Asia-Pacific markets saw a mixed start on Wednesday, as investors monitored the easing United States-China trade tensions.

By 11:15 am AEST (1:15 am GMT), Australia’s S&P/ASX 200 had edged down 0.1%, while South Korea’s Kospi 200 climbed 0.5%. Japan’s Nikkei 225 slipped 0.7%.

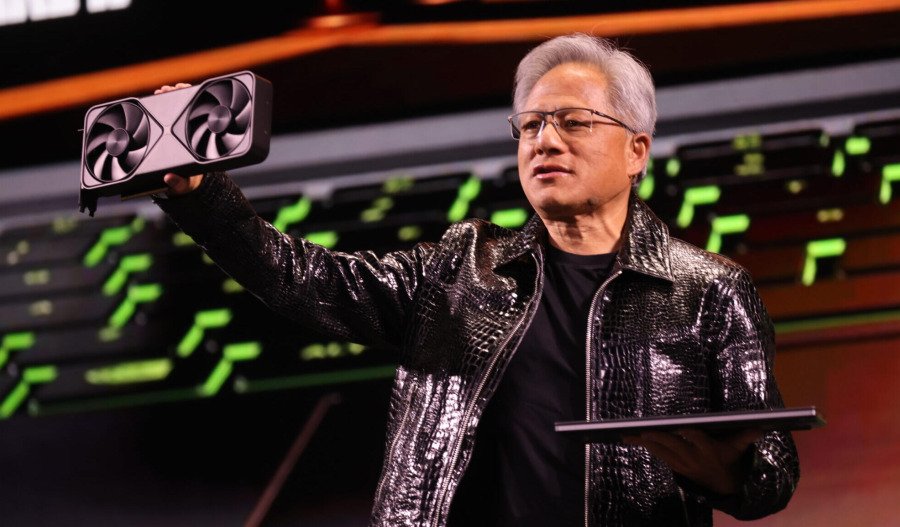

Gains in chip-related stocks helped buoy sentiment in Japan and South Korea following NVIDIA's announcement that it would supply over 18,000 of its new AI chips to Saudi firm Humain.

SK Hynix rose 2.8%, Samsung Electronics added 0.5%, Tokyo Electron gained 0.3%, and Advantest surged 4.1%.

However, Japanese auto manufacturers retreated as Nissan posted quarterly results, with the company announcing plans to cut its workforce by 20,000 and close seven factories by 2027.

Nissan, Honda, and Toyota were down by 3.4%, 3.3%, and 3.0%, respectively.

The tech optimism follows a rally on Wall Street, where the Dow Jones Industrial Average surged over 1,000 points on Monday after the U.S. and China reached a temporary truce on tariffs.

However, Tuesday’s session saw more subdued action, with the Dow slipping 0.6%, while the S&P 500 gained 0.7% and the Nasdaq Composite jumped 1.6%.

In commodities, Brent crude extended its gains, rising 2.6% to approach a three-week high at US$66.37 per barrel. Spot gold rose 0.5% to US$3,250.18 per ounce, recovering part of Monday’s decline.

Mainland Chinese markets finished modestly higher. The Shanghai Composite climbed 0.2% to 3,374.9, and the CSI 300 rose 0.2% to 3,896.3, marking six consecutive weeks of gains.

However, Hong Kong’s Hang Seng Index dropped 1.9% to 23,108.3.

India’s BSE Sensex pulled back 1.6% to 82,414.8 after hitting a seven-month high, as investors booked gains amid regional volatility.

In Europe, markets closed mostly higher on Tuesday. The UK’s FTSE 100 ended flat at 8,602.9, while Germany’s DAX and France’s CAC 40 each rose 0.3% to 23,638.6 and 7,873.8, respectively.