Australia is a global giant when it comes to energy; with vast coal, oil, gas and uranium reserves and unused land area that’s climate-ready for renewables such as wind and solar. So why is there a decade-long and counting energy supply shortage for industry and households, especially on the east coast, that’s pushing up our electricity costs?

Momentum to move away from fossil fuels into cleaner energy sources has been growing for decades and the first cab off the rank to move away from has been coal, one of the most polluting energy sources on the planet.

While global miners such as BHP (ASX : BHP) and Rio Tinto (ASX : RIO) have moved away from coal production, energy intensive countries such as China, Germany and India - while purporting to maintain efforts towards zero carbon emissions - have actually increased the construction of coal-fired energy plants.

Even America has now decided to rekindle its - as Trump has put it - “beautiful clean coal” industry, undoing a decades-long move away from its use in power generation.

Find out more: Trump to revive coal for AI despite clean energy boom

Bonkers, right? Well, there are reasons behind their moves, and they’re largely due to high consumption - all three countries have large populations and are industrious.

The same can’t be said for Australia. Our energy consumption pales in comparison, and when you correlate that with the amount of energy we produce and export from our shores (and even just off our shores!), from a consumer perspective, it’s difficult to come up with a reasonable explanation.

Years of selling off our energy materials for export at the beginning of the value chain and politically motivated decisions around our energy mix.

That cocktail led to less new refineries and a reliance on old coal-fired power plants which underlie east coast gas shortages.

Gas itself is expensive, yet constantly relied upon to fill in gaps when a coal plant needs servicing or the intermittent nature of renewables isn't up to the task.

Dining out on expensive energy

Last month, the Australian Energy Regulator (AER) laid out benchmark household power bill rises of between 5% and 8% for FY2025-26 in its draft Default Market Offer (DMO).

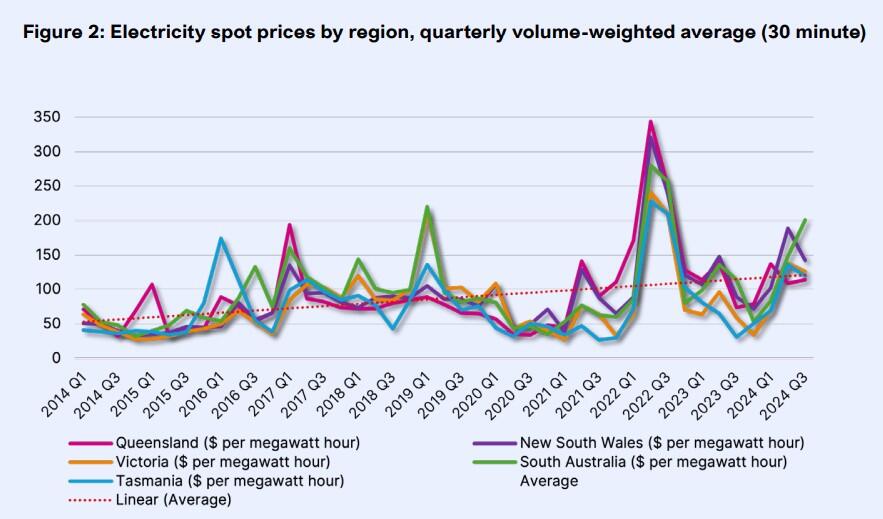

In March, the Institute for Energy Economics and Financial Analysis (IEEFA) examined long-term trends in wholesale and network cost components and found wholesale spot prices for electricity were between $40-$80 per megawatt hour (MWh) in 2014.

10 years later, in Q3 2024, customers of the National Electricity Market (NEM) were paying between $114/MWh and $201/MWh.

“Wholesale electricity prices have outpaced the Consumer Price Index (CPI), meaning price rises can’t be explained by inflation alone,” the IEEFA said in its report.

The energy think tank points to a volatile supply-demand balance on the NEM, citing flooding in the Hunter Valley coal region of NSW with a spike in coal and gas prices due to the Russia-Ukraine conflict in 2022 that sent spot prices above $350/MWh, forcing the market to suspend.

“Coal generators less than 40 years old in Australia have an average availability of 81%, while those older have an average availability of 65%, declining as they age,” the IEEFA said.

“Most major recent spikes in wholesale prices corresponded with coal generator outages. When coal power plants have outages, more expensive electricity generators usually step in, such as gas, which drives prices upward.”

This is historically confirmed by a Griffith University report that stated “gas prices drove 50-90% of pricing periods in the NEM from 2012 to 2021, directly and indirectly”.

Renewables can help

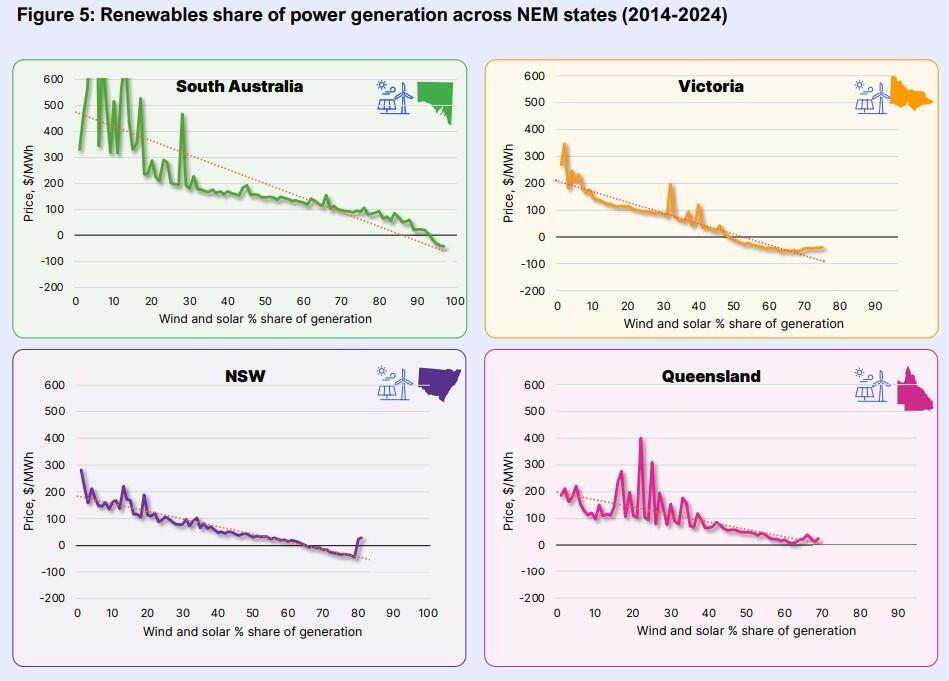

The study also found that higher output from renewable generation significantly reduced the influence of gas prices on electricity prices when overlayed onto Australian Energy Market Operator (AEMO) data.

“Renewables have no fuel cost, so they bid into the wholesale spot market at very low prices,” the IEEFA said.

“This would suggest that increasing renewables penetration, and reducing the reliance on gas-powered generation, would support wholesale price reductions.”