Guzman Y Gomez (GYG) and Zambrero restaurants stand almost side-by-side with a Taco Bell outlet less than 50 metres away on a busy Melbourne high street.

Could there be a better representation of competition in the A$24.9 billion (US$15.4 billion) Australian quick service restaurant (QSR) industry than this cluster of Mexican-themed outlets in Australia’s most populous city?

They and other players are competing for property to successfully execute their growth strategies in a market that is forecast to expand at almost 6% per year over the next three years.

Although Mexican restaurants have been in Australia since the late 1960s, this slice of the market has grown significantly over the last 20 years, with GyG and Zambrero established in 2005, Mad Mex in 2007, Burrito Bar in 2011 and Taco Bell in 2017.

Apart from the ASX-listed GyG (ASX: GYG), they are privately-owned except for Taco Bell, which is owned in Australia by Collins Foods (ASX: CKF) under a franchise agreement with Yum! Brands (NYSE: YUM).

So tough has business been that Collins Foods has announced it will close the 27 restaurants in Queensland, Victoria, and Western Australia in the loss-making Taco Bell if it is unable to transfer it to Yum! or another operator.

Taco Bell is not to be confused with Taco Bill, a chain started by an American on the Gold Coast in 1967, and which has 28 outlets in Victoria and New South Wales.

Growth drivers

Why has this space become so crowded?

Zambrero founder Sam Prince said on the company’s website the idea for his business came in 2005 while he was working part-time at a Mexican restaurant and realised that Mexican food “was just not done well for a long period of time in Australia”.

One analyst said growth had been driven by demand from younger customers, including Millennials (born between 1981 and 1996), for ‘cleaner’ food, free of preservatives and artificial flavours and colours, as reflected in GyG’s ‘clean is the new healthy’ campaign.

Founded in 2005, GyG sees restaurant openings in Australia as the primary contributor to its sales growth over the long term and believes it could increase its network to more than 1,000 restaurants in Australia over the next 20+ years from 210 in May 2024.

Analysts said the company was also looking to broaden sales across the day by lifting business at breakfast time, which accounts for just 4% of sales, compared with closer to 20% for McDonald’s.

Co-Chief Executive Officer Hilton Brett said GyG had a real estate development team of 10 people “on the ground” and was receiving a lot of interest from landlords because of its strong reputation.

“We'll open the 31 restaurants this year, building up to 40 restaurants (per year) over the next five years and (we’re) well placed with our team to (achieve) our long-term goal of getting to 1,000 restaurants over time, ” Brett said on the half year results webcast on 21 February.

The company has earmarked $180 million of the $335.1 million raised in its initial public offering (IPO) in 2024 for restaurant network expansion and general corporate purposes, according to the prospectus.

This aspiration means it is squared off with its competitors in the fast-growing QSR sector, which is distinguished from other restaurant formats through a focus on convenience, consistency, speed of service and value for money.

Diversity of opinions

At the time of writing GYG shares were trading at $31.64, capitalising the company at $3.25 billion, having risen from an offer price of $22 on 20 June 2024 to a high of $45.99 in February 2025 before easing back.

Analysts are divided on the company with MST Marquee assigning it an ‘overweight’ recommendation with a 12 month target price of $42.10, Morgans Financial rating it an ‘Add’ with a $38 target, RBC Capital Markets giving it an ‘Underperform’ rating and a target of $31.00, and Goldman Sachs rating the stock a ‘sell’ with a target of $33.60.

Before the float Morningstar analyst Johannes Faul valued the company at $15 a share, saying he was “hesitant to fully bake in management’s 20-year store-count aspirations” but others are more positive.

“While the 1,000 store long-term target seems ambitious, GyG is achieving industry-leading sales productivity in its Australian stores and still has upside from breakfast sales and more menu options,” MST Marquee analysts Craig Woolford, Garth Francis and Noah Hunt wrote in a note on 23 January 2025.

Goldman Sachs analysts Elijah Mayr and Elise Bailey said GyG was a high quality operator but its “overly ambitious” long-term store expansion profile had no recent successful precedent in Australia and its “stretched” valuation was based on its highest growth U.S. peers without consideration of market differences and expansion risks.

They also noted a share overhang with 13% of shares released from escrow in March, an event which allowed major shareholder TDM Growth Partners to reduce its stake from 27.4% to 23.2% on 11 April 2025.

This included the sale of 2.451 million shares (2.4% of the issued capital) in a block trade for $80.645 million, or $32.90 per share.

Growth potential

One analyst said the company was still relatively under-represented in the QSR market and would be looking for the best ‘AAA’ sites for the drive-through stores it hopes to provide most of its growth.

“They can afford to do it and they have a pretty small footprint,” he told Azzet.

As a mature company, Collins Foods was looking at adding only seven to eight KFC stores per year, compared with 20 to 30-plus GYG stores over the next five years.

GYG has forecast the QSR market to generate $24.9 billion in sales in 2024 and grow at a compound annual rate of 5.9% until 2028.

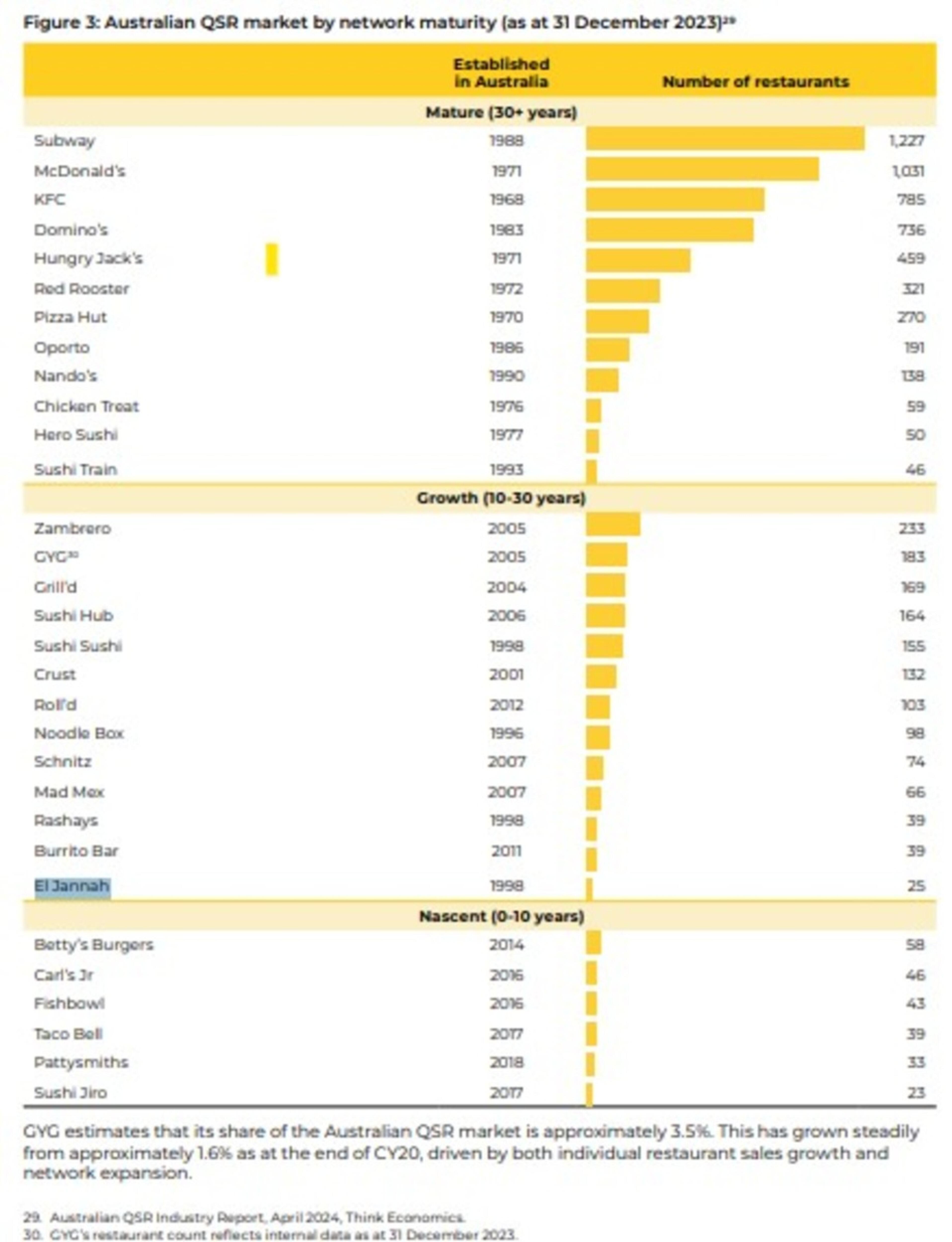

Competitors include ‘mature’ brands like Subway, McDonald’s and KFC, ‘growth’ brands such as Grill’d and Sushi Hub and ‘nascent’ brands like Betty’s Burgers, Carl’s Jr and Fishbowl.

As GYG noted in its prospectus, the annualised 6.9% growth in spending at cafes, restaurants and takeaway food between 1983 and 2023 demonstrated the structural shift in Australian meal consumption.

This ’away-from-home’ consumption outstripped the 6.1% growth in spending at food retailers such as supermarkets and other grocers over the same period.

“This shift has been driven by a change in lifestyle (that is, urbanisation, busier lifestyles and dual-income households), the rise of dining out as a social and cultural activity, greater variety, improved food quality and convenience,” the company said.

Another analyst said although it was logical for GyG to develop mostly drive-through stores because they generated higher returns than strip stores, it would be challenging to reach 1,000 stores in 20 years.

“If you want to build a drive-through network where people need to shop in-store you need something on a major arterial road with high visibility,” the analyst told Azzet.

“A lot of that property is relatively limited in nature and it is competitive. You’re not just competing against other Mexican QSR chains. You’re competing against some of the largest, well capitalised places in the world.”

He noted the biggest competitors to GYG were other QSR players like McDonald’s and KFC rather than those branded Mexican.

“They want to be McDonald's. That’s where they want to go. They talk about how they do breakfast and coffee. It’s about opening other parts of the day to store sales. That’s a huge part of their business,” the analyst said.

Although it was a ‘herculean task’ to hit its target, investors should have confidence in GYG because it had one of the biggest development teams in Australia.

Rivals not just Mexican

Other competitors include charcoal chicken chain El Jannah, which has expanded out of its western Sydney base since 1998 to have 37 stores around the country, and Craveable Brands businesses Red Rooster, Oporto, Chicken Treat and Chargrill Charlies.

El Jannah has reportedly been looking for a private equity buyer and the private equity owner of Craveable Brands has tried to sell it.

In January Flynn Restaurant Group, which operates thousands of Wendy’s, Arby’s, Applebee’s and Taco Bell stores in the United States, opened a Wendy’s burger restaurant on the Gold Coast, with plans to roll out 200 in Australia by 2034.

Flynn expanded into Australia two years ago when it bought the rights to Pizza Hut from private equity firm Allegro Funds.

Azzet contacted Zambrero and some of GyG’s other competitors to discuss their growth aspirations and competition in the market, but received no response at the time of writing.