Remaining Australian banks are set to cough up interim earnings results this week, with Westpac having reported a dip in profits this morning and Comm Bank a 6% increase back in February. There will be news from ANZ and NAB before the end of the 'big four'.

Citi Research says Aussie banks have initially outperformed the overall market amid tariff volatility, thanks to their domestic focus and strong balance sheets, with the sector outperforming the ASX 200, up 2.5% YTD.

However, “we expect investors will have to examine the second-order impacts of trade volatility, which likely include a slowdown in global and domestic growth as confidence wanes. For bank investors, that likely includes a slowing in credit growth and possible NIM (net interest margin) contraction if the RBA moves to cut rates in response”, Citi analyst Thomas Strong said.

“Despite high valuations, we think the bank sector may be perceived as a safe haven for investors. When investors are triaging their portfolio for companies that are directly impacted by tariffs, the now largely domestically focused banks are well down the list of examination – and possibly a safe place to hide.”

However, Citi warns to remain cautious into the rest of 2025 as headwinds from three or more expected 25 basis point rate cuts by the end of the year may pressure banks' net interest margins.

Market cap: $109.6 billion

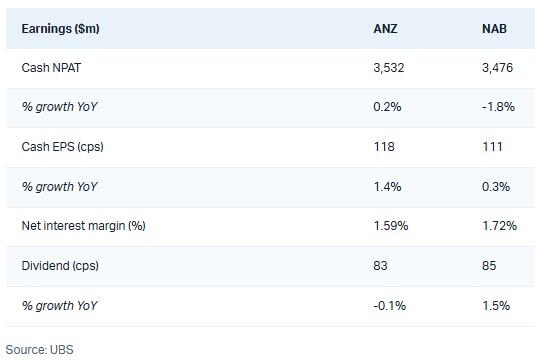

Analysts expect NAB to deliver a $3.47 billion NPAT, down 2% year-on-year (YoY) with a CET1 ratio of 11.6%. Yet a new CFO and concerns over its asset quality are downplaying optimism, says UBS.

The big four bank is down 3.5% YTD and trading down 1.89% on the daily for $35.80 per share at the time of writing, ahead of its Wednesday earnings report.

Market cap: $89.5 billion

Up 5.45% YTD, ANZ is expected to be one of the softer performing lenders in earnings this week with a 0.2% growth outlook YoY and an NPAT of $3.52 billion.

Suncorp Bank's integration and updates on its ANZ Plus client migration will be key drivers of its balance sheet.

A fallout from a bond trading scandal and $250 million in regulator addons will also weigh on its Thursday earnings release this week.

ANZ's stock underperformed the ASX 200 and was down 0.73% at $30.14 in the middle of trade today.

Commonwealth Bank (ASX : CBA) earnings released

Market cap: $280 billion

Comm Bank's interim report in February showed a net profit after tax (NPAT) of $5.14 billion, up 6% on H1 2024 on what it says was supported by volume growth across its core businesses and lower loan impairment expenses.

The bank’s return on equity increased to 13.7% due to higher profits, leading it to pay an interim dividend of $2.25 per share at a payout ratio of 73% NPAT.

It also completed a $300 million purchase of an announced $1 billion share buy-back.

“It has been another challenging period for many of our customers and we have maintained our focus on proactive engagement to offer a range of support options," chief executive Matt Comyn said.

“We will continue to invest in our franchise, including to protect our communities against fraud, scams, and financial and cyber crime.”

Comm Bank stocks have shot up a whopping 46% in the last 12 months, including a 10.71% rise for the calendar year so far and are currently trading at $169.66 per share.

Westpac (ASX : WBC) earnings released

Market cap: $114 billion

Reporting period profit for Westpac was down 1% to $3.32 billion instead of an expected 3% rise to $3.5 billion by some analysts, numbers from its interim earnings report show.

The bank also paid a below average dividend of 76 cents per share, down from 90c a year ago and 4c under expectations.

Not unexpected and leading up to the results, new Westpac chief executive Arthur Miller had flagged a $140 million hit to profits due to hedge impacts.

It prioritised profitability over volume growth, mortgage lending increased 5% in the six months to the end of March, yet slightly below market average, while business lending was up 14% to $106 billion.

Miller says while the prospect of further official rate cuts this year will underpin improving credit quality, housing credit will slow 0.2% down to 5.3% this year and lending to businesses will drop 2.5% to 6.4%.

Knock-on effects of tariffs, he says, remain a key risk going forward.

“Geopolitical uncertainty is a key risk that’s as high as it has been for a very long time,” he said.

“Changes to global trade policies have impacted markets and funding for the bank. Despite the volatility, it’s important that we look through the noise and avoid reacting to the headlines. Australia is well-placed to handle the instability.”

Though Westpac’s shares have risen 22.8% in the last 12 months they have remained flat so far this year, after dropping almost 3% to $32.45 per share on today's news.