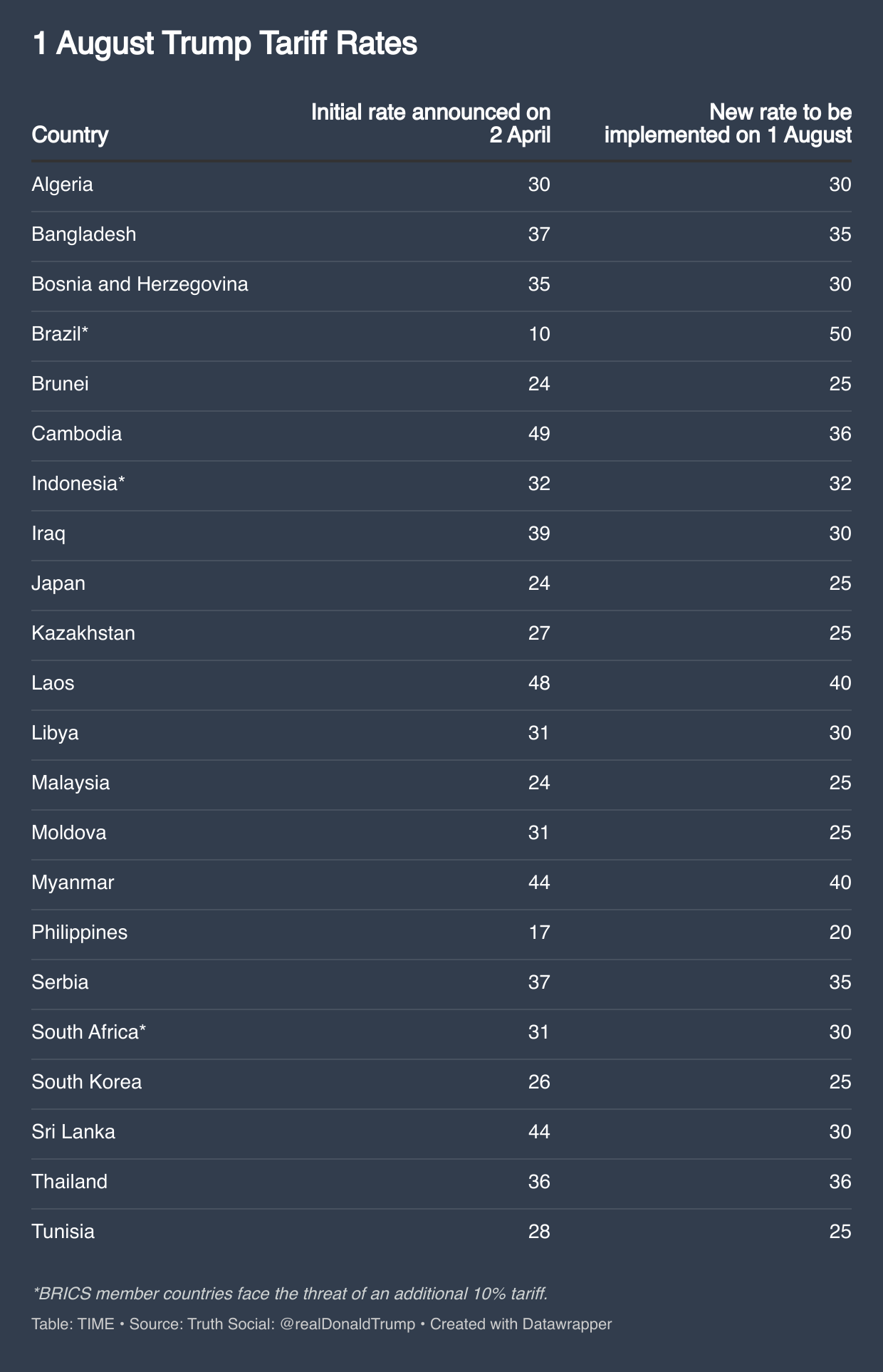

Tariff headlines have dominated market sentiment throughout 2025, with the President of the United States sparking a huge surge in volatility after the 2 April "Liberation Day" tariffs announcement that sent shockwaves through global financial markets and triggered a scramble for bilateral trade deals.

President Donald Trump's sweeping reciprocal tariff policy imposed a 10% baseline tariff on imports from nearly all countries, with additional country-specific duties ranging from 11% to 50% based on bilateral trade deficits.

The immediate market reaction was severe, prompting the administration to implement a 90-day pause on most country-specific tariffs just one week later on 9 April, reducing rates back to the 10% baseline while negotiations proceeded.

Confusion Reigns as Deadline Extended

As the original 9 July deadline approached, confusion emerged over the timing of tariff implementation. President Trump and Commerce Secretary Howard Lutnick announced that tariffs would be delayed until 1 August, providing trading partners with an additional three-week reprieve.

The president also acknowledged the complexity of negotiations when he told reporters, “We have more than 170 countries, and how many deals can you make? They're very much more complicated”.

Trump tariff timeline, according to Holland & Knight, including updates after 30 June:

2 April, 2025: Trump announces "Liberation Day" - sweeping reciprocal tariffs imposed on all U.S. trading partners, with 10% baseline tariff and country-specific rates ranging from 11% to 50% based on bilateral trade deficits

9 April, 2025: Trump implements 90-day pause on most country-specific tariffs, reducing rates back to 10% baseline to allow time for bilateral negotiations through 9 July

9 May 2025: UK reaches initial agreement to maintain 10% tariff rate with preferential treatment for autos and aircraft engines

11 May 2025: Japan's Ishiba demands U.S. lift auto tariffs

16 June, 2025: UK trade deal finalised at G7 summit, implemented 30 June

18 June, 2025: Philippines hopes for extension beyond 9 July deadline

19 June, 2025: Japan-U.S. negotiations reportedly deadlocked over auto tariffs

22 June, 2025: Malaysia reports U.S. agreement to finalise talks before deadline

25 June, 2025: Pakistan expects to conclude talks "in the near term"

25 June, 2025: Switzerland remains optimistic about reaching 9 July deadline

26 June, 2025: China preliminary agreement reached on rare earth exports

26 June, 2025: EU negotiations continue following new U.S. trade proposal

26 June, 2025: Cambodia submits detailed proposal, enters multi-round negotiations

27 June, 2025: Vietnam deal expected to be finalised, reducing tariffs from 46% to 20%

29 June, 2025: Taiwan completes second round of talks with "constructive progress"

29 June, 2025: Thailand submits five-point proposal requesting 10% tariff cap

30 June, 2025: India negotiations reportedly at “sensitive stage”, with Trump promising "very big" deal

30 June, 2025: South Korea requests extension beyond 9 July deadline

30 June, 2025: Canada negotiations resume after digital services tax removed

30 June, 2025: Indonesia offers increased U.S. access to critical minerals

3 July, 2025: Vietnam trade deal announced, with a 20% tariff and a 40% tariff on transshipped goods

8 July, 2025: Trump announces 1 August deadline extension while releasing tariff letters to 14 countries

9 July, 2025: Trump suggests new tariffs of 50% on copper and 200% on pharmaceuticals, with copper rates set to come into effect from 1 August

9 July, 2025: Trump issues letters setting new U.S. tariff rates on imports from six additional countries - Philippines, Brunei, Moldova, Algeria, Iraq, Libya and Sri Lanka

9 July, 2025: Trump announces tariff on imports from Brazil, partly in retaliation for the ongoing prosecution of the country’s former president, Jair Bolsonaro. President Luiz Inacio Lula da Silva said his country would respond with reciprocity

10 July, 2025: Trump announces sweeping 35% tariff on all Canadian imports, set to take effect on 1 August

11 July, 2025: Trump issues new tariff threats in letters to the European Union and Mexico, demanding they comply with U.S. trade demands by 1 August or face a 30% tariff on all imports

11 July, 2025: Trump suggests blanket tariffs of 15% - 20% on all remaining countries

12 July, 2025: Trump threatens “very severe” tariffs against Russia if no Ukraine deal within 50 days

15 July, 2025: Trump announces a 19% tariff on Indonesian imports under a new trade agreement with the country

15 July, 2025: The U.S. Trade Representative launches an investigation into Brazil’s digital trade, tariffs, intellectual property (IP) practices, and environmental policies to assess potential harm to American commerce

16 July, 2025: Trump said he would be sending letters to over 150 countries, and flagged drug and chip levies also set to take effect on 1 August

22 July, 2025: Donald Trump announced a fresh trade agreement with the Philippines, including a 19% tariff on imported goods

22 July, 2025: Trump reveals trade agreement with Japan

22 July, 2025: Trump announces a finalised trade agreement with the Republic of Indonesia

27 July, 2025: The United States and the European Union finalised a trade agreement during President Donald Trump’s visit to Scotland, establishing a 15% U.S. tariff on E.U. imports.

Progress on Bilateral Negotiations

Despite the challenges, the administration has made progress with several key trading partners. The United Kingdom secured a comprehensive trade deal implemented on 30 June, which reduced tariffs on British exports, including cars and aerospace products, while providing the U.S. with increased market access for agricultural exports.

The UK remains the only country exempt from the global 50% tariff on steel and aluminium. As reaffirmed by the Prime Minister and President Trump, both nations will continue working towards 0% tariffs on core steel products as previously agreed.

China reached a preliminary agreement on 26 June, involving eased restrictions on rare earth exports and lifted U.S. export controls, though significant issues, including the massive trade deficit, remain unaddressed.

Vietnam finalised a deal that reduced U.S. tariffs on Vietnamese goods to 20% from the previously threatened 46%. The country also granted the United States full access to its markets for trade, allowing American products to be sold in Vietnam with zero tariffs.

The Struggle for Additional Agreements

Despite the administration's remarks suggesting that multiple trade agreements are nearing completion, public evidence suggests otherwise, with several major trading partners remaining locked in difficult negotiations:

India continues discussions in Washington, with Trump announcing that a "very big" deal is likely to be finalised soon. However, disagreements over agricultural and dairy products persist, creating uncertainty about the timeline.

Japan faces a particularly challenging situation, with negotiations reportedly deadlocked over Tokyo's demands for lower auto tariffs - a request the U.S. has firmly rejected.

The confirmation of 25% tariffs on Japanese goods, announced Monday, represents a significant escalation given Japan's status as America's fifth-largest supplier of imports, with over $148 billion in goods shipped to the U.S. last year.

South Korea presents perhaps the most complex case, with President Lee Jae Myung acknowledging at his first press conference since taking office that "it's still not clear to each side what the other side wants".

The country now faces the confirmed 25% tariff rate, up from the current 10%, creating particular challenges given that exports equivalent to more than 40% of South Korea's economy flow to international markets.

South Korean officials have publicly stated that the chances of reaching a deal before the deadline are slim.

The European Union, despite Treasury Secretary Scott Bessent's claims of "good progress", is reportedly preparing contingency measures if no agreement is reached.

The E.U.'s complex regulatory framework and the administration's demands for significant concessions on agricultural access create substantial obstacles to a quick resolution.

Smaller Nations Face Uncertainty

While major trading partners dominate headlines, approximately 100 smaller countries face their own challenges. Treasury Secretary Bessent indicated that these nations would likely receive a standard 10% reciprocal tariff rate.

Countries like Vietnam, which Trump announced had reached an agreement reducing tariffs from a threatened 46% to 20%, represent success stories in this category.

However, many smaller nations have had minimal engagement with the Trump administration, leaving them uncertain about their ultimate tariff fate.

Legal Challenges and Future Outlook

Added to the uncertainty, two federal court rulings have struck down the reciprocal tariffs, finding that the measures exceed presidential authority under the International Emergency Economic Powers Act.

However, the tariffs remain in place while appellate courts hear the administration's appeals, with the Supreme Court potentially deciding their ultimate legality.

The administration has also introduced additional complexity with threats of an extra 10% tariff on any country aligning with BRICS (Brazil, Russia, India, China, and South Africa), responding to the bloc's criticism of unilateral tariff measures that risk hurting the global economy.

Strategic Implications

The tariff campaign has fundamentally altered global trade dynamics, forcing countries to reassess their economic relationships with the U.S.

While some nations have successfully negotiated favourable terms, others face the prospect of significantly higher import costs that could disrupt supply chains and impact all sectors of the economy.

According to the latest data, the United States government recorded a US$27 billion budget surplus in June, supported by a sharp rise in tariff-driven revenue.

This follows a US$316 billion deficit in May, pushing the fiscal year-to-date shortfall to US$1.34 trillion, a 5% increase from the same period last year.

It marks the first June surplus since 2017, during Donald Trump’s initial term as president.

Budget data shows that tariff collections are becoming a significant revenue stream, with gross customs duties reaching US$27.2 billion in June and netting US$26.6 billion after refunds.

The coming weeks will prove decisive in showing whether the administration’s aggressive trade strategy can deliver its policy objectives without inflicting lasting damage on the broader economy.

Related content