Shares of Omnicom Group - one of the biggest integrated advertising and communications companies in the world - fell 3.6% after the bell on Tuesday (Wednesday AEST), as an uncertain economic environment weighed on several of its segments.

In the quarter, Omnicom saw revenue declines in healthcare, public relations, branding, and retail. Media and advertising, the company's biggest business, rose 7.2%.

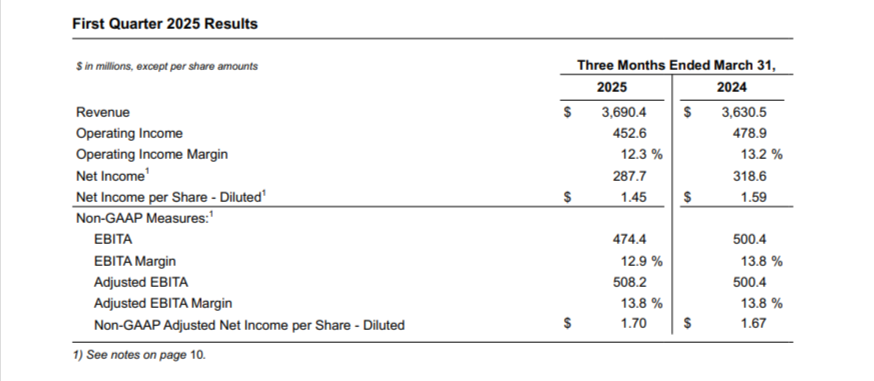

Reuters reported Omnicom's revenue of $3.69 billion came in lower than the analysts' average estimate of $3.72 billion (via LSEG data).

"Organic revenue growth for the first quarter was 3.4%. We are assessing the implications of economic and market events to determine how they will affect our clients and business for the remainder of 2025. While uncertainty has increased, one thing hasn’t changed and will always be true – Omnicom is a trusted partner for our clients, offering strategic advice to grow their sales while delivering flexibility, value and performance,” said John Wren, Chairman and Chief Executive Officer of Omnicom.

“I am confident that our diversified portfolio and strong balance sheet, together with our experienced leadership teams, will allow us to navigate this challenging economic environment. We are also very excited about the expected closing of the Interpublic acquisition in the second half of this year. It will give the combined company substantial opportunities for revenue growth and distinctive cost synergy potential to drive increased profitability, EPS growth, and free cash flow."

Revenue Growth: In the first three months of 2025, the company’s revenue grew by $59.9 million, or 1.6%, compared to the same period last year. Most of this growth came from “organic revenue,” which means they make more money from their regular business activities like advertising and marketing. However, some changes, like buying or selling parts of the business, lowered revenue slightly. Also, currency exchange rates affected revenue as well, reducing it by $59.2 million. In certain areas like Media and Advertising, revenue grew strongly, while in others like Healthcare and Public Relations, it declined.

Expenses Rising: The company spent $86.2 million more on operating expenses this quarter than last year. Part of this increase came from salaries and service costs, as they hired freelancers and paid suppliers to handle more client work. Another chunk of these expenses came from an upcoming business acquisition. Interestingly, even though they spent more overall, they saved some money by restructuring their workforce last year, which lowered regular employee salary expenses.

Profit Margins Shrinking: Operating income — the money left after expenses — was down $26.3 million, or 5.5%, compared to last year. This decrease made their operating margin (a percentage showing profit compared to revenue) shrink slightly from 13.2% to 12.3%. The cost of preparing for the business acquisition contributed to this drop.

Interest and Taxes: The company paid $2.6 million more in net interest expenses this quarter, due to higher borrowing costs. Taxes also increased, mainly because some acquisition-related costs weren’t tax-deductible. Their effective tax rate (percentage of profits paid in taxes) rose from 25.7% to 28.5%.

Net Income Decline: The company’s net income, or total profit, fell by $30.9 million, or 9.7%, compared to last year. Earnings per share, which shows profit divided among shareholders, decreased slightly. However, when taking into account special circumstances like acquisition costs, they maintained a small increase in adjusted earnings per share. This adjusted metric helps show company performance without one-time expenses.

At the time of writing, Omnicom's (NYSE: OMC) stock was trading at US$76.83. Omnicom's market cap stands at US$15.10 billion (A$23.85 billion).