Einstein considered it the most powerful force in the universe. We’re talking about compounding returns, and regardless of what asset class you invest in, you really need to understand how it works.

It’s not exactly nuclear physics, and you don’t need a super huge IQ like Einstein’s to make it work for you.

Stripped down to its bare essentials, compounding returns is simply adding regular amounts to the money you’ve already got, accelerating your savings at a much faster rate.

The difference a month makes

For starters, let’s look at the difference compounding interest monthly versus annually makes.

For example, take $25,000 in a savings account earning 4% interest annually, and after five years you'll have $30,000.

However, if your interest compounds monthly, you’ll simply earn more money.

That’s because it's calculated on a higher balance each month. For example if you had the same $25,000 in a savings account paying 4% annually that’s also compounding monthly, after five years you’d have $30,525.

That’s great – a difference of $525 with no extra effort from you. But if you continue to put money into your savings, you’ll effectively put a rocket under your ability to save more, and that’s got to be compelling in anyone’s language.

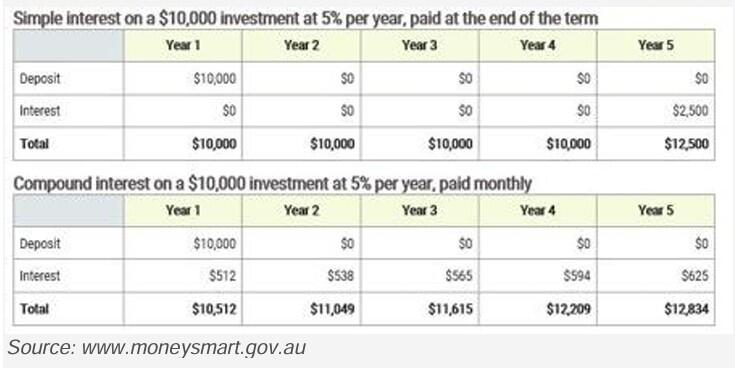

Here’s another example that compares simple interest on a $10,000 investment at 5% annually, paid at the end of the term, with compound interest on the same investment and the same annual interest rate paid monthly.

Small, regular amounts really matter

One of the single biggest reasons for saving or making additional contributions to your super is to reap the benefits of both capital growth and the power of compounding returns.

Believe it or not, squirrelling away small, yet regular amounts can make a big difference over time.

Here’s one powerful example that most people have the ability to implement right now.

What would happen if you put aside $50 a week and invested it in the share market every time you saved $1000?

Short answer: If those shares earned 9% annually, in 30 years you’d have $442,000 in wealth – and this would be achieved by investing only $78,000 of your own money.

That’s an exceptional outcome, and the good news is that you can apply compounding returns principles to literally any investment.

What drives compounding returns?

Compounding returns are based on three key drivers:

- The rate of return (or the interest rate you receive).

- The amount of money you contribute.

- The timeframe you choose.

Returns on returns

The beauty of committing to a longer time-frame is that every month, the rate of return (or interest rate) is calculated on a higher balance than the month before (aka returns on returns).

Remember, every time your boss pays your super guarantee (SG) contributions, you’re repeatedly getting returns on higher monthly returns, and maximising the power of compounding interest.

But you can also turbocharge your savings by doing some of the heavy lifting yourself.

For example, every time you make additional contributions to your super, either through salary sacrifice or non-concessional amounts (on which you’ve already paid tax), you’re maximising the overall effect of compounding returns on your money over time.