The number of trades made by clients using mobile devices has increased to 50% in 17 years since it launched its first iPhone trading app, according to CommSec.

The Commonwealth Bank of Australia’s (ASX: CBA) online broking business said the average value of shares bought and sold on its platform reached $575 million each day, giving it a 3.3% share of the Australian equities trading market.

Celebrating the 30th anniversary of its launch, CommSec said four trades were placed via telephone and fax at $75 each when it started operating on 17 July 1995, compared with the 40,000 it handles each day now.

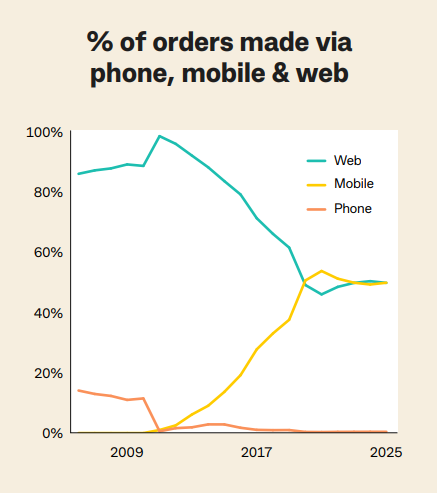

It first provided a share trading website in 1997, which four years later was handling 80% of its trades, an iPhone trading app in 2018 and an investment app in 2019.

“CommSec’s journey in many ways mirrors the broader evolution of investing in Australia, moving from the margins to the mainstream and becoming a core part of how Australians build wealth,” the broker said in a media release.

The proportion of customers under 40 had more than doubled to 43% in the last decade and the percentage of female customers had almost tripled in five years.

Government privatisations, the rise of self-managed super funds (SMSFs), the popularity of exchange traded funds (ETFs), and the increasing use of mobile apps had produced a more engaged and informed investor base.

The top 10 trading days had been in the five years, including the three-day drop in the S&P 500 index after the introduction of the United States on 2 April, which produced one of the worst market sell-offs since World War II and the ASX’s biggest one-day drop since 2020.

“In fact, April 7 was CommSec’s largest trading day in three years, with the team processing over $1.4 billion in trades,” CommSec said.

Parent company CBA is now the most traded stock, compared with 30 years ago when it was not in the top 5.