Despite a few false starts, the long talked-about rotation from ASX-listed bank stocks back into the unloved mining sector – notably big iron ore miners - dragged down by softer demand and lower prices for commodities - appears to be an early-stage rally.

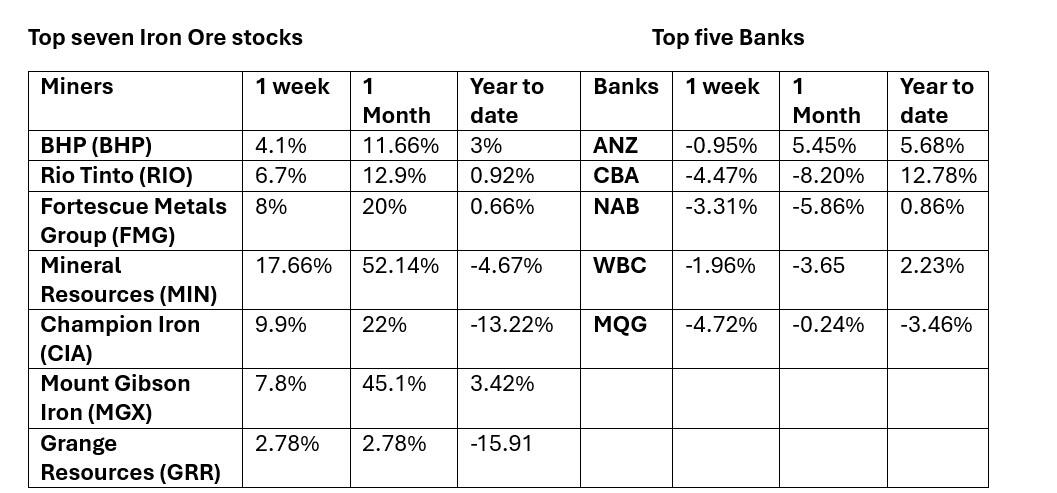

While the seven banks within the S&P ASX200 Banks Index (XBK) are down around 5% in the last month, the 39 companies within the S&P ASX300 Metals and Mining Index (XMM) are up around 9% over the past month, despite being down around 1.8% today.

The trend line within these price movements tends to suggest future gains ahead for attractively-priced miners as bank stocks continue to unravel from their recent heady gains.

What’s noteworthy within these numbers (see table) is an 8.2% fall in Commonwealth Bank - the world’s most overvalued bank – and the corresponding 11.6% and 12.9% rises in BHP (ASX: BHP) and Rio Tinto (ASX: RIO) respectively.

China’s steel production stalls

However, like most of his peers, Romano Sala Tenna fund manager with Katana Asset Management doesn’t expect institutional investors to consummate their nascent swing back into the materials until there’s both stabilisation in tariffs and greater evidence of strengthening PMI numbers in China.

China’s dismal steel production numbers have arguably taken their toll on the big iron ore stocks.

But the recent green shoots emanating from China’s support for the country’s beleaguered property sector - which accounts for about 25% of steel demand – have added a recent kicker to the iron ore price, which is up from US$91 in early July to US$98.27 today.

Iron ore prices rallied on the expectation that China will now put some substance behind recent promises made last September to “halt the decline" in the real estate sector to help China reach its targeted 5% growth.

Property sector

However, fast forward 10 months and the big-ballsy stimulus that was expected to ignite China’s steel production, and iron ore along with it, still appears nowhere to be seen.

Meanwhile the property data coming out of China speaks for itself:

New home sales were down 7.3% by volume and 12.6% by value in June. Home prices fell for the 25th consecutive month. Residential property investment fell 12.4% in June. Home starts – a critical measure of steel demand – plunged by 13.1% in June.

According to Bank of America’s China economist Helen Qiao, the need to step up policy stimulus has become more urgent, especially to boost investment demand and support the labor market, but she’s not holding her breath.

“We continue to believe that policy that supports government purchases of excess housing inventory has the best shot of stabilising the property sector,” said Qiao.

“Only once the financial stress of property developers’ eases do we see the possibility of stable commodity demand from the property sector.”

Pivot to renewables drives stockpiling

Meanwhile, in the absence of any movement on China’s property front, what’s been underpinning domestic demand in China is the country’s major investment in renewable energy and electricity grids which is deriving from the demand for steel and copper.

While machinery exports and electric vehicle production have also been good, the great unknown is how long this can last if there’s no relief in the U.S. trade war.

Ironically, while China’s iron ore imports appear to be on a tear, steel production in the June quarter is headed to be its lowest since 2018.

What’s clearly evident, notes Westpac commodity guru Robert Rennie is that it is currently stockpiling iron ore as it already has done with nickel, lithium, cobalt and copper.

However, given the slowing pace of Chinese retail sales - 4.8% in June, well below the 6.3% in May), weakening domestic demand and an over-reliance on exports – the great unknown is how long this stockpiling can continue.

Despite growing calls for Beijing to rein in its supply overcapacity, manufacturing accounted for around 26% of China’s GDP in the first quarter, Caixin said, citing official figures.

What the PMI numbers are telling us

Meanwhile, late June the Caixin/S&P Global manufacturing purchasing managers’ index (PMI) gave renewed hope to mining investors desperate for any blue sky coming out of China.

The PMI came in at 50.4, beating Reuters’ median estimate of 49.0 and rebounding from 48.3 in May, which had been its worst contraction since September 2022.

“This marked the eighth month of growth in the manufacturing sector out of the past nine months, showing that market conditions were improving,” Wang Zhe, senior economist at Caixin Insight Group said.

The rise in Caixin PMI was largely supported by an expansion in production, which grew at the fastest pace since November, according to Caixin and S&P Global, as “better trade conditions and promotional activities” boosted new orders.

New export orders, however, declined for a third month in June, signalling potential headwinds for exports in the second half of the year.

Lithium resurges

Meanwhile, iron ore is not the only commodity receiving a current updraft, with Australia’s lithium sector resurgence this month due to indications that an oversupply of the battery material is finally starting to diminish.

This shift has sparked increased trading activity on the market, reversing a period of decline for many companies in the industry.

Both Pilbara Minerals (ASX: PLS) and Mineral Resources (ASX: MIN), have seen their prices soar by more than 50% since June.

While these two stocks tend to be heavily targeted by short sellers – who make money when the price falls - the recent rally suggests renewed investor sentiment.

Added an additional kicker to lithium stocks was the news that Chinese producer Zangge Mining was compelled to cease production at its Qarhan project.

This action followed a regulatory finding that the company’s mining license was invalid.

While Zangge Mining’s expected output of 11,000 tonnes of lithium carbonate this year represents a small fraction (less than 2%) of China’s total annual production, the announcement caught commodity traders off guard.

While Pilbara Minerals is a lithium mining company focused on producing spodumene concentrate, Mineral Resources is a diversified resources company with operations across mining services, iron ore, and lithium.

What this recent development highlights is the sensitivity of the lithium market to supply-side disruptions, even those involving relatively smaller producers.

Meanwhile, investors are closely monitoring the situation for further impacts on the pricing and availability of lithium, a crucial component in electric vehicle batteries.