United States aluminium buyers are set for price hikes and will be looking elsewhere other than Canada for their requirements as tariffs on imports from their neighbour start to take effect this month, with producers Rio Tinto and Alcoa also set to take a hit.

While a lower additional 10% levy will be slapped on energy imports from Canada, aluminium does not fit that mould and will receive an extra 25% tariff, steering American purchasers to look elsewhere.

The U.S. imported over half its aluminium needs from Canada in 2023 - some 3.08 million tonnes (mt) out of a total 5.46Mt, according to trade data.

Canadian producers will likely divert as much aluminium to other regions as they can, increasing prices at the gate for U.S. importers no matter where they turn, yet likely at a lesser premium than continuing to rely on material from their northern neighbour.

The tariffs represent a “significant upside risk to the US Midwest premium this year”, ING analysts wrote in a note.

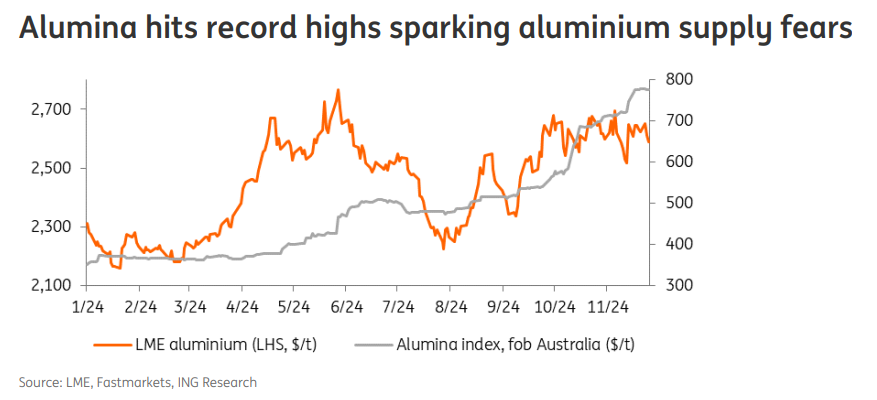

Buyers everywhere are set to be paying a lot more in the coming year as alumina prices reach record highs and aluminium production cuts are actually happening. The Russian company Rusal has already said it will cut its aluminium output by up to 500,000 tonnes this year alone.

Rio has not said if or where it will reroute its aluminium production so far. However, Alcoa is already looking at diverting its material to the European market, its president William Oplinger said in an earnings call.

Oplinger also said he envisaged U.S. buyers looking towards the Middle East and India to fill the looming import gap.

Other Canadian metals such as gold, silver and copper are set to be affected too - as Canada and Mexico combined account for about 50% of U.S. domestic silver consumption and ~10% of copper imports.