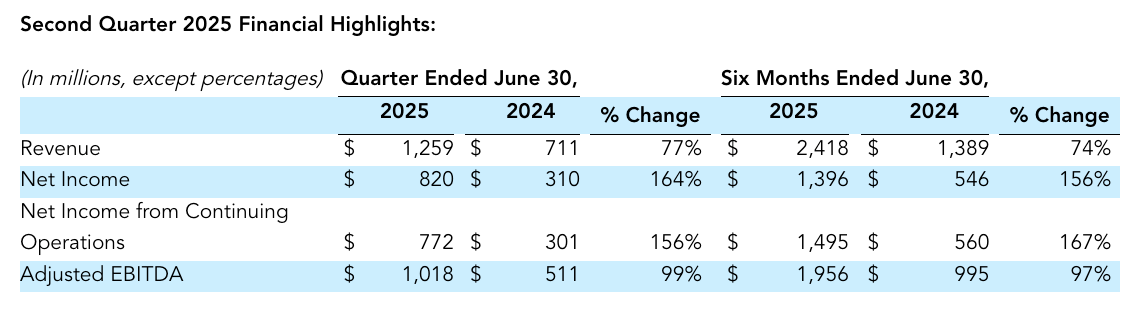

Marketing platform AppLovin (NASDAQ: APP) beat second quarter expectations in its second quarter earnings.

Quarterly revenue rose by 77% from US$711 million the same time last year to US$1.26 million.

Net income also saw a massive increase of 164% from US$310 million to US$820 million.

AppLovin expects revenue between US$1.32 million and US$1.34 million in Q3.

“We are confident we can sustain 20 to 30% year-over-year growth driven by just gaming,” said CEO Adam Foroughi on the second-quarter earnings call.

“However, what gets us more excited now than ever in our history before is the opportunity to really expand outside our core market.”

However, the company’s stocks dropped by 6.9% following the earnings release.

1:56 pm (AEST):

Thank you, Chloe! Harlan Ockey back with you this afternoon.

Back to the NYSE, Brookfield Asset Management (BAM) reported major growth in distributable earnings.

Distributable earnings were US$613 million, up from $548 million year-over-year. Fee-related earnings were $676 million, rising from $583 million.

Net income was US$620 million, compared with $495 million one year ago.

Brookfield's fee-bearing capital was US$563 billion at the end of the quarter, up 10%.

It raised US$22 billion last quarter, with $16 billion of this in credit. Brookfield also raised more than $1 billion in each of renewable power, infrastructure, private equity, and real estate.

The company has sold more than US$55 billion in asset sales to date in 2025.

“As the secular trends of decarbonization, deglobalization, and digitalization continue to accelerate, we are extending our leadership by forming large-scale, proprietary investment partnerships with governments, corporates and institutions. These themes are driving significant investment activity and fundraising momentum, positioning us to deliver strong long-term value for both our clients and our shareholders,” said president Connor Teskey.

2:23 pm (AEST):

Staying with the NYSE, Occidental Petroleum (OXY) bested estimates on earnings per share last quarter, but saw profits decrease year-over-year.

Its adjusted earnings per share were US$0.39, down from $1.03 one year ago but above estimates of $0.31. Net reported income was $288 million, plummeting from $992 million year-over-year.

Operating cash flow was US$3.0 billion.

Daily production volumes in the U.S. were 1,167 million barrels of oil equivalent last quarter, up from 1,031 million barrels one year ago. Worldwide production was 1,400 million barrels of oil equivalent per day, up from 1,258 million and above its guidance midpoint.

"Excluding items affecting comparability, the decrease in second quarter oil and gas income, compared to the first quarter of 2025, was due to lower commodity prices, partially offset by higher crude oil volumes and lower lease operating expense," the company wrote.

During 2025's second quarter, the company announced US$950 million in divestitures, with $370 million closed so far.

"Continued well performance leadership and a focus on enhanced operational efficiencies enabled us to generate strong financial results in the second quarter," said CEO Vicki Hollub. “By unlocking lower cost resources, accelerating our deleveraging efforts and advancing our strategic growth projects, we have positioned our portfolio to deliver long-term value.”

2:53 pm (AEST):

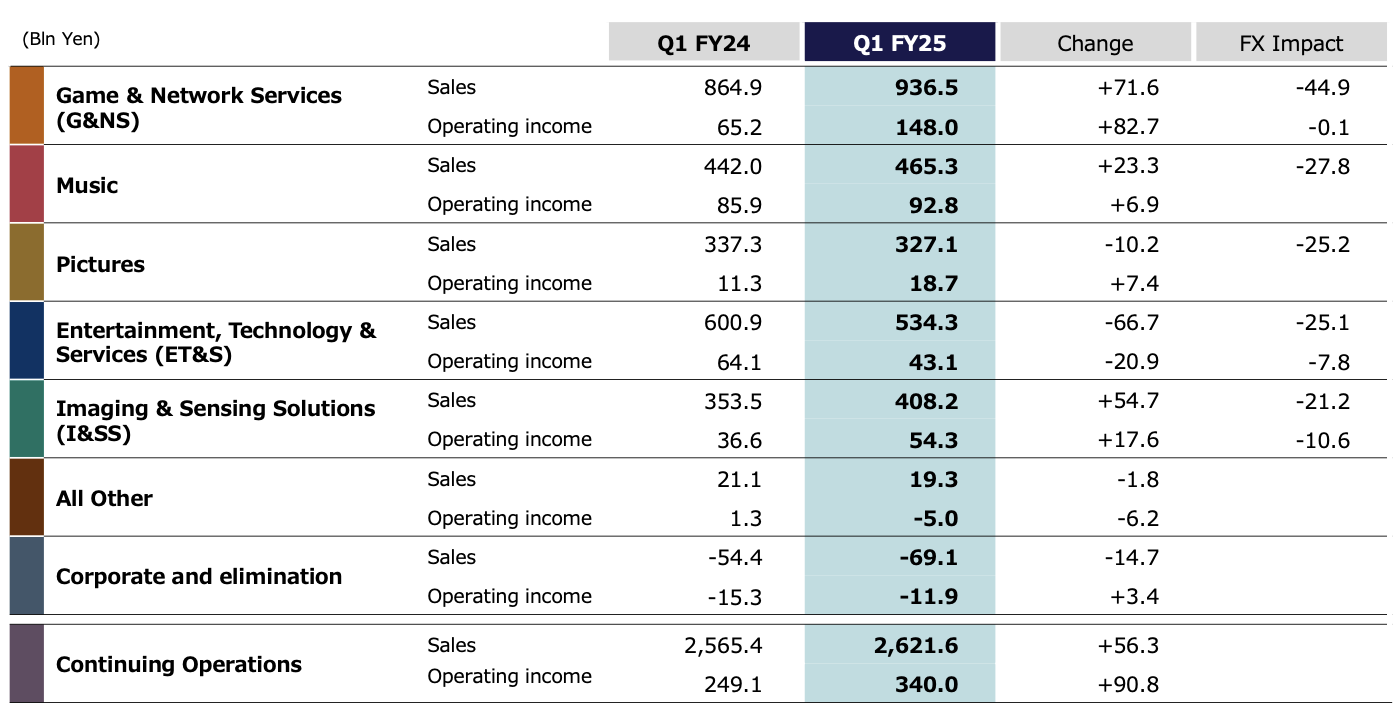

Heading to the TYO, Sony (6758) has raised its guidance due to strong growth in its gaming segment's sales and operating income.

Overall sales were JP¥2.62 trillion, up 2% year-over-year. Diluted earnings per share were ¥42.84, rising from ¥34.37.

Operating income grew by 36% to JP¥340 billion.

Its Game & Network Services segment led in both sales and operating income last quarter. Sales were JP¥936.5 billion, up ¥71.6 billion, while operating income grew by ¥82.7 billion to ¥148 billion.

Monthly active Playstation users increased by 6% year-over-year in June.

Sony's Music and Imaging & Sensing Solutions segments also reported sales increases. Entertainment, Technology & Services posted the largest decrease, falling JP¥66.7 billion to ¥534.3 billion.

The company's full-year guidance includes sales of JP¥11.70 trillion, with operating income before the impact of tariffs at ¥1.40 trillion. Sony has raised its operating income projections from ¥1.38 trillion in its May forecast, due to the increase in Game & Network Services operating income.

It also lifted its expected operating income after tariff impacts by JP¥50 billion to ¥1.33 trillion, as it now estimates a lower tariff impact.

3;35 pm (AEST):

At the NYSE again, combat sports conglomerate TKO Group (TKO) posted major increases in World Wrestline Entertainment (WWE) revenue, and has raised its full-year guidance.

Revenue was up 10% year-over-year to US$1.31 billion, above Zacks estimates of $1.2 billion. Earnings per diluted share were $1.17, rising from $0.72 but missing estimates of $1.23.

Net income was US$273.1 million, up $226.9 million. “The increase primarily reflected the increase in revenue and a decrease in operating expenses,” the company wrote, with direct operating costs one year ago stemming from the writedown of unsold tickets to the 2024 Summer Olympics.

Its WWE segment led revenue last quarter, increasing from US$456.8 million one year ago to $556.2 million. This was largely due to a $41.6 million rise in live events and hospitality revenue.

Ultimate Fighting Championship revenue grew from US$394.4 million to $415.9 million, while the IMG management group's revenue fell from $319.6 million to $306.6 million.

“TKO generated strong financial results in the quarter, led by record performance at both UFC and WWE,” said CEO Ariel Emanuel. “Our live content and experiences are proving a key differentiator for organizations and brands looking to capture audience, and our strategy is tailor made for today’s experience economy and the white-hot sports event marketplace."

The company's full-year guidance expects revenue of US$4.63-4.69 billion. Its previous projection was $4.49-4.56 billion.

TKO also announced today that it would add WWE's premium live events in the U.S. to ESPN's new direct-to-consumer streaming service, with select simulcasting on ESPN's linear platforms, under a new five-year deal.

4:06 pm (AEST):

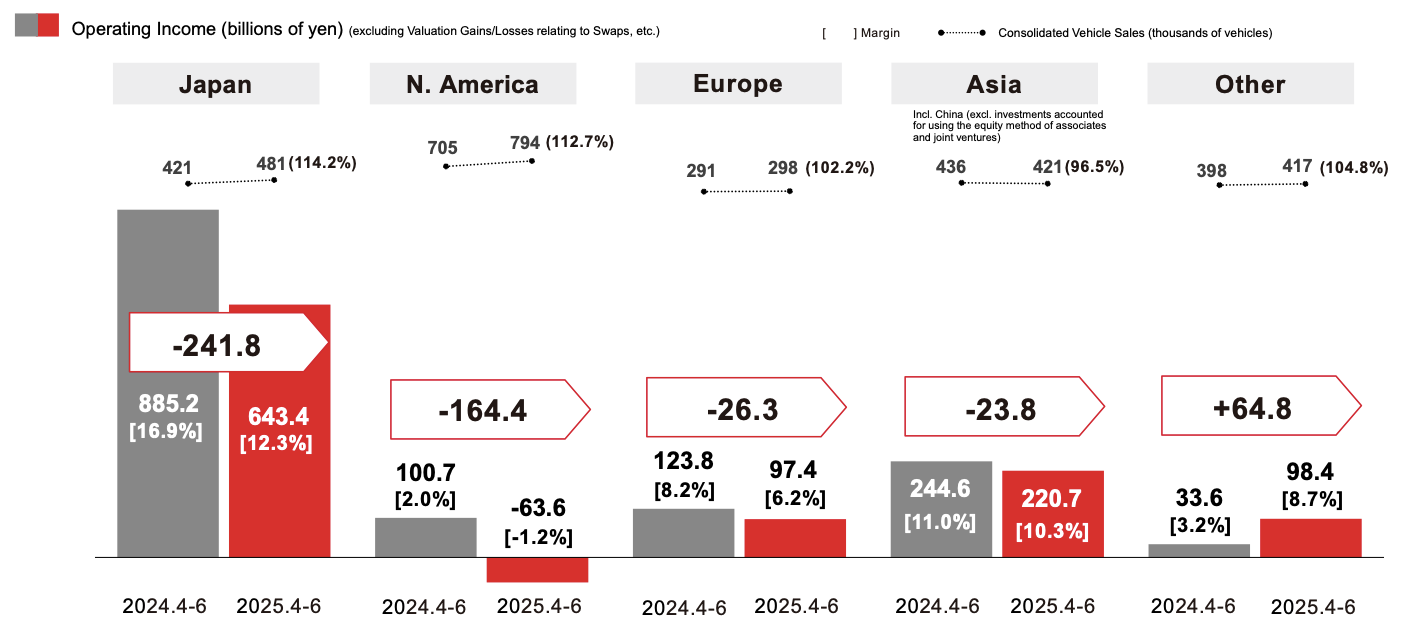

And again at the TYO, Toyota Motor (7203) saw net income drop by 36% last quarter as U.S. tariffs hit, though revenue continued to rise.

Net income was JP¥872.19 billion last quarter. Toyota's sales revenues were ¥12.25 trillion, up 3.5% year-over-year.

Earnings per share were JP¥64.56, falling from ¥98.99 one year ago.

The company's operating income dropped by 10.9% to JP¥1.17 trillion. Operating income in North America sank from ¥100.7 billion to a loss of ¥63.6 billion, amid U.S. tariffs. However, operating income dropped across regions, except for its Other markets.

Toyota reported 2,829,000 retail vehicle sales last quarter, growing from 2,636,000 one year ago. Electrified vehicles represented 1,259,000 of these sales, up from 1,075,000, with hybrid electrified vehicles accounting for 1,165,000.

Its full-year guidance includes revenue of JP¥48.50 trillion, a 1% increase from the previous financial year. Total retail vehicle sales are expected to be 11,200.

Operating income is predicted to be JP¥3.20 trillion, down 33.3% from the prior financial year. This is also a decrease of ¥600 billion from its previous forecast, due to the expected impact of U.S. tariffs on imported cars and vehicle parts.

4:30 pm (AEST):

And ending at the NASDAQ, Lyft (LYFT) reported record gross bookings last quarter, with double digit percentage growrth in revenue and EBITDA.

Gross bookings were up 12% year-over-year to US$4.5 billion. Revenue increased by 11% to $1.6 billion.

Net income was US$40.3 million, rising from $5 million one year ago. Adjusted EBITDA also reached a record, up 26% to $129.4 million.

Total rides increased 14% to 234.8 million, another record, and notched a ninth consecutive quarter of double digit year-over-year growth. Active riders were up 10% to 26.1 million, also a record.

“We delivered off-the-charts performance, resulting in our strongest quarter ever,” said CEO David Risher. “Our marketplace is thriving, our TAM is expanding with the close of Freenow, and we are building meaningful partnerships, including with Baidu and United Airlines."

The company closed its acquisition of Germany-based vehicle booking company FreeNow at the end of July. “Both teams will work together to bring the best of both companies to the global Lyft ecosystem,” Lyft wrote at the time.

Its third quarter outlook projects gross bookings of US$4.65-4.80 billion, with adjusted EBITDA of $125-145 million. This quarter will include combined results with FreeNow prior to the purchase's close.

Thank you for joining us today! We'll see you next time.