If the noise leading up to the United States President-elect’s entrée into the Oval Office is anything to go by, Trump 2.0 has serious implications for both the U.S. and global economy.

Having examined a baseline Donald Trump scenario, including tariff hikes, extension of the Trump 2017 tax cuts, curbs on immigration and broad deregulation of Biden era requirements, Goldman Sachs foresees a potent cocktail of favourable and adverse supply and demand shocks.

While Trump's tariff plans are a major source of uncertainty and downside risk, the broker believes investors who stay riveted on the economy’s fundamentals will reap the benefits.

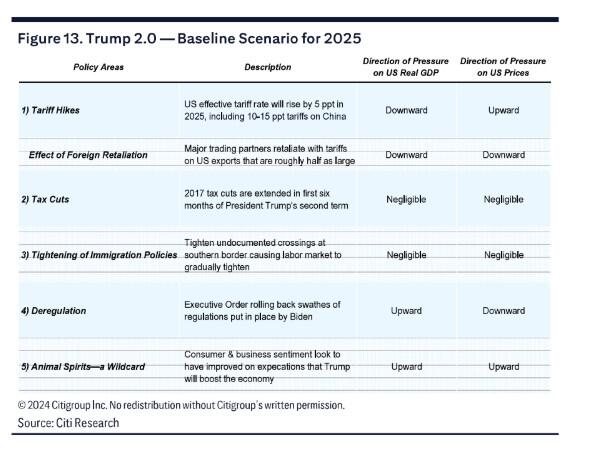

Goldman's baseline Trump scenario is based on the following five factors.

- Tariff hikes: While Trump’s initial tariffs target China, he quickly pivots to bilateral negotiations with other countries, including Mexico, Canada, the European Union and Japan. While Trump threatens tariffs if his negotiating demands aren’t met, Goldman expects the US effective tariff rate will be forthcoming. As a rule of thumb, the broker assumes the U.S. effective tariff rate will rise by roughly 5 percentage points (ppt) in 2025, including 10-15 ppt tariffs on China.

“Foreign retaliation on U.S. products is assumed to be roughly half as large… it’s hard for other countries to retaliate one-for-one because the U.S. imports are significantly larger than U.S. exports,” Goldman notes. - Tax cuts: As an extension of his 2017 tax cuts, Trump may introduce a reconciliation bill during his first six months in office.

But Goldman notes that extending these cuts involves preserving the tax rates that currently prevail, and as such, creating no new macro stimulus or inflation pressures. While Trump may push through other tax cuts, including lower corporate taxes and abolishing tax tips, Goldman assumes these measures will be funded by increased revenues from tariffs. In addition, Goldman assumes some cost cutting due to the Musk-Ramaswamy “DOGE” initiative. - Tightening immigration policies: While Trump will clamp down on security at the U.S. Southern border, Goldman’s expects labour markets to remain well supplied for the next couple of years. “Labour demand is currently restrained as firms digest labour resources hired in recent years, and many recently arrived migrants are still diffusing into the labour market,” said Goldman.

“… the scale of deportation will not be sufficient to affect overall labour market conditions.” - Deregulation: On entering office, Trump is expected to sign an Executive Order reversing broad swathes of the previous administration’s regulations in areas like energy, finance, employment practices and consumer protections.

While the macroeconomic implications are difficult to assess, Goldman expects such policies to cumulatively boost growth and restrain inflation in the near-term.

“The more challenging question, however, involves these policies longer-term effects, with many Republicans arguing that they could unlock additional trend growth,” Goldman said.

“Democrats, in contract, argue that reversing regulations is likely to make the economy less fair and sustainable over the medium term.” - Animal spirits – a wild card: Based on various measures, U.S. economic sentiment and market confidence have risen since Trump’s election victory. While this should help stimulate the economy, the deeper question notes Goldman is the durability of these effects.

The great unknown, adds Goldman is whether the observed bounce in economic sentiment will actually translate into more spending, hiring and investment?

“For US prices, the effects look to skew toward some moderate upward pressures… the clear implication is that over the coming year, the Federal Reserve will need to remain alert for signs of emergent inflation pressures, and monetary policy may need to be bit tighter,” Goldman adds.

Rest of the world

An adverse demand shock for tariff-hit countries is among the likely global implications expected by Goldman.

Secondly, while animal spirits have skewed to the positive in the U.S., Goldman notes that the opposite is true for the rest of the world.

Closer to home, Woodside Energy (ASX: WDS) chairman Richard Goyder says it is now up to Australia to ensure that with the necessary resources and the right regulatory environment, Australia becomes a beneficiary of Trump’s second term.

In light of the growing attractiveness of the U.S. as a place to invest, Goyder urges Australia to assess its own attractiveness. “It’s a great country, a great place to live, has a highly educated workforce but we need a strong focus on productivity and encouraging investment,” he said.

If we don’t act now, one of the risks, warns Susan Forrester director of Iress (ASX: IRE) is that after four years of Trump's improvement to U.S. business and capital markets, Australia simply gets left behind to pick up the pieces.

“Deregulation in the U.S. may boost short-term global growth, however, inflationary pressures and higher interest rates could slow Australia's economic growth.”