Australia’s corporate regulator has expressed concern about the rise of private markets and warned that investors will lose money as more private credit investments fail.

The Australian Securities and Investments Commission (ASIC) said it was worried about the future of public equity markets as the number of publicly traded companies fell and initial public offerings (IPOs) were at their lowest level in more than a decade.

The regulator made the comments in Australia’s evolving capital markets: A discussion paper on the dynamics between public and private markets, which also explores the influence of Australia’s $4.1 trillion superannuation industry on markets.

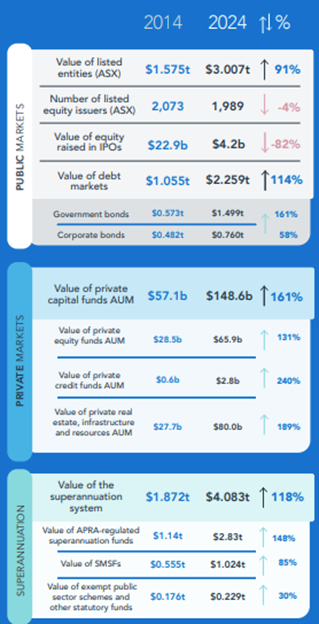

ASIC said private capital funds increased 161% to $148.6 billion between 2014 and 2024, outstripping ASX-listed equities' 91% growth to $3.007 trillion, as the number of listed equity issuers fell 4% to 1,989 and the value of equity raised in IPOs plunged 82% to $4.2 billion over the same period.

ASIC said the risks of private markets including illiquidity, leverage, conflicts and valuation uncertainty posed a challenge to informed investor decision-making and raised questions about appropriate regulatory oversight.

It said although private credit growth was not yet systemically significant to the Australian economy, it was at historically high levels. It was often invested alongside private equity and leveraged loans and subject to less regulatory oversight.

“This combination of risk factors is untested in historic stress scenarios, making it critical that regulators and participants understand the associated risks,” ASIC said.

“There will be more failures in private credit investments, and Australian investors will lose money.”

Chair Joe Longo said ASIC was keen to understand how the growing dominance of superannuation in Australia’s economy influenced markets. This is given its crucial role in securing financial wellbeing at retirement.

ASIC said the $3 trillion Australian public equity market was concentrated because most companies were in the financials and mining sectors. Fewer were in sectors that would drive growth in an increasingly digital future.

Many companies chose to stay private where opportunities for funding and sell-downs were more accessible, while others chose to list in the United States.