Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals supply chains - from production and refinement to manufacturing and consumer products.

Traditionally an economic bellwether, the red metal is now more synchronised with structural growth sectors like AI, our clean energy transition, and the urbanisation and industrialisation of developing countries.

AI and data centres especially - which rely heavily on copper for infrastructure - represent a new and significant demand driver for the commodity.

2025 a key year for copper?

For the last two years the world’s biggest mining companies have been flirting with each other on potential M&A deals as unlike its spot prices, demand for copper is on the rise.

Last year the world’s biggest miner BHP (ASX: BHP) made a major, yet conciliatory move into the red metal after its failed US$49 billion bid to takeover over Anglo American.

Instead, it increased its South American footprint with a US$2.1 billion purchase of copper projects in Chile and Argentina in a JV with Canada’s Lundin Mining.

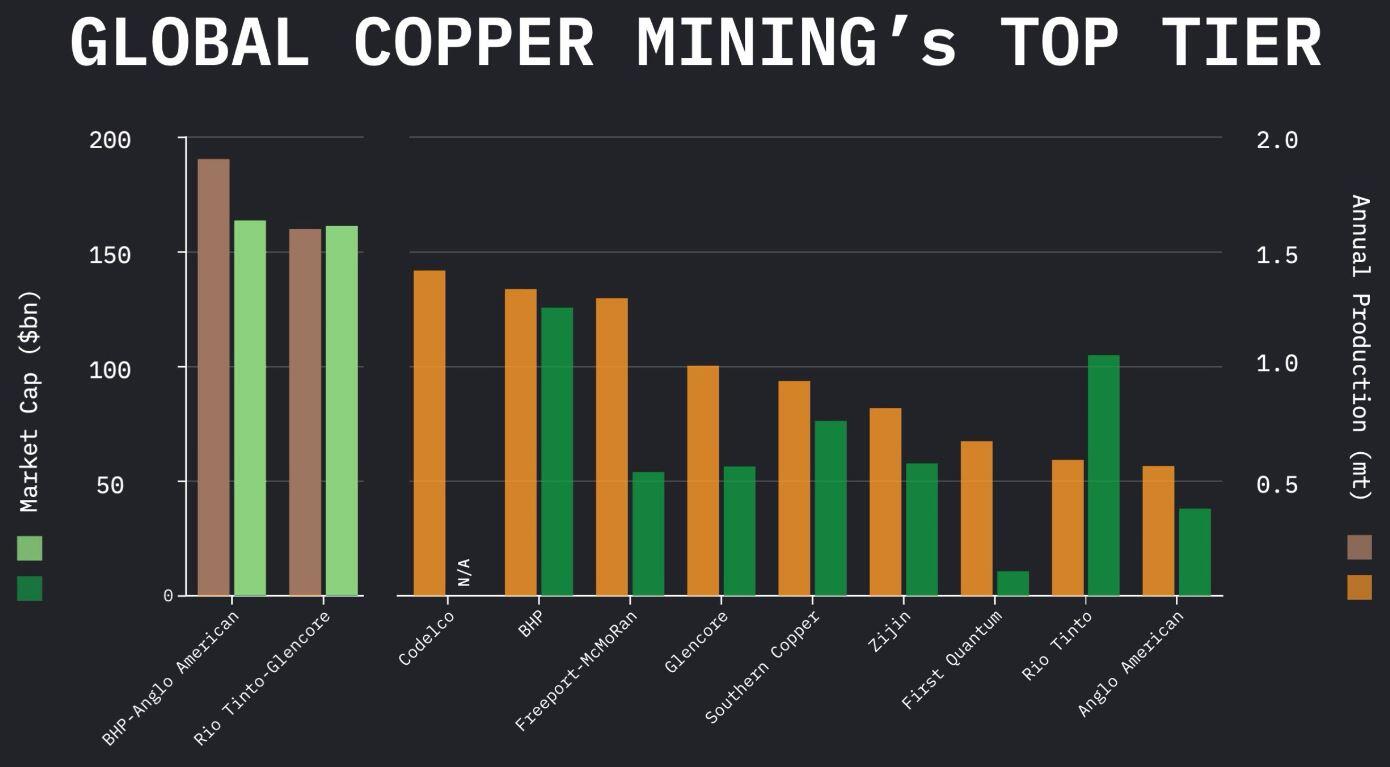

Rival miner Rio Tinto is rumoured to have its eyes on a merger with Glencore to gain exposure to the world-class Collahuasi copper mine, yet that would also see Rio go back into coal - a commodity that it is seemingly proud to recently have divested from.

The jury is out on that move coming to fruition, however it’s certainly something to keep one ear to the ground on.

Find out more: Glencore open to M&A, but is Rio really interested?

Benchmark Intelligence’s latest top-tier producer chart imagines what it may look like too:

Copper yo-yo

As usual, anything and everything out of Trump’s mouth seems to have an effect and at the end of last week, it was his remarks that he’d “rather not” impose tariffs on China that bounced copper to almost 3-month highs of US$9,219 per tonne, yet his mixed messaging seems to be stalling copper prices from an overdue lift.

It doesn’t help that those gains were erased on Monday this week amid the DeepSeek-generated stock rout that dumped US$1 trillion dollars out of tech stocks and weak China purchasing indicators.

The mid-to-long-term sentiment is, however, positive on an uptick in prices, bolstered by a number of 2025 production guidance cuts from industry majors including BHP, Teck Resources and Zijin Mining.

And if Trump lifts the lid on America’s copper production potential, miners in the region could be in for a sustained payday.

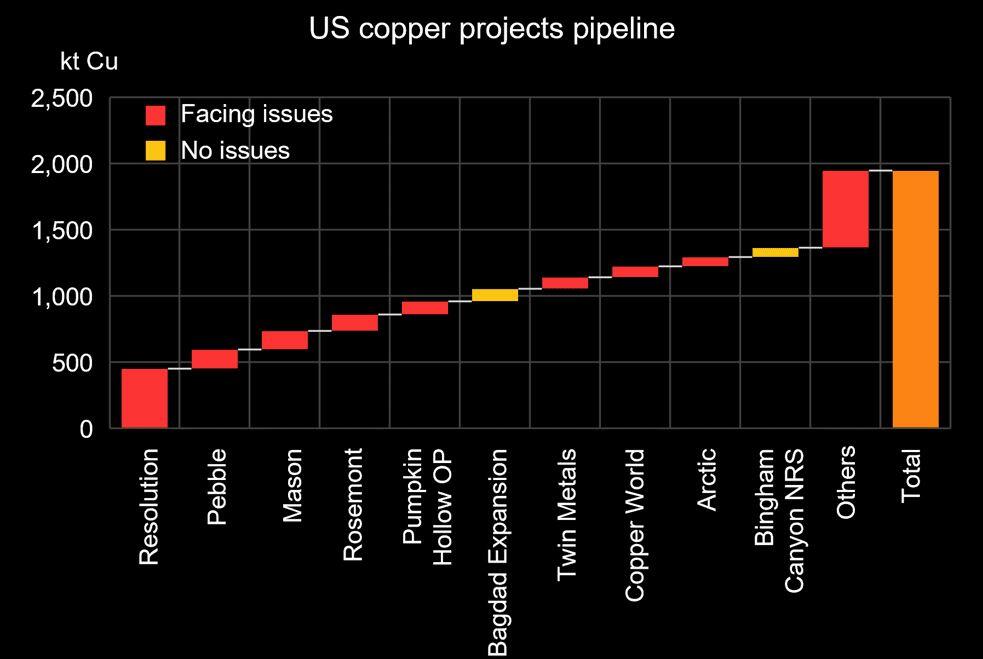

Benchmark Intelligence says the U.S. boasts several significant copper projects that have been stalled in regulatory limbo for years.

“Most notable is Rio Tinto's Resolution project, one of the largest copper deposits in the world, which has the potential to produce 450ktpa of domestic copper,” it said in a recent note.

Find out more: Rio has high hopes for Resolution

“Overall, Benchmark has identified 31 copper mine projects in the U.S. that are categorised as Highly Probable, Probable or Possible, with a total capacity of 1.9Mtpa.

“Eight projects in this group represent 1.2Mtpa of capacity, but have stalled due to permitting issues, [and], should these go ahead, the U.S. could double its copper output from 1.15Mt to 2.30Mt to reach self-sufficiency.

“The full suite of projects we cover could take the production to above 3Mtpa, potentially rivalling countries such as the DRC or Peru.”