In recent years, Real Estate Investment Trusts (REITs) have emerged as the cornerstone of diversified investment portfolios in Australia.

Following the Reserve Bank of Australia's 25 basis point rate cut, the historically rate-sensitive A-REIT sector offers opportunities to build wealth, manage risk, and gain exposure to real estate without the complexities of direct property ownership.

Historical Evolution of REITs

The concept of REITs dates back several decades, with their origins rooted in the United States before spreading to global markets, including Australia.

Early iterations of REITs were designed to democratise real estate investments, enabling individual investors to access high-quality property portfolios that were once the domain of institutional players.

Over time, regulatory changes and market innovations have spurred REIT growth and diversification worldwide.

In Australia, the REIT model has evolved significantly, reflecting broader economic trends and investor demands.

The Appeal and Benefits of Australian REITs

Investors are drawn to Australian REITs for a host of reasons. One of the primary attractions is the ability to gain diversified exposure to real estate assets without the burden of direct property management.

REITs offer a way to invest in a broad array of property types - ranging from commercial offices and industrial facilities to retail spaces and residential developments - thus providing a hedge against market volatility in any single sector.

The benefits of investing in Australian REITs extend beyond diversification. Investors benefit from relatively stable income streams generated by rental yields, alongside the potential for capital appreciation.

As Australia enters an environment of potentially lower interest rates, REITs are positioned as a compelling alternative to traditional fixed-income investments.

Additionally, REITs provide liquidity in a market that is typically less liquid when it comes to direct property investments, making it easier for investors to adjust their portfolios as market conditions change.

The Australian Securities Exchange (ASX) further emphasises how REITs have become an integral part of wealth-building strategies, noting that these investment vehicles have evolved to offer competitive yields, making them a practical tool for long-term capital growth and income generation.

Navigating Risks in the REIT Landscape

While REITs offer significant benefits, investors must also contend with a variety of risks. REIT investments are associated with market volatility, interest rate fluctuations, and operational challenges linked to property management.

Primarily, fluctuations in interest rates can have a pronounced impact on REIT performance, as rising rates may reduce the relative attractiveness of high-yielding income investments.

In the Australian context, similar risks are present. Economic uncertainty, changes in regulatory environments, and shifts in demand for different property sectors can all affect REIT performance.

Investors must remain vigilant, assessing the quality of the underlying assets, management teams' expertise, and overall market conditions.

While income streams are relatively stable, property values can be subject to economic cycles that introduce volatility to investment returns.

A critical aspect of managing these risks involves a deep understanding of market trends and economic indicators. Investors are encouraged to examine not only historical performance but also forward-looking insights provided by market surveys and updates.

2024 Performance and Current Market Trends

Industry analyses paint an optimistic picture of the Australian REIT market through 2024.

For instance, Cromwell’s September 2024 Quarter ASX A REIT Market Update provides a detailed snapshot of current performance metrics, noting that many REITs have shown resilience amid fluctuating economic conditions.

The market update indicated robust trading volumes and a steady inflow of investor capital, which bodes well for the overall health of the sector.

Complementing this perspective is the comprehensive BDO Australia A REIT Survey Report for 2024. This report captures investor sentiment, highlighting growing confidence in the sector.

The survey indicates that investors are increasingly considering REITs as a long-term strategy for building wealth, with particular emphasis on their ability to provide regular income and potential for capital gains.

The insights provided in the report underscore the importance of balancing risk and reward, especially as market dynamics continue to evolve in response to both local and global economic pressures.

BDO noted that the S&P/ASX A-REIT 200 index returned 19.9% in FY24, outperforming the ASX 200 Index by 12.1% by year end, largely due to dovish interest rate expectations and resilience in the property market.

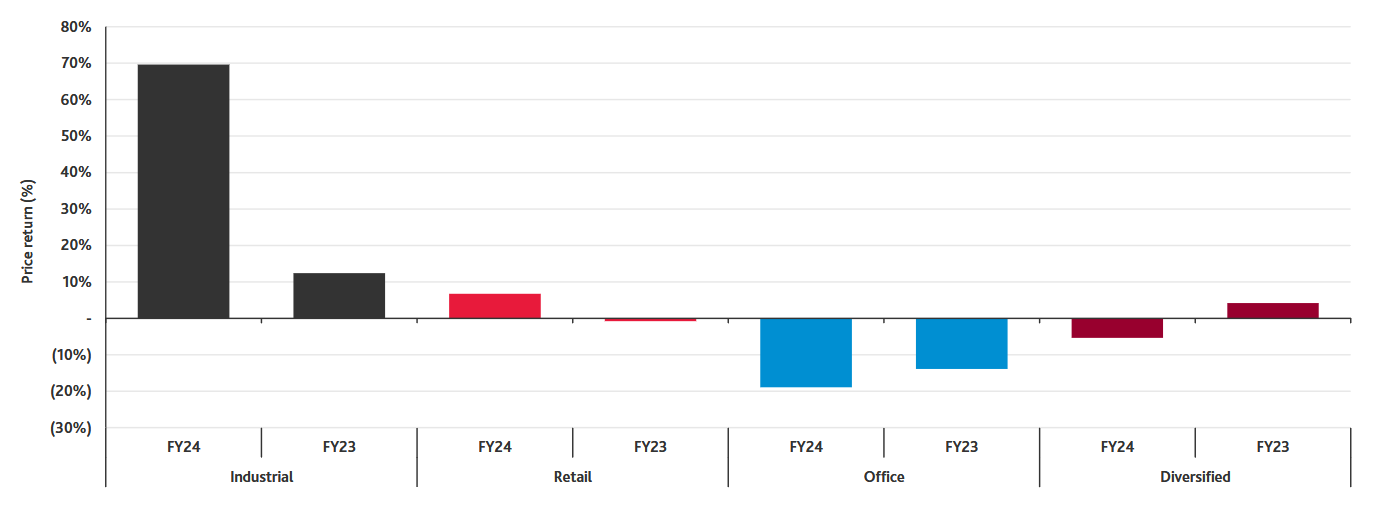

The report also noted strong performance in the Industrial sub-sector:

“On the back of a stellar FY23, the industrial sub-sector went from strength to strength in FY24. FY24 was an exceptional year for the sub-sector, with an annual increase of 69.7%. Returns were robust throughout the year, as the sub-sector rallied despite continued increases in borrowing costs and stubborn inflation."

"Growth in the sub-sector was primarily driven by an increase in e-commerce adoption, data centre demand, and on-shoring of production and assembly. In the wake of global supply chain uncertainty caused by the COVID-19 pandemic, businesses have shifted their supply chains from global to local where possible, leading to a large demand for more premium industrial spaces.”

The confluence of positive market updates and robust investor sentiment drives renewed interest in REITs. As investors seek diversification and income stability, the Australian REIT market appears well-positioned to attract both domestic and international capital.

Companies to Watch:

Goodman Group (ASX: GMG)

Goodman Group reported strong earnings for FY2024, alongside an A$4 billion capital raising initiative to expand its data centre capacity.

For the six months ended 31 December 2024, operating profit increased by 8% to A$1.22 billion, while operating earnings per share (OEPS) rose 7.8% to 63.8 cents.

Statutory profit stood at A$799.8 million, a sharp turnaround from a A$220.1 million loss in the prior year. Revenue also surged 25.2% to A$1.339 billion.

The trust plans to use the capital raised to develop data center projects in Los Angeles, Tokyo, Sydney, and Melbourne, targeting completion by mid-2026, reflecting strong demand for cloud and AI-driven infrastructure.

Consensus: Moderate Buy

DigiCo Infrastructure REIT (ASX: DGT)

Goldman Sachs rating: Buy | Target price: A$5.80

DigiCo Infrastructure REIT is positioned to benefit from the expanding global data centre market, with AI and cloud computing driving demand. Goldman Sachs projects a 15.9% CAGR in global data centre capacity from 2024 to 2027.

Goldman Sachs commented in a note to clients: "We are bullish on global data centre growth, driven by continued cloud and AI-led demand for digital infrastructure assets.

“DGT is currently exposed to what we believe are two of the most attractive markets, the U.S. & Australia - which are being supported by a favourable supply/demand environment as an acceleration in hyperscaler AI demand increases the requirements for more compute capacity, driving pricing growth.”

Stockland Corporation Ltd (ASX: SGP)

Stockland Corporation reported a 140% year-on-year increase in statutory profit to A$245 million for the first half of the fiscal year.

Net tangible assets per share rose from A$4.12 to A$4.14, though funds from operations (FFO) declined 5.6% to A$251 million compared to the previous period.

The fund reaffirmed its full-year guidance, citing strong contributions from its logistics portfolio and increased settlements in land lease communities.

Consensus: Moderate Buy

Strategic Considerations for Investors

For investors contemplating entry into the REIT market, a strategic approach is essential. Diversification remains a key principle - not only within the real estate sector but also across different asset classes.

Investors should consider a balanced portfolio that integrates REITs with other income-generating investments, such as bonds and equities, to mitigate market volatility risks.

Moreover, understanding the local regulatory framework and market-specific factors is crucial. Australian REITs are subject to specific regulatory standards that can influence their performance and the investor’s risk profile. As highlighted by industry experts, maintaining awareness of these nuances, along with ongoing market updates, will be vital for those looking to capitalise on REIT investments' potential.

Conclusion

Australian REITs have carved out a significant niche in the nation’s investment ecosystem. Their ability to offer diversified exposure to real estate, combined with relatively stable income streams, makes them an attractive option for investors aiming to build wealth. Yet, the inherent risks - ranging from interest rate volatility to operational challenges - demand a thorough, well-informed approach to investment.

With Reserve Bank of Australia policymakers lowering interest rates and investor surveys noting a robust performance in 2024, Australian REITs are well-positioned to continue playing a pivotal role in wealth-building strategies throughout the year.

This article does not constitute financial product advice. You should consider independent advice before making financial decisions.