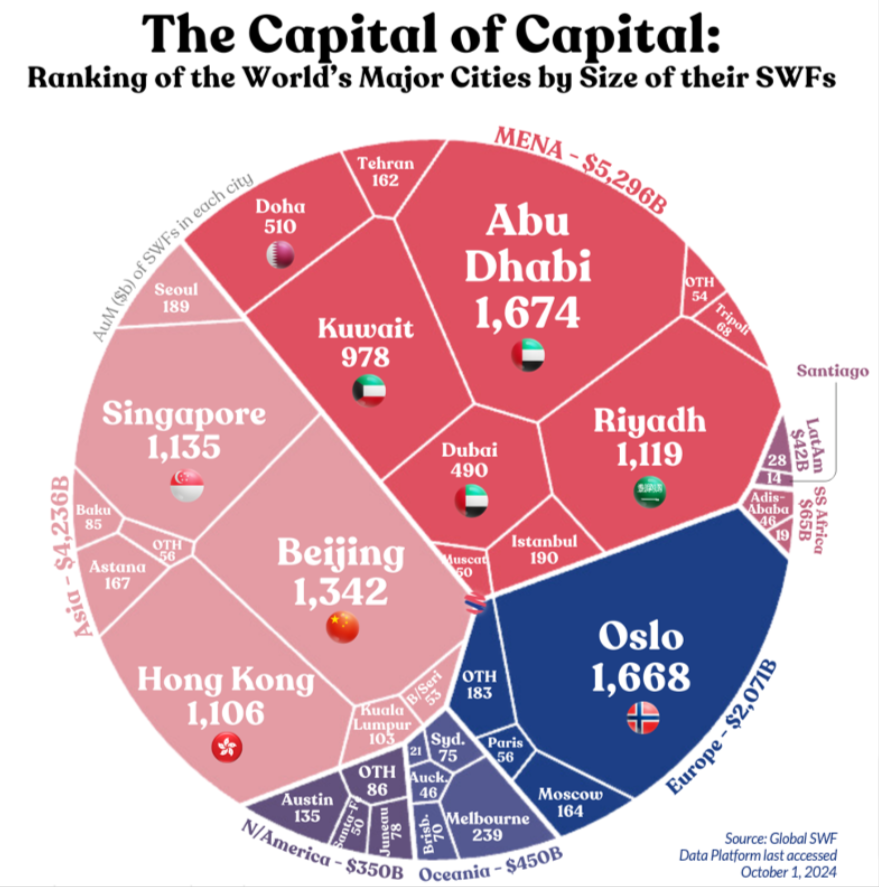

A new global ranking of cities has been released by Global SWF based on capital managed by their Sovereign Wealth Funds.

Global SWF reports Abu Dhabi as the world's richest city by SWFs, with US$1.7 trillion as of October 2024.

Abu Dhabi's wealth is primarily driven by its robust oil and gas sector, which remains a significant contributor to its economy.

The city has also been diversifying its economic base by investing in renewable energy, tourism, and real estate, further enhancing its financial stability.

These strategic sectors, combined with smart fiscal management, have solidified Abu Dhabi’s position as a leading global financial hub.

The US$1.7 trillion figure includes assets managed by ADIA, Mubadala, ADIC, ADQ, Lunate, ADFD, Tawazun, and EIA.

Abu Dhabi's main rival, Oslo's NBIM, is followed by Beijing's CIC, Singapore's GIC and Temasek, Riyadh's PIF, and Hong Kong's SAFE IC.

A total of US$12.5 trillion is held by SWFs in these six cities, which is two-thirds of the total wealth of SWFs globally.

During the past few decades, Abu Dhabi has developed one of the world's largest and most active institutional investor portfolios.

Aside from SWFs, the emirate is also home to Central Banks (CBs), Public Pension Funds (PPFs), and Royal Private Offices (RPOs).

Abu Dhabi's public capital is estimated at US$2.3 trillion and will reach US$3.4 trillion by 2030.

Abu Dhabi's investment growth is significant as it showcases the city's ability to strategically diversify its economy beyond oil and gas, ensuring long-term financial sustainability.

By channeling funds into sectors like renewable energy, tourism, and real estate, the emirate is reducing its dependency on fossil fuels and preparing for a future where global energy demands may shift.

This immense concentration of wealth has significant implications for Abu Dhabi's economic development and global influence.

The emirate's financial power allows it to invest heavily in infrastructure, innovation, and diversification efforts, reducing its reliance on oil revenues and fostering a more sustainable economy. Abu Dhabi's robust investment portfolio enhances its ability to influence international markets and forge strategic partnerships worldwide.

This proactive approach not only enhances its resilience to economic fluctuations but also positions Abu Dhabi as a forward-thinking leader in global finance.

Despite its impressive financial growth, Abu Dhabi's future challenges include managing the volatility of oil prices, which can impact its economic stability.

The city must continue to innovate and adapt to global shifts towards sustainable energy and digital transformation to maintain its competitive edge. Balancing the need for economic diversification with environmental sustainability will be crucial for Abu Dhabi's ongoing prosperity.

The report is now available at https://globalswf.com/reports/abudhabiinc.