Given the paucity of ASX-listed stocks with scale and global reach, operating within dynamic sectors like IT, defence, electronics, aeronautics, and pharmaceuticals, most Australian investors now see the benefits of having exposure to offshore share markets.

The United States has typically been the go-to offshore market for Australian investors, especially given the rich pickings of high growth global tech giants listed on the NASDAQ.

India is quietly filling the void

However, with the U.S. economy in the middle of a structural descaling, as it pivots away from international trade, investors will increasingly look to other popular global markets to fill some of this void.

Admittedly, investor interest in China – the world’s second largest economy - is far from new.

However, with the economy having stalled since lengthy COVID lockdowns and issues related to their property market, it’s India which has quietly emerged as a strong candidate to fill the void.

Admittedly, subsistence agrarian-based farming remains India's lifeblood.

However, this self-sufficient agricultural system often masks the rapid emergence of modern day India – now the world’s fifth largest economy – from a developing into a first world economy.

During financial year 2023-2024 India cemented its place as the world’s fastest growing economy.

The Indian market reached the US$1 trillion market capitalisation milestone in 2007.

The next trillion might take a decade, after six years of equity market growth were lost to the global financial crisis.

However, having reached the US$2 trillion mark in 2017, it would take only four years to reach US$3 trillion in 2021, and only two more years before hitting the US$4 trillion milestone.

Having overtaken China since 2021 at an average growth rate of 8.2% annually - compared to 5.5% annually – India also now boasts the highest projected economic growth rate among major developed and developing nations.

Interestingly, at a time when the U.S. economy is scaring foreign investment away, India, like China are only too happy to take on all-comers.

This is increasingly evident with the growing number of international operations incorporating the subcontinent into their global supply chains.

Population power

Underpinning India's growth is its large, young, tech-savvy, and well-educated workforce which provides a foundation for economic growth, plus a domestic consumer base to fuel it.

Unlike the U.S. and China, India does not have a diminishing birth rate.

By 2050 China will have more than a quarter of its population over the age of 65. By comparison, in 2023 around 65% of India’s population was under the age of 35, while around 50% were under the age of 25.

It’s this demographic divergence that has promoted BlackRock to identify India’s youthful population as the driver of its future growth.

It’s this cohort, adds BlackRock, that also underscores India’s burgeoning middle class, a larger work force, and growing productivity.

Open door

Unlike the U.S., which is currently scaring global business with policy uncertainty, the Indian government under Prime Minister Narendra Modhi has introduced policies to encourage manufacturers to locate there, and they appear to be working.

Other reforms since Modhi’s election victory in 2014 in India have delivered key milestones, including:

• 375% growth in exports.

• Doubled its number of national airports, highways, and railways.

• Quadrupled the number of metro cities.

• Improved internet penetration from 25% to 93%.

In an attempt to reduce its reliance on Chinese manufacturers, over 14% of Apple’s iPhones are now being produced in India with an eye toward moving 25% of production there.

Then there’s Micron Technology, a leading U.S. memory chipmaker, which also views India as a key part of its global strategy and long-term growth plans.

“We are huge believers in India's long term growth story and potential,” Micron said.

“…we expect that growth not just to occur from an economic perspective, lifting the per capita income of the citizens, but also in terms of the extent of consumption of electronics in the economy.”

Interestingly, while Apple has repeatedly rejected the idea of manufacturing in the U.S. – due to the paucity of qualified workers - India boasts a large population of STEM (Science, Technology, Engineering, and Mathematics) graduates, all fluent in English.

Technology know-how and people power aside, economists are also quick to acknowledge major improvements in the Indian financial system.

So much so that the country’s financial system now ranks seventh in total assets among global financial systems.

How Aussies can tap into India's upside

In light of India’s booming growth trajectory, Azzet looks for ways local investors can play in this market.

Due to the country’s unique demographics, India has lower correlations with other economies and equity markets, which offers investors even greater diversification.

ETFs

Firstly, we look at three key ETF options offering exposure to India-based growth stocks. These include:

A) Betashares India Quality ETF, (ASX: IIND): Since listing on the ASX in 2019 at $8, the share price has increased 50% to $12.00.

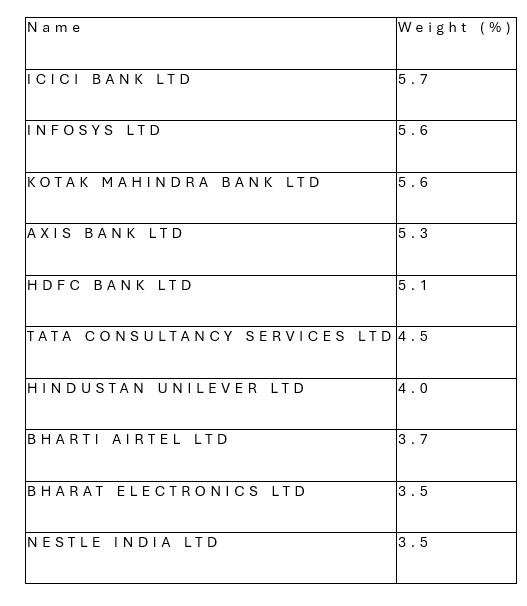

IIND passively tracks an index of thirty of the top companies in India selected by high profitability, high earnings stability, and low leverage.

The fund has returned 9.23% annually since its inception and distributes to shareholders semi-annually.

While they may be unrecognisable to most Aussie investors, here are the top ten companies in the IIND portfolio.

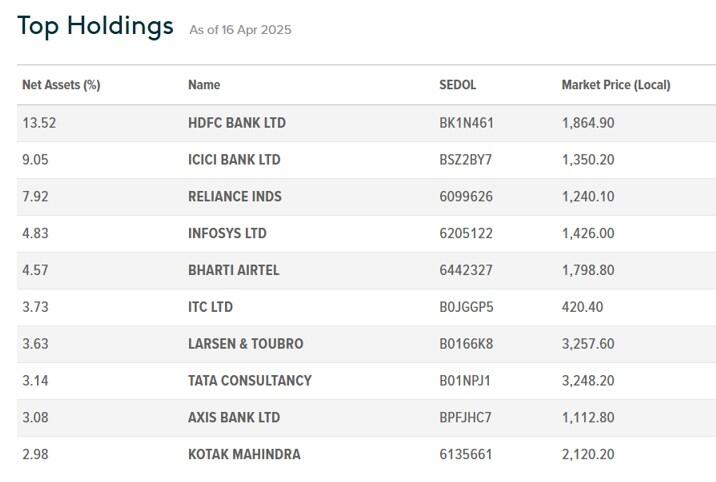

B) The Global X India Nifty 50 ETF (ASX: NDIA): Tracks the performance of the Indian Stock Exchange Nifty 50 Index.

The ETF has delivered a total annual return of 8.32% annually since its inception in June 2019.

C) India Avenue Equity Fund Active ETF (IAEF): Trading on Cboe, an alternative trade execution venue to the ASX, the actively managed fund seeks to outperform the MSCI India Index (Net).

The fund is an unlisted unit trust which provides investors with exposure to 60-80 companies listed on India's stock exchanges.

The fund is actively managed and benefits from its founders' experience and robust network in India.

Slippage

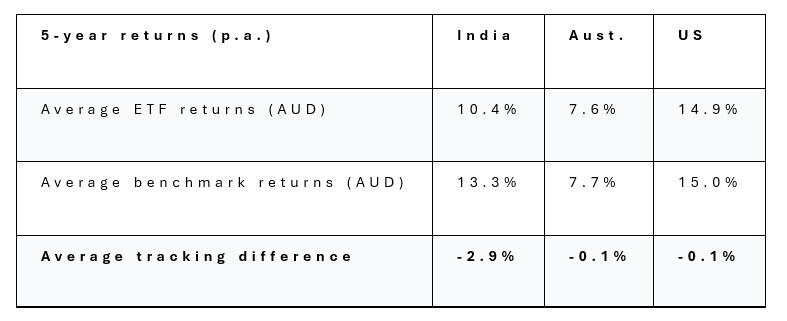

However, before investing in these India-focused ETFs it is important to note that they tend – across all timeframes – to underperform their own benchmarks/indices.

For example, across longer-term periods (3-5 years), India ETFs produce a slippage of around 3% annually (ex-fees).

This slippage highlights the difficulty of capturing index returns within an inefficient market like India, and the need to maintain active positioning.

While there are myriad factors contributing to slippage - of around 50bps annually - one of them is the bilateral tax agreement between Australia and India.

Investors receive a partial to full refund of capital gains taxes paid in India by the Funds/ETFs they invest in at the point when they lodge their tax refund.

Here’s a snapshot of how Indian ETFs have fared compared with their local and U.S. counterparts.

Buying Individual Indian Stocks

While there are no Indian companies with dual listings on the ASX, a common way for foreign investors to tap into shares on India’s stock exchange – now the world’s fourth largest share market – is via a FPI (foreign portfolio investment).

Remember, if you’re planning to enter the India share market using the FPI you must firstly register with India’s stock market regulatory agency, the SEBI (Securities and Exchange Board of India).

SEBI typically requires these investors to be high net worth individuals.

Aussie investors can make FPI investments via custodian banks that manage FPI transactions like Citi Bank and Deutsche Bank or through registered brokers like Jarvis Investments which has an AI platform and is registered with SEBI.

Indian stocks have outperformed the broad emerging markets for four consecutive years.

The U.S. FDA has been conducting inspections of Indian pharmaceutical companies, including the likes of Sun Pharmaceutical Industries SUNPHARMA (NSE), and Aurobindo Pharma AUROPHARMA (NSE) since 2005 and there are many more of a similar size, 99% of which have in the past headed for the U.S.

Another vibrant sector in India is defence, which includes stocks like leading defence companies in India, Hindustan Aeronautics Limited (HAL).

Managed funds

Australian investors also have access to Indian-themed managed funds, including the Fidelity India Fund which invests in a diversified selection of 30 to 60 Indian companies.

The management costs: 1.20% annually.

Investors may also want to check out the Fiducian India Managed Fund and the Ellerston India Fund.

Investors can also check out a myriad of Asia-based and global funds and ETFs which all have, in varying degrees, exposure to India-based stocks.

This article does not constitute financial or product advice. You should consider independent advice before making any financial decisions.