As 2025 approaches, the U.S. economy continues to display remarkable robustness amid rising geopolitical risks and the threat of increased protectionism under President-elect Donald Trump’s administration.

Meanwhile, China stimulates growth, and central banks in developed economies are cutting rates across the board.

From a foreign exchange perspective, continued dominance by the U.S. is expected to translate into a stronger U.S. dollar throughout 2025.

Currency Markets: Dollar Strength and Diverging Trends

The U.S. dollar remains poised for strength in 2025, buoyed by relatively high interest rates, fiscal loosening, and threats of protectionist policies under the Trump administration.

Analysts at ING expect the dollar’s trade-weighted index to break its two-year range, potentially creating a dollar rally despite occasional pullbacks.

According to ING’s ‘FX Markets in 2025’ report, “2025 should be the year when more air gets pumped into any potential dollar bubble”.

Meanwhile, Goldman Sachs echoed bullish sentiment for the U.S. dollar. It noted, “Our baseline forecast remains essentially benign for the US: solid growth, cooling inflation and further non-recessionary rate cuts, alongside a range of policies that could be friendly to corporate earnings. And while the US is a clear outperformer, non-US economies still see stable growth, falling inflation and monetary easing in our central scenario.

“We think our baseline forecasts justify higher equity prices and further USD outperformance.”

Economic Resilience and Risks

The U.S. economy has remained resilient throughout 2024, with growth averaging near 3% in recent quarters and unemployment holding at 4.1%. While inflation has cooled across the West, a trade war remains a critical risk.

The Trump administration’s campaign rhetoric suggested a steep rise in tariffs on car imports. This could cost European and U.S. carmakers up to 17% of annual earnings, according to a report from S&P Global.

“We expect mitigating actions will make potentially higher tariffs manageable, but the combined effects of tariffs, tighter CO2 regulation in Europe from 2025, and earnings pressure from stronger competition in China and Europe could increase the risk of downgrades,” S&P said.

China’s economy, meanwhile, has initiated stimulus measures to counteract domestic economic pressures and U.S. trade policies.

However, concerns over peaking oil demand and weakening global trade volumes, exacerbated by tariffs, are pressing down on long-term growth prospects for both developed and emerging markets.

Asia: Tariff Pressures and Currency Stability

China will remain a focal point as U.S. tariffs return in 2025. However, the People’s Bank of China’s focus on currency stability and reduced global exposure to Chinese assets mitigates volatility.

The Australian dollar is also expected to retreat amid renewed China-U.S. trade tensions. CBA analysts forecast that “The Australian dollar could fall further and/or faster if the trade war is more disruptive than we expect.

"The more the US and Europe seek to constrain China, the more the Chinese government will seek to support its economy with positive spillover to commodity prices that support the Australian dollar.”

South Korea’s won (KRW) is expected to weaken due to its trade surplus with the U.S., sensitivity to the renminbi, and domestic fiscal constraints.

Meanwhile, Indonesia’s rupiah (IDR) could outperform, supported by fiscal prudence and reduced reliance on U.S. exports, as well as diminished political risks.

Yen-Funded Carry Trades Lose Appeal

Historically, Japan's policy of negative interest rates and a depreciating yen provided a favourable environment for investors pursuing higher returns. The strategy involved borrowing yen at minimal cost and reallocating funds to higher-yielding assets.

This approach allowed traders to capitalise on the interest rate differential and currency appreciation.

However, the unwind of yen-funded carry trades in August has made this strategy less attractive amid heightened volatility and diminished returns from high-yield currencies like the Mexican peso.

Analysts at JPMorgan noted, “Stability of JPY carry trades has clearly declined. The Japanese authorities made it clear in July that they would manage excessive yen speculation more proactively, using a combination of monetary policy and direct FX interventions. This should discourage traders from rebuilding those positions on a large scale.”

“Moves in USDJPY will likely return to tracking its traditional drivers, with interest rate differentials back in the driver’s seat.”

Monetary Policy and Market Dynamics

The Federal Reserve is expected to maintain a cautious approach to rate cuts in 2025. While the Fed may cut rates in December, recent data on inflation and economic activity suggests a slower easing trajectory.

In contrast, the ECB and central banks in emerging markets are likely to accelerate rate cuts to counteract trade-related slowdowns.

In financial markets, U.S. equities remain elevated, with the possibility of a year-end “melt-up” fuelled by post-election optimism and deregulation hopes.

Treasury yields, however, could rise further as deficits expand, challenging bond valuations.

Geopolitical Uncertainties

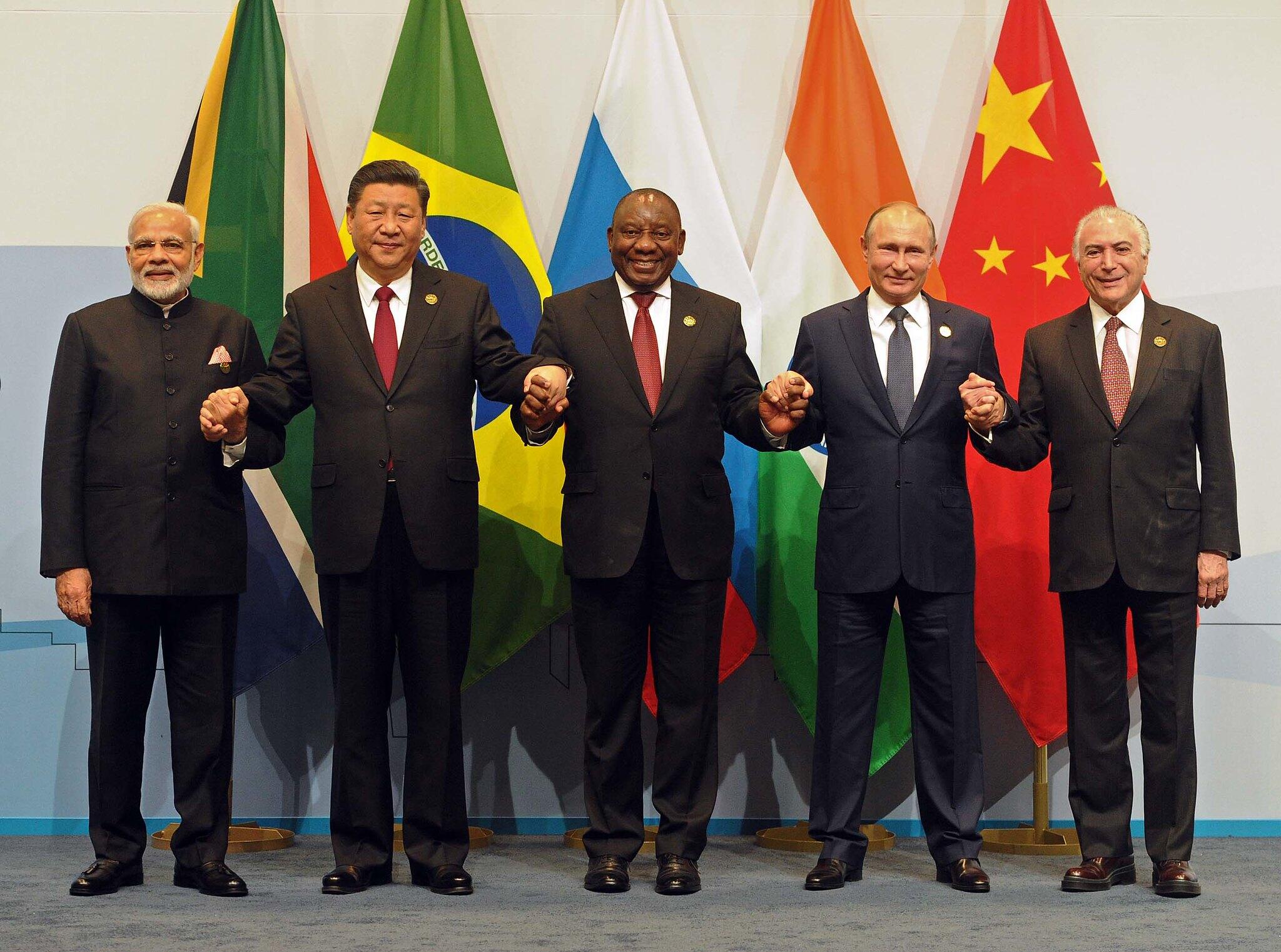

Geopolitical tensions, particularly in the Middle East and between the U.S. and BRICS nations, add another layer of uncertainty.

The BRICS alliance of emerging economies is intensifying its de-dollarisation push. President-elect Trump has threatened 100% tariffs on BRICS members that attempt to replace the U.S. dollar as the global reserve currency.

While these threats underscore America’s commitment to preserving the dollar’s dominance, the BRICS bloc’s growing GDP share and intent to trade in alternative currencies could shift dynamics over the longer term.

Market Dynamics and Outlook

U.S. equities remain buoyant, with potential for a post-election rally fuelled by deregulation optimism. Treasury yields, however, may face upward pressure as deficits grow, challenging bond markets.

As 2025 unfolds, the global economy looks set for increased volatility. This is as market participants navigate simmering trade tensions and geopolitical uncertainties coupled with diverging monetary policies from central bank leaders across the globe.