Termination payouts for Australia’s top corporate leaders have plunged to their lowest level in 15 years, according to updated data from the Australian Council of Superannuation Investors (ACSI).

In FY24, total termination payments for ASX100 CEOs fell to $8.38 million - down sharply from $33.52 million the year prior - a drop driven by both fewer exits and tighter governance.

The average payout per departing CEO dropped from $1.97 million to $1.40 million, saving investors roughly $500,000 per termination.

ACSI credits post-GFC reforms to the Corporations Act — particularly the 2009 rule giving shareholders a vote on large exit packages — for curbing “pay for failure” practices.

“Boards have responded to the challenge,” said ACSI’s Ed John. He noted that over $80 million was paid to terminated CEOs in the year before the law changed.

While termination costs have shrunk, realised pay (fixed salary plus bonuses) for ASX100 CEOs has remained largely flat over the past decade.

Median realised pay in FY24 was $4.15 million, up modestly from $3.96 million in FY14.

CEO pay now averages 55 times the earnings of the typical Australian worker — down from 71 times in 2014, but still high by global standards.

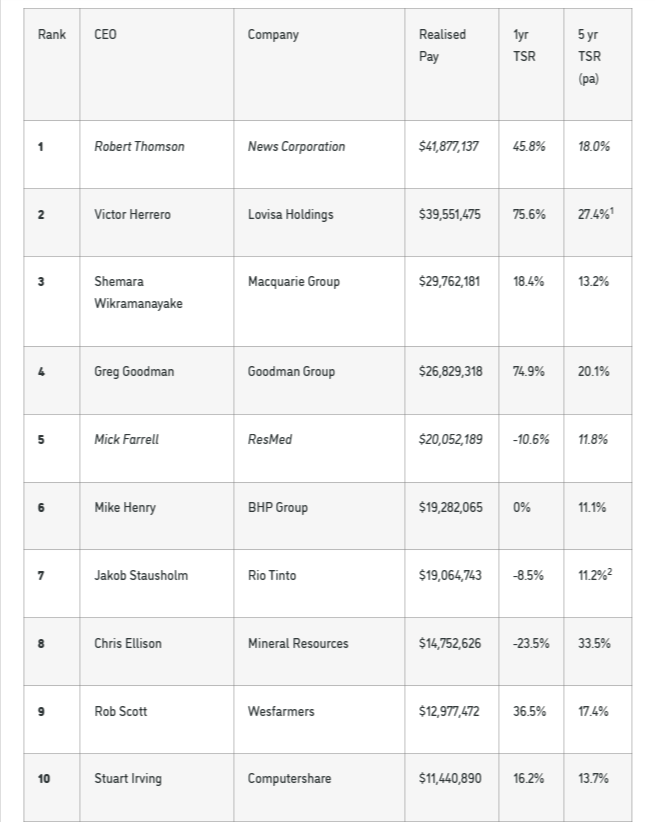

Outliers persist. Lovisa’s outgoing CEO Victor Herrero topped the list of Australian-based earners with $39.55 million in realised pay, despite leading a company outside the ASX100.

Meanwhile, News Corp’s Robert Thomson led all CEOs in the sample with $41.88 million. This underscores the continued dominance of U.S.-based executives in the top pay ranks.

Bonuses also remain entrenched: Of 142 eligible CEOs, only five received none, with the median bonus paid at 66% of maximum — a figure consistent with long-term trends.