A centre-left think tank has come out in support of stalled legislation that would double the tax paid by Australians with more than $3 million in retirement savings.

The Australia Institute said Australians would be better off if the Government convinced crossbenchers in the Senate to support the increase in the tax rate on superannuation accounts with balances of $3 million or more to 30% on 1 July 2025.

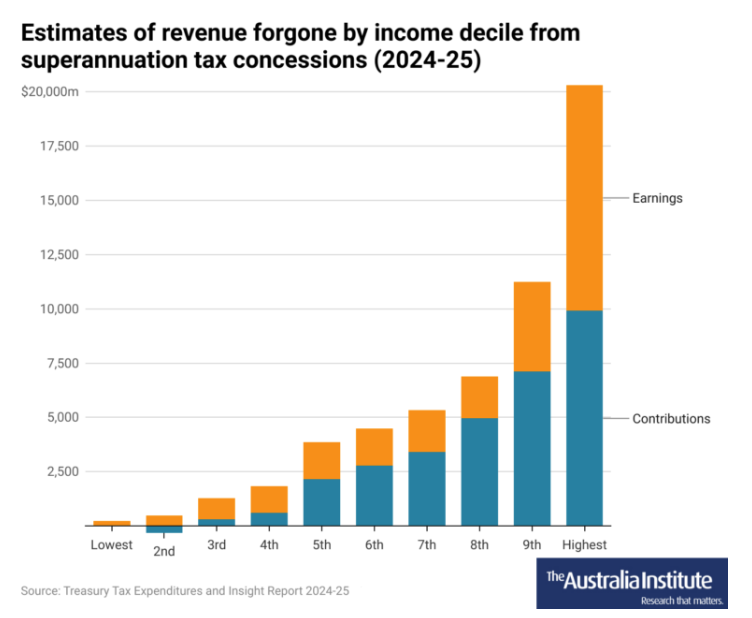

It said the Treasury Department had estimated superannuation concessions cost the Government $51.7 billion in foregone revenue, which compared to the cost of the age pension of $58.9 billion.

The Superannuation (Better Targeted superannuation Concessions) Imposition Bill 2023 has been held up in the Senate, where the Labor Party does not have a majority, because it has not won the support of Greens, One Nation, cross-benchers and minority parties.

Australia Institute Chief Economist Greg Jericho said the proposal was a much-needed reform to Australia’s $4.1 billion superannuation system and would affect only 80,000 of the 17 million people with a super account.

He said the richest 10% of Australians would receive more than $20 billion in super tax concessions this financial year, at a time when about 23% of Australians retired into poverty, compared to 11.1% in Sweden and 3.8% in Norway.

Critics have argued that, if passed, the legislation could force some primary producers to sell their farms, because it was based on unrealised capital gains, and they may not have enough assets outside super to pay the tax.

But the Australia Institute said few farmers or small business had put assets into their super and most, if not all, did so to reduce the amount of tax they pay.

“This is not what the superannuation system was designed to do,” it said in a media release.

“The vast majority of Australians can only dream of retiring with a super balance of $3 million. Most people end their working lives with just a fraction of that.”

Related content