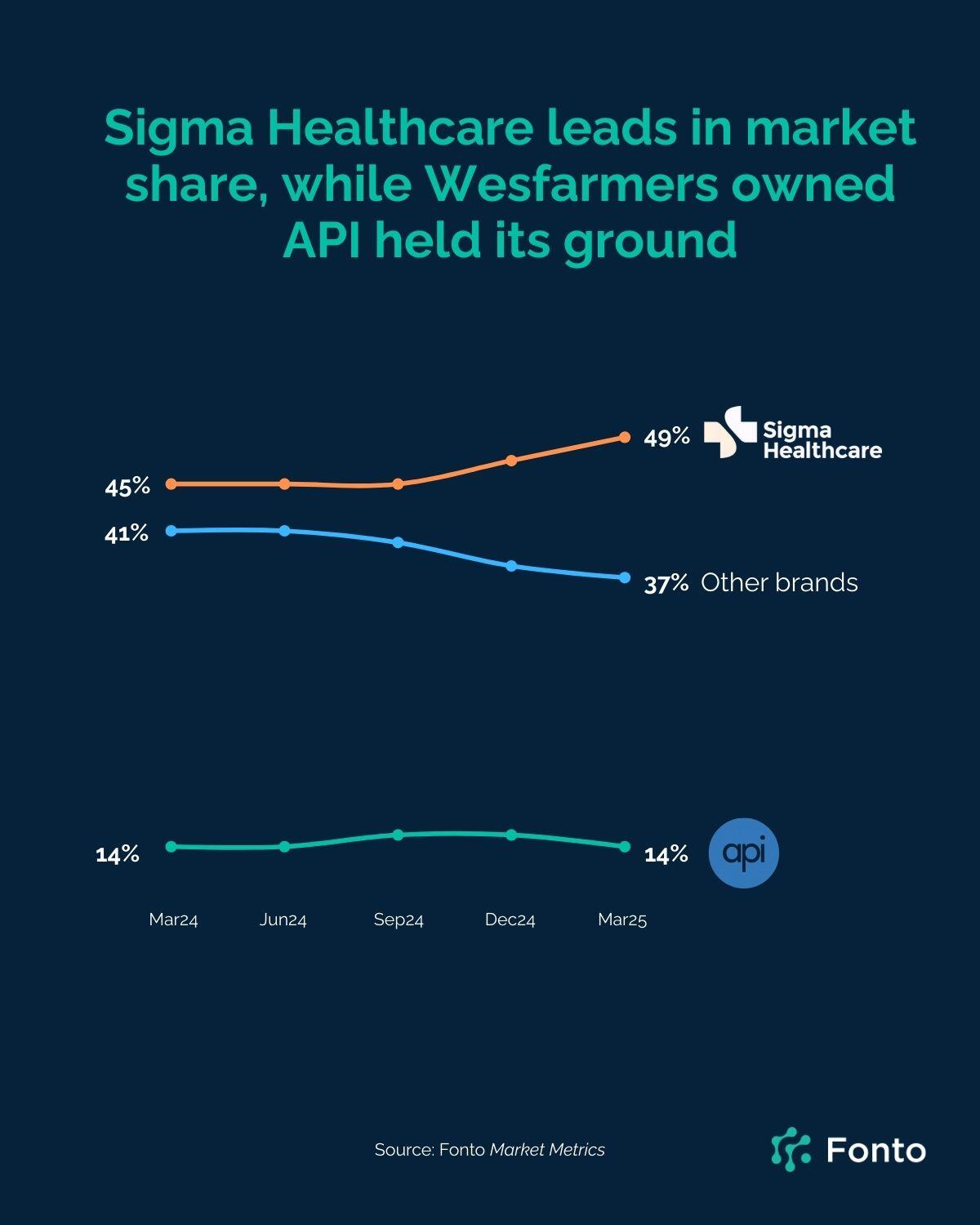

Sigma Healthcare’s brands now represent 49% of consumer spending in Australia’s pharmacy sector, according to a report by Fonto.

This is an increase of 4.4% from the first quarter of 2024, and follows the completion of Sigma Healthcare’s merger with Chemist Warehouse in February 2025. Wesfarmers’ API retained a stable 14% share of consumer spending, while other brands’ share fell from 41% to 37%.

“The Chemist Warehouse effect has changed consumer thinking on how to shop the category,” said Fonto CEO Ben Dixon. “At a category level, consumers are shopping less frequently but spending more each time.”

The average pharmacy transaction rose by 12% year-over-year to A$42 in Q1 2025. Meanwhile, the average frequency of purchases declined by 11% to 4.5, or between 1 and 2 visits each month.

Customers spent $145 per person at Chemist Warehouse in the first quarter of 2025. This is a new high for the company, and an increase of 9% year-over-year.

Fonto found that Chemist Warehouse’s large stores, which allow for a wider range of products, and its price incentives contributed to the rise in purchases.

Sigma Healthcare and Chemist Warehouse together control around 16% of Australian pharmacies, the most of any company.

The merger was approved by the ACCC in November, and by Sigma Healthcare’s shareholders in January.

Sigma Healthcare’s (ASX: SIG) share price stood at A$2.94 at time of writing, down from its previous close at $2.97. Its market capitalisation is $34.05 billion.