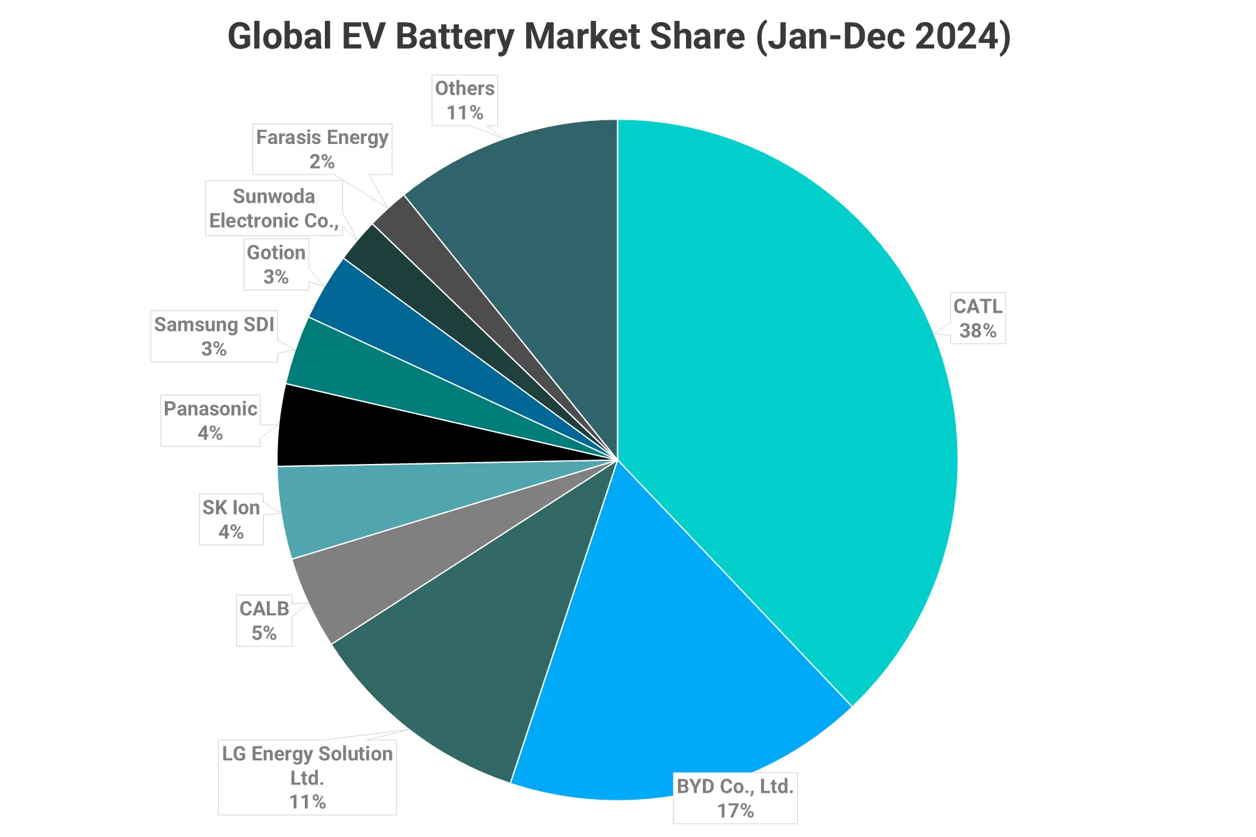

The company behind the world’s biggest initial public offering (IPO) so far this year for an expected US$4.7 billion commands an eye-whopping 37.5% share of the world's battery market, yet onshore United States institutional investment is nowhere to be seen in the float - by design.

By comparison, Wall Street's largest IPO so far this year is LNG exporter Venture Global, which raised $1.75 billion in January.

Founded by Chinese billionaire Robin Zeng, the $158 billion Contemporary Amperex Technology's (CATL) is already trading on the Shenzhen market and - by proxy with it now listed on the Hong Kong Stock Exchange (HKEX) - has excluded a pool of investors usually needed for larger listings in the Asian financial centre.

CATL is the world's dominant battery supplier to a wide range of automakers including Tesla, Mazda, BMW, Ford, Volkswagen, Stellantis and Honda - not to mention dozens of domestic Chinese car manufacturers.

Listing with a 6.7% discount to its Shenzhen-traded shares - starkly lower than the ~25% discount for dual-listed Chinese firms - oozes confidence in uptake by the general market.

And by listing on the HKEX, it cuts down the geopolitical risks for China-based CATL and its market debut, shielding it from a potential legal quagmire should U.S.-China trade relations further deteriorate.

A reinforcement of the decision to float in Asia was made in January this year, when CATL was added to a U.S. government list of banned organisations because of its ties to the Chinese military.

Having onshore U.S. funds on the register would've left CATL exposed if relations with the West went south, yet it hasn't stopped JPMorgan and Bank of America - two of nine underwriters of the IPO - from getting involved.

Oil money interest

CATL has also been able to draw from a strong Middle Eastern investment base, with petrodollar-backed sovereign funds increasingly attractive to the oil-hungry occident.

Sinopec HK and the Kuwait Investment Authority each pledged to invest $500 million in the offering with over 20 cornerstone investors for $2.6 billion and shares are purportedly already subscribed multiple times over.

The Gulf has more than investment cash to offer too.

Chinese passenger-vehicle exports to the Middle East jumped 61% last year thanks largely to EV adoption, making it their fastest-growing market.

Growth plans

CATL says it will use proceeds of the share sale to develop its Hungary-based battery plant - strategically positioned right down the road from offtake partner BMW's top of the line EV manufacturing plant.

The battery giant's cash margins are growing too, with profit jumping 33% during the March quarter compared to Q1 2024.

Trade on the HKEX starts this morning at HK$263 per share.