Tencent has beaten analyst Q4 revenue forecasts by 11% and increased net profit by a whopping 90%, as it looks to accelerate a drive into integrating artificial intelligence across its products and services.

It sees itself in a race competing with rival Chinese tech companies which are making huge investments - notably Alibaba, which announced a US$52 billion spend over the next three years in cloud computing and AI infrastructure.

The ByteDance and ergo TikTok parent company has partnered up with DeepSeek AI and has been integrating it at pace, across product stables such as WeChat and the Yuanbao AI assistant.

Yuanbao became the most downloaded iPhone app in China earlier this month, surpassing that of DeepSeek's own app, with downloads rising more than 20-fold on the back of the AI integration.

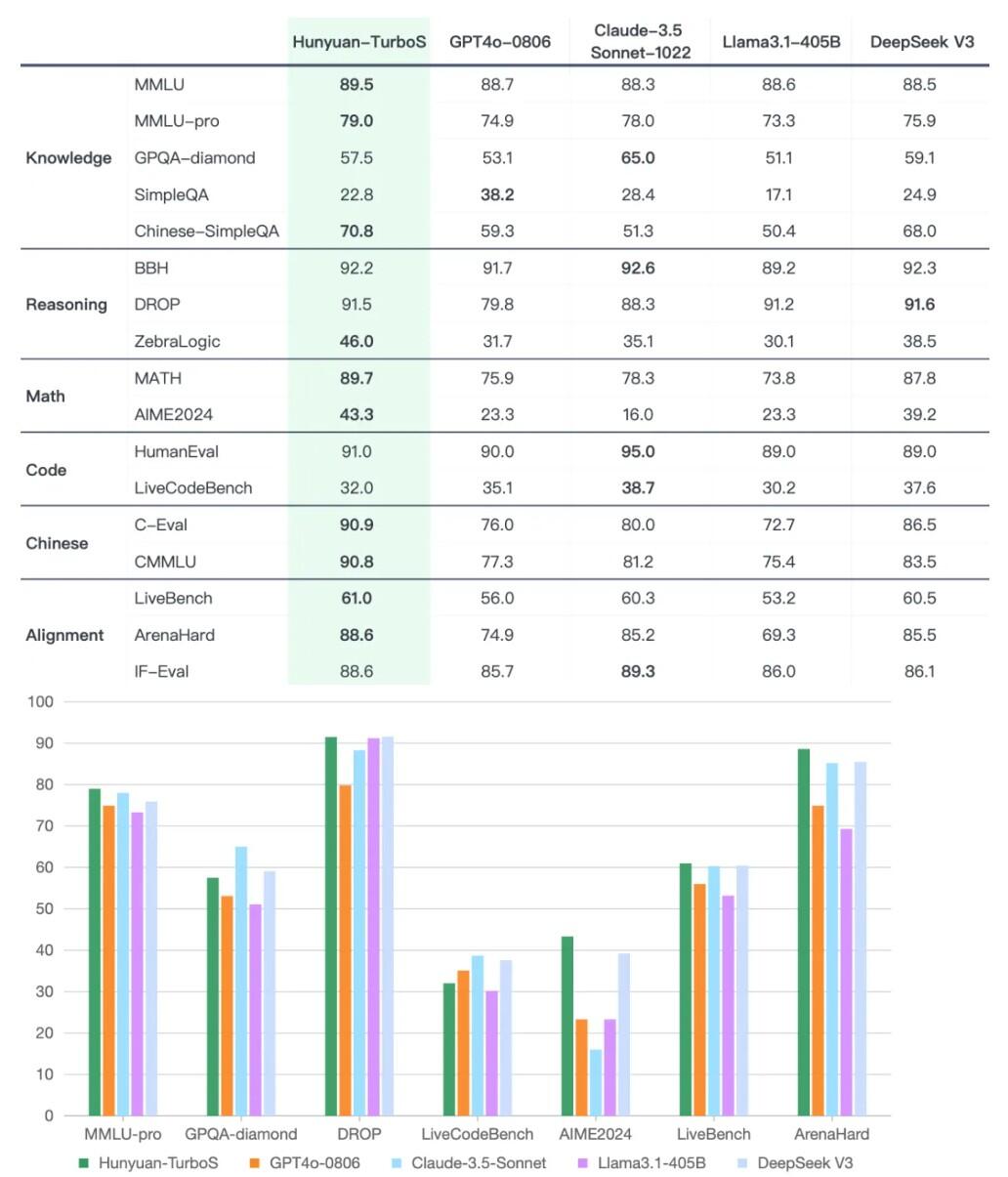

The Chinese tech giant is also advancing its own proprietary AI, led by its Hunyuan large language model (LLM).

March 1 saw the release of Tencent's latest LLM, the Hunyuan Turbo S, which the company claims doubles word generation speed and cuts first-word delay by 44% compared to previous models.

AI the growth driver

Tencent CEO Ma Huateng says double-digit growth during Q4 last year was largely driven by AI advancements in its advertising platform.

“Starting a few months ago, we have reorganised our AI teams to sharpen focus on both fast product innovation and deep model research, increased our AI-related capital expenditures, and increased our R&D and marketing efforts for our AI-native products,” Ma said.

“We believe these stepped-up investments will generate ongoing returns via uplifting productivity in our advertising business and longevity of our games, as well as longer term value from accelerated consumer usage of our AI applications and enterprise adoption of our AI services.”

There was also a marked increase in user engagement on its videos and sustained domestic growth across its evergreen gaming products such as the flagship Honour of Kings, Peacekeeper Elite and PUBG Mobile titles, leading to a 23% YoY jump, while international gaming revenue climbed 15%.

By the numbers:

Q4 profit: up 90% year-on-year to US$11.2 billion

Gross profit: up 19% to US$48.6 billion

Total 2024 revenue: up 8% year-on-year to US$91.9 billion

Outlook:

Tencent's "low teens" capex guidance for 2025 remains in line with last year's significant rise in spending, yet may be adjusted upward if demand increases.

AI will be at the forefront with Hunyuan and and a suite of new tools capable of converting text and images into 3D visuals released this week, as it looks to lead China's growing generative AI field.