Australia's most successful steel maker, BlueScope Steel has emerged as the only viable contender to potentially play a role in helping to turn around the fortunes of the embattled Whyalla Steelworks in South Australia.

According to Clean Energy Finance director Tim Buckley, BlueScope is the logical successor to GFG Alliance.

"They bring all of the management, engineering, and workforce expertise, [an] understanding of the Australian market," he said.

"[It] is an asset that BlueScope would love to own in the right circumstances, at the right price."

However, it remains unclear whether Bluescope will play an advisory role, takeover the company completely or agree to manage Whyalla on behalf of a state-owned entity that uses Whyalla for government projects.

Lifeline

Both the federal and the SA state governments agreed to throw a $2.4 billion lifeline to rescue the troubled Whyalla steelworks, which was pushed into administration last week.

The rescue package involves transferring the steel mill, which is owned by the Sanjeev Gupta-controlled GFG Alliance, into public hands.

While Bluescope CEO Mark Vasella has confirmed he's in discussion with Whyalla's administrators KordaMentha, he stressed that any level of involvement, including a permanent acquisition would have to make sense for the company's shareholders.

Interestingly, while Bluescope and Whyalla are both in the steelworks industry, that's about where their similarities end.

Two different operations

While Bluescope operates two lossmaking mills at its Port Kembla operation in the NSW Illawarra region, the steelmaker has a thriving operation in the U.S - the company's biggest revenue-generating geography in FY24 - with its North Star steel mill in Ohio accounting for around 43.9% of its total sales.

Admittedly, Vasella has flagged an opportunity around the distressed Whyalla assets.

However, it remains to be seen whether the company has the appetite for turning around loss-making Whyalla's fortunes ahead of efforts to drive the same outcome for its much larger Port Kembla operations, which employ the bulk of the company's 7,000 staff.

What may also discourage Bluescope from taking over Whyalla is the relatively small scale of its operation, which produces only around 1 million tonnes of steel, compared with its two blast furnaces at Port Kembla which produce at least three times that amount.

Meanwhile, Bluescope is saying all the right things, and recently noted that "Whyalla Steelworks provides important sovereign capability for the nation and it stands ready to provide technical and operational support."

Clearly, managing Whyalla with government funding would allow Bluescope to see more clearly the commercial viability of incorporating it into its own business.

But having provided support when the mill was shut down for an extended period last year due to issues with its blast furnace, Bluescope is no stranger to the Whyalla steel mill operation.

Port Kembla $1 billion capex

Given that BlueScope has worked hard to turnaround the fortunes of its local operation in the face of cheap Asian steel, the company won't like the idea of Whyalla being a burden on its balance sheet. After all, BlueScope is currently relining a blast furnace at Port Kembla at a cost of more than $1 billion.

But what could attract Bluescope is the proximity of Whyalla to its nearby iron ore mine which produces high quality materials. However, the SA government will only grant access to GFG Alliance's iron ore reserves if it includes running the steelworks as well.

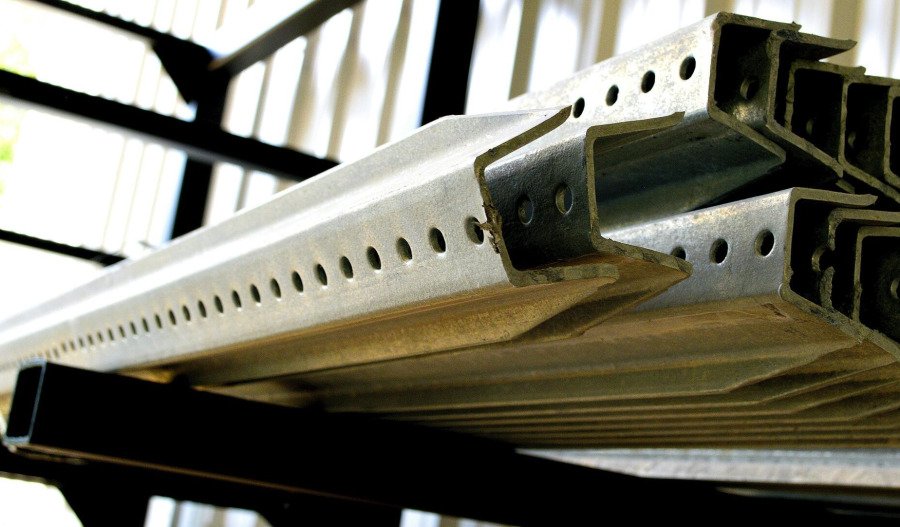

While Whyalla - the only manufacturer of rail to Australian standards - also makes long steel products like wire, rods, and bars used in construction and infrastructure, BlueScope Steel makes flat steel products typically used to create construction materials such as fences and roofs.

In an attempt to revive Whyalla's fortunes, GFG chair Sanjeev Gupta wanted to leverage Whyalla's access to SA's iron ore resources to build Australia's first green steel plant at a cost of around $2 billion.

Whether this opportunity has any appeal to a new owner, be it the Australian government, Bluescope or another investor remains to be seen.

While potential suitors aren't queueing up to buy Whyalla, South Korean steel giant POSCO which made a failed bid to acquire the plant in 2017 may see a potential fire sale as a way to leverage SA-based magnetite iron ore resources and export green iron to South Korea.