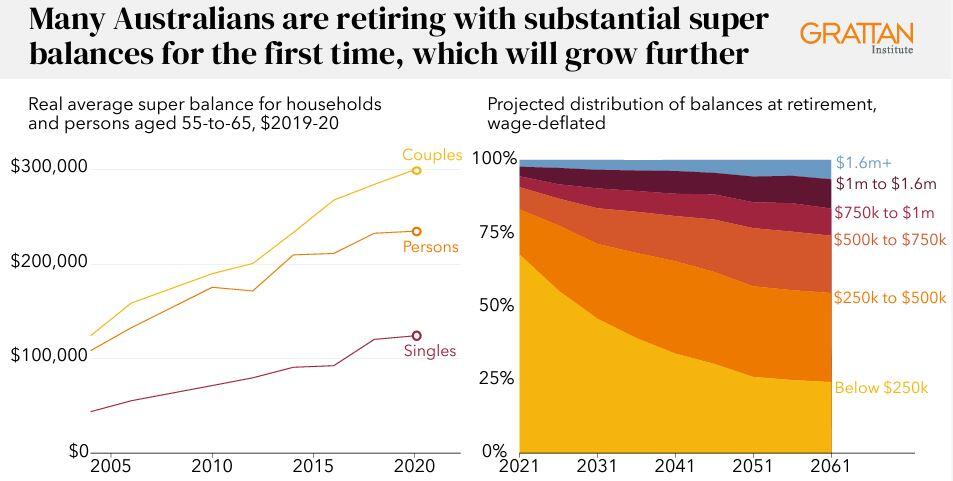

More education around superannuation is needed as about 40% of retirees are not spending up their super and are leaving an average of about 65% of their super balances untouched when they die.

Analysis from the Grattan Institute has revealed that about 80% of Australians find retirement planning complicated, with about 60% expecting their retirement will be financially stressful.

Few retirees draw down on their retirement savings as intended, and many are net savers – their super balance continues to grow for decades after they retire.

This is turning Australia’s multi-trillion-dollar compulsory superannuation system into a massive inheritance scheme.

Grattan says that’s not how it was meant to be.

“Too few retirees are enjoying the benefits of the savings they built up during their working lives,” the policy group said in its Simpler Super report.

“How they use their super in retirement is one of the biggest decisions Australians will ever make. Yet the little guidance Australians are offered is unhelpful.

“More than four in five retirees are steered into account-based pensions, which require retirees to manage their spending to try to avoid the risk of outliving their savings.”

Half of retirees using an account-based pension draw their super at legislated minimum rates, which leave 65% of super balances unspent by average life expectancy.

To counter, a push by Coalition backbenchers wish to allow a reduction in super payments guaranteed by employers from the new 12% back down to 9% - instead putting that money into workers’ take home pay.

The ACTU says that could cost the average 30-year-old worker $165,000 by the time they retire in their 60s, as reported by news.com.au.

What can be done

In the report to the Government, Grattan says Australia needs a three-pronged reform strategy to simplify super in retirement:

- 1. The Federal Government should offer all Australians a lifetime annuity, which would pay them a guaranteed income for life. Retirees should be encouraged to allocate 80% of their super balance above $250,000 to the government annuity. This reform could boost retirees’ incomes by up to 25%.

- 2. The Government should create a Top 10 list of the best super funds, and then steer retirees towards those funds. And the government should ask APRA (the Australian Prudential Regulation Authority) to assess and performance-test all account-based pensions. These reforms could boost the incomes of future retirees who continue to opt for an account-based pension by up to $70,000 over their retirement.

- 3. The Government should establish a free, high-quality guidance service to help retirees (and people approaching retirement) to plan their retirement incomes. The service should also assist eligible retirees to apply for the Age Pension. This service would cost about $360 million over its first four years and should be funded by a levy on all super account balances.

Grattan says this blueprint for better old age in Australia would let retirees stress less, spend more, and truly enjoy their retirement years.