Lindt & Sprüngli fell to a multi-month low on Tuesday after the Swiss chocolate maker missed earnings expectations and trimmed its full-year profit margin outlook, citing the impact of persistently high cocoa prices.

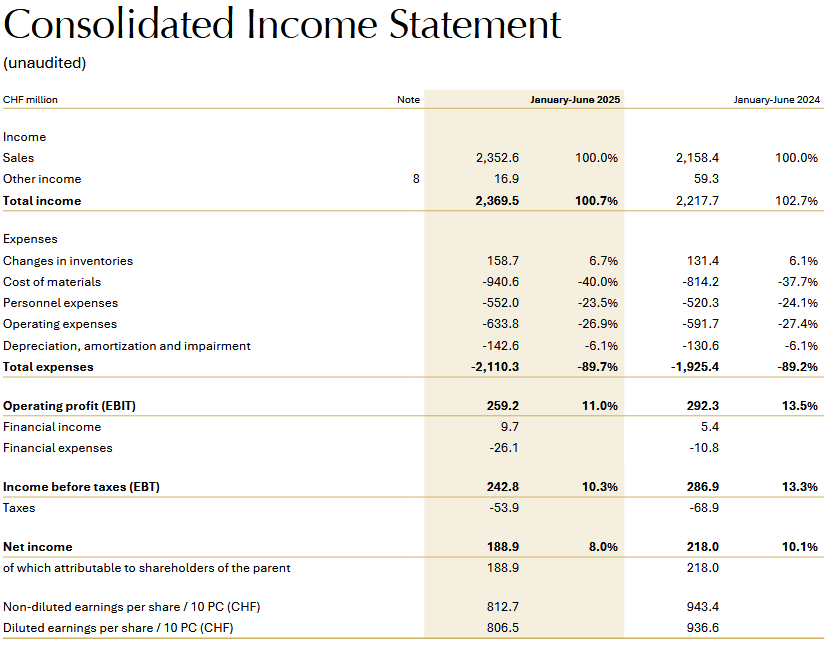

The company reported first-half earnings per share of CHF806.5, slightly below the 813 that analysts had forecast.

While revenues beat expectations, coming in at 2.35 billion versus 2.3 billion expected, the company’s operating profit dropped 11% to 259.2 million, missing the 270.9 million anticipated.

Chocolate manufacturers have been contending with sharply rising raw-material costs following a record surge in cocoa prices last year. Although prices have eased from their December 2024 peak of nearly $13,000 per metric ton, they remain historically elevated.

Cocoa currently trades above $8,000 per ton - still more than double its level at the start of 2024.

The price rally was driven by weather-related supply concerns in Ghana and Ivory Coast, the world’s largest cocoa producers. But the rally has since reversed as demand destruction sets in, with confectioners cutting back purchases in response to high input costs.

Lindt has attempted to offset these pressures through price hikes, but they have failed to fully absorb the impact of elevated cocoa costs.

Looking ahead, Lindt said it now expects to grow its full-year operating profit margin at the lower end of its previously projected 20 to 40 basis-point range.

Despite Tuesday’s pullback, Lindt’s shares remain up 26% year-to-date. However, the registered shares—those with voting rights—slid 6.7% in late European trading following the results.

Group CEO Adalbert Lechner praised the company’s efforts amid difficult conditions. "I’m proud of what our teams achieved in the first half of the year. We have shown resilience in a challenging market environment. Innovations like our Lindt Dubai Style Chocolate aren’t just new products, they’re a reflection of how we connect with our consumers and reinforce our premium positioning."

Lindt also raised its full-year organic sales growth forecast to between 9% and 11%, up from the prior 7% to 9%.

On Tuesday, Lindt (SIX: LISN) stock fell 6.4% to close at CHF$126,200. The company's market cap stands at CHF28.91 billion.