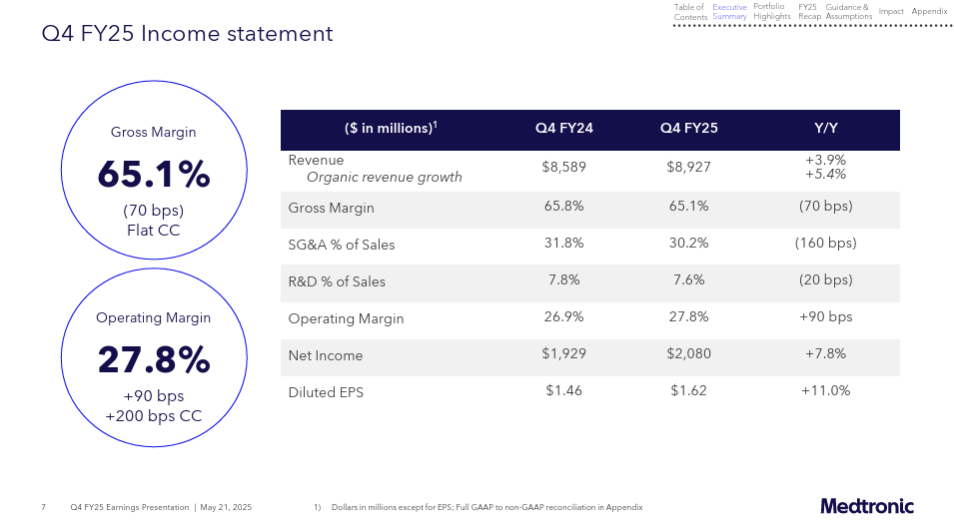

American-Irish medical device company Medtronic closed FY25 on a high note, reporting US$8.9 billion in Q4 revenue, up 3.9%, with organic growth of 5.4%.

GAAP earnings per share (EPS) soared 67% to $0.82, while non-GAAP EPS climbed 11% to $1.62, beating market expectations of $1.58.

The company expanded its margins, increasing operating profit by 36% GAAP and 8% Non-GAAP.

Cardiac Ablation Solutions led the charge, with 30% revenue growth, fuelled by pulsed field ablation adoption.

Medtronic also advanced its pipeline, submitting the Hugo™ RAS system for U.S. FDA approval and launching BrainSense™ Adaptive Deep Brain Stimulation.

For the full fiscal year, Medtronic delivered $33.5 billion in revenue, reflecting a 3.6% increase, while organic growth reached 4.9%. GAAP EPS surged 31% to $3.61, with non-GAAP EPS rising 6% to $5.49.

Cash flow remained strong, with $7 billion in operations and $5.2 billion in free cash flow.

Shareholders benefited, as Medtronic returned $6.3 billion and raised its Q1 FY26 dividend to $0.71 per share, marking its 48th consecutive increase.

A strategic shift was also announced - Medtronic plans to spin off its Diabetes division into a standalone public company.

The company’s innovation engine remains in high gear, fuelling momentum in Pulsed Field Ablation, Transcatheter Aortic Valve Replacement (TAVR), Cardiac Rhythm Management, Diabetes, Spine, and Neuromodulation.

Medtronic also saw success in robotic surgery with Hugo™ RAS and expanded neurology offerings. Strategic investments in brain-computer interfaces, adaptive therapies, and artificial intelligence enhance Medtronic’s competitive edge.

These advances set the stage for sustainable growth in a dynamic healthcare landscape.

Looking ahead, Medtronic forecasts 5% organic revenue growth in FY26, with reported revenue growth ranging from 4.8% to 5.1%, depending on currency fluctuations.

EPS growth is projected at 4% pre-tariffs, with a $5.50 to $5.60 range depending on United States-China trade impacts.

CFO Thierry Piéton, who joined in March, emphasised strong fundamentals, disciplined execution, and a focus on mitigating tariff risks.

Piéton said: “Our fiscal 2026 guidance reflects increasing revenue growth contribution from our key growth drivers, and increased investment to support their growth, leading to leveraged operating profit growth pre-tariffs. In addition, the team has rallied to identify opportunities to offset a large portion of tariffs, and we have high confidence in our ability to execute additional mitigation efforts.”

“This is an exciting time to join Medtronic. I am energised by the opportunities for durable growth and value creation ahead of us.”

Medtronic’s strategy hinges on leveraging its investments while optimising profitability.

Chairman and CEO Geoff Martha is bullish about Medtronic’s trajectory, citing accelerating revenue and operating leverage.

“We had a strong close to our fiscal year, and I’m excited to see the progress we are making as our growth drivers continue to build momentum. Operationally, we translated our accelerating revenue growth into earnings leverage, as we delivered at the upper end of the commitments that we laid out a year ago,” said Martha.

“The underlying fundamentals of our business are strong, and they are getting stronger. We are now at an inflection point as we accelerate our speed of travel to higher, more profitable growth.”

Medtronic is positioned at an inflection point, primed for higher, more profitable growth.

With a clear strategic roadmap, innovative product launches, and disciplined financial management, Medtronic’s fiscal outlook remains compelling for global investors.

At the time of writing, Medtronic PLC's (NYSE: MDT) share price was US$84.41, down $1.96 (2.27%) today. It has a market cap of around $108.26 billion.