Australian housing prices continue to rise, with Melbourne and Sydney leading the charge, spelling bad news for hopeful first home buyers but good news for sellers.

For sellers, Cotality has revealed that 94.9% of property resales in the March 2025 quarter delivered a profit, with gross resale profits reaching A$31.7 billion.

The research showed that the median nominal gain reached $305,000, a decline from the previous quarter’s $310,000. This marks the first decline since March 2023.

According to Cotality’s head of research, Eliza Owen, this reflects a housing market in transition to profitability, set to rise further following March's and February’s rate cuts, with signs of renewed momentum.

“With rate reductions now flowing through to buyer demand and value growth, we expect stronger resale returns in the months ahead,” Owen said.

“Profit-making resales closely followed home value trends, with profitability dipping slightly as prices softened late last year. But that pullback has already reversed.”

Sellers also made slightly smaller losses this quarter. Of the 5.1% of home sales that resulted in a loss, the median was $44,000, down from $45,000 in the previous quarter.

This was led by house sales, which outperformed unit sales, with 97.2% of house sales being profitable in comparison to 90.1% of units.

Brisbane claimed the top spot for profit-making sales with 99.7% of sales making a nominal gain.

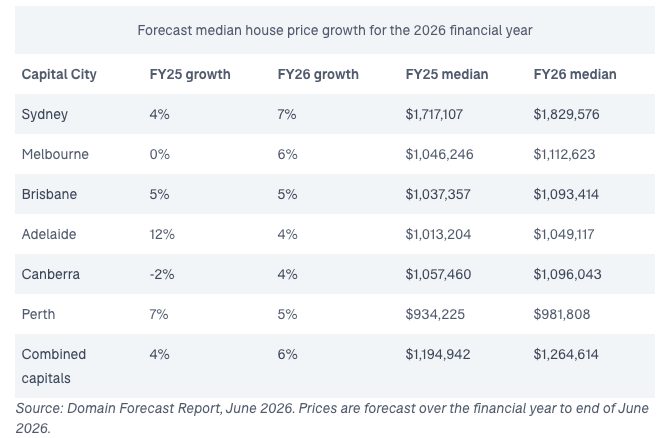

According to Domain’s Price Forecast Report, every major city is forecast to have record growth except for Canberra, spelling potential bad news for home buyers.

Sydney is set to experience the steepest rise of 7%, resulting in a median house price of $1.83 million. This means a total increase of $112,000, which is higher than the national average annual salary.

Melbourne will still remain 63% more affordable than Sydney, with an expected 6% growth in median prices to a record $1.1 million, giving it a competitive edge over Sydney.

“Lower interest rates, cheaper borrowing, and targeted support for first-home buyers will keep prices rising, especially in Sydney and Melbourne, which are most sensitive to rate changes,” Domain chief of research and economics Dr Nicola Powell said.

After significant upswings in recent years, Brisbane and Adelaide’s growth trajectories are stabilising with an expected 5% and 4% growth respectively. Despite the stabilisation, the cities are still set to reach record high median prices of $1.09 million in Brisbane and $1.05 million in Adelaide.

Canberra housing prices are forecast to grow by 4% to $1.10 million. Despite the rise, Canberra remains the most affordable capital based on price-to-income ratios. Canberra is the only city not expected to hit record growth.

Perth is poised to join the million-dollar club by the end of 2026 but is currently forecast to grow by 5% to a median of $982,000 by the end of 2025.

Overall, Powell said rate cuts could have an impact on market growth.

“Even with more rate cuts on the horizon that will increase buyer capacity, the upswing in house prices is expected to be more modest than in previous rate-cutting cycles,” she said.

“This reflects forecasts of smaller, more gradual rate reductions and ongoing affordability challenges, with housing costs continuing to take up a significant portion of household income in most capital cities.”

Related content