ALS Global has unveiled a A$350 million (US$228 million) capital raising after posting a small drop in in underlying net profit after tax (NPAT) for the 2025 financial year (FY25) due to adverse currency movements and higher interest costs.

The testing and laboratory services business will raise funds from a placement with institutional and sophisticated investors to invest in its laboratory network and fund other growth initiatives including acquisitions.

The placement at $16.70 per share is a discount to the closing share price of $17.64 on Monday, which was five cents (0.28%) lower than the previous close and which capitalised the company at $8.55 billion.

ALS said it would raise up to $40 million by offering eligible shareholders the opportunity to buy up to $30,000 of shares at the lowest of the placement price and a 2.0% discount to the five-day volume weighted average price (VWAP) at the close of the offer period.

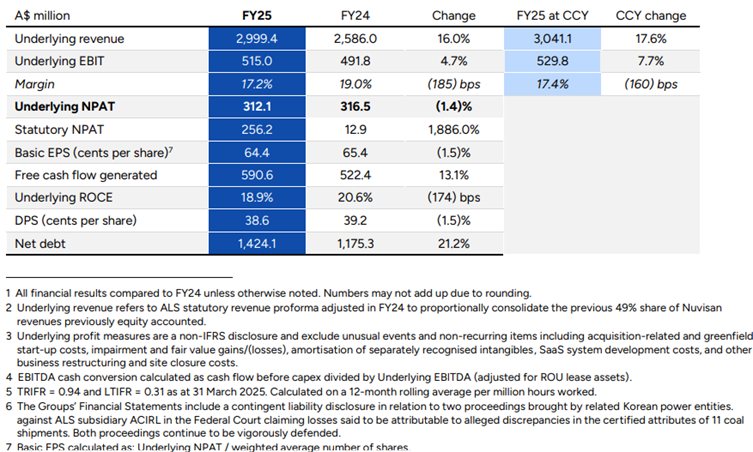

The company said underlying NPAT fell 1.4% to $312.1 million in the 12 months ended 31 March due to a fluctuating exploration environment, unfavourable foreign exchange impacts and high interest costs linked to recent acquisitions.

Underlying earnings before interest and taxes rose 4.7% to $515 million on underlying revenue which grew 16.0% to $3 billion as a result of strong organic and scope growth within Life Sciences and despite softer growth conditions within Commodities.

Directors declared a 30% franked final dividend of 19.7 cents per share to be paid on 25 July to shareholders on the register on 4 July 2025, bringing the full year payment to 38.6 cents, down from 39.2 cents a year earlier.

ALS said it remained on track to meet its FY27 financial targets. This included growing revenue to $3.3 billion and underlying EBIT to $600 million, with a Group EBIT margin floor of 19%.

Chairman Nigel Garrard said the Group delivered solid financial performance, growing revenue to $3 billion and increasing underlying earnings in FY25.

“In a year marked by uncertainty and challenging conditions, ALS demonstrated the strength and resilience of the operating model,” Garrard said in an ASX statement.

CEO and Managing Director Malcolm Deane said its Commodities business showed resilience in a recovering market and the Life Sciences businesses delivered robust performance.

ALS announced its operational headquarters would move from Houston to Europe in July with CEO and Managing Director Malcolm Deane and Chief Financial Officer Stuart Hutton relocating to Madrid.