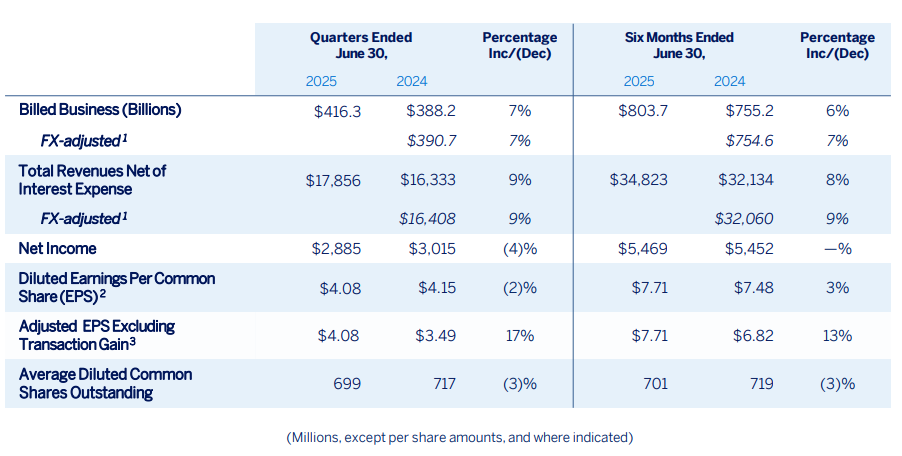

American Express (Amex) has reported a 4% fall in net income for the second quarter of the 2025 financial year (FY25) due to a one-off profit on an asset sale in the previous corresponding period (pcp).

The global financial services company said net income was US$2.89 billion (A$4.43 billion) in the quarter ended 30 June compared with $3.02 billion in the pcp.

Amex said earnings per share (EPS) fell 2% to $4.08 but, if a gain from the sale of digital risk management and fraud prevention business Accertify in the pcp was excluded, they rose 17% while revenue net of interest expense increased 9% to a record $17.9 billion.

The company said the increase in revenue was mainly driven by increased card member spending, higher net interest income supported by growth in revolving loan balances, and continued strong card fee growth.

Chairman and Chief Executive Officer Stephen Squeri said that the Q2 results continued the strong momentum seen over the last few quarters, with record card member spending, strong demand for premium products and ‘best in class’ credit performance.

He said Amex was reaffirming full-year revenue growth guidance of 8-10% and EPS of $15.00 to $15.50, based on its strong performance in the year to date.

Amex was confident about its ability to sustain leadership in the premium space, drawing on its competitive strengths, based on the upcoming refresh of its U.S. Consumer and Business Platinum Cards.

“With our differentiated membership model and proven product refresh strategy, combined with the expansion of the premium category, we see a long runway for growth,” Squeri said in a press release.

The results were ahead of expectations with EPS excluding one-off items of $4.08 exceeding the $3.89 forecast by analysts polled by LSEG.

However, American Express (NYSE: AXP) shares closed $7.40 (2.35%) lower at $307.95 on Friday (Saturday AEST), capitalising at $215.75 billion.

Best known for its credit cards and traveller's cheques, Amex was established in 1850 by the same founders as financial services company Wells Fargo (NYSE: WFC) but the companies are independent of each other.