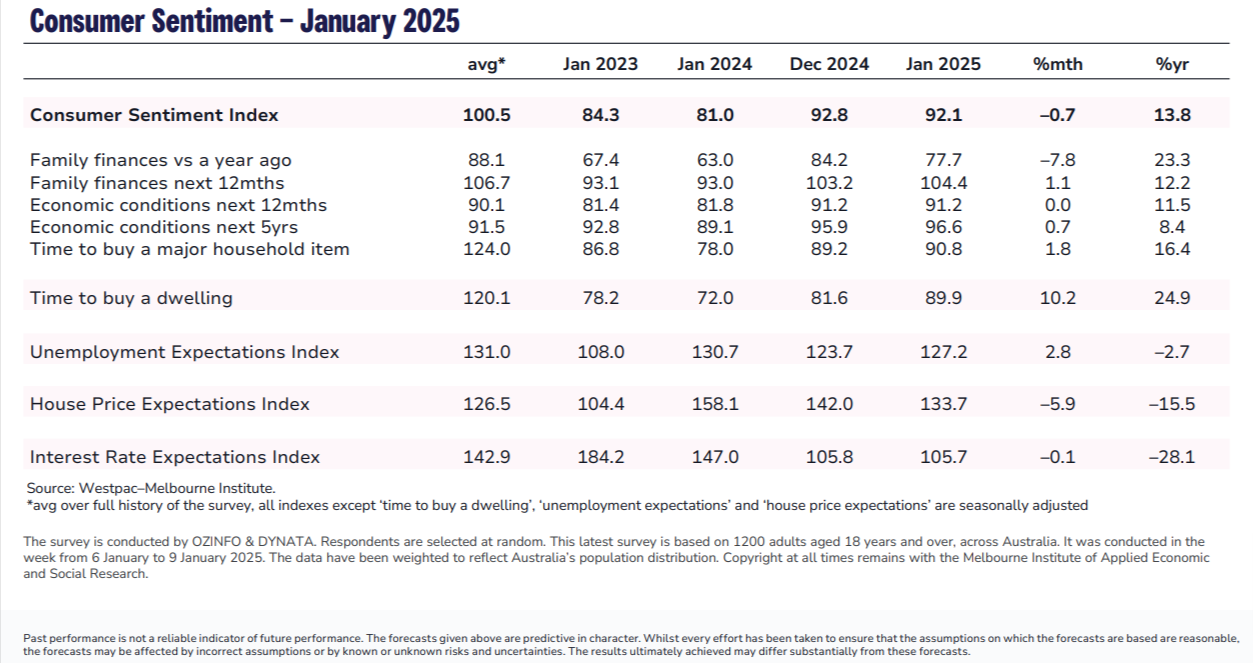

The Westpac-Melbourne Institute's Consumer Sentiment Index dropped to 92.1 in January from 92.8 in December - a 0.7% decrease.

This shows that consumers have felt less confident for two months now and are generally pessimistic about the future. Interestingly, the survey's results got worse as it went on, but people are feeling a bit better compared to last year. Some parts of the survey suggest that there’s hope for improvement moving forward.

The Consumer Sentiment Index is made up of five parts: two looking at current conditions and three looking ahead. In January, the scores for current conditions went down, while the ones predicting the future stayed the same or got better. This is different from December, when the opposite happened.

The survey was done from 6-9 January. Even though seasonal changes were already considered, it’s notable that all five parts of the index worsened in the last two days of the survey compared to the first two days.

There wasn’t a clear political event causing this change, but news about the Australian dollar dropping against the US dollar might have influenced people’s feelings. This led to negative news about interest rates and the economic outlook.

People's views on their finances compared to a year ago dropped by 7.8% to 77.7, especially among homeowners. Renters saw a small decline too. However, homeowners with mortgages felt a 15% improvement, bringing their outlook back to 2022 levels, likely because they benefitted from last year's tax cuts. Despite this, the positive impact of tax cuts is being balanced out by other factors like rising living costs.

Looking ahead, consumer confidence about whether it's a good time to buy big household items stayed stable. People’s expectations about their finances for the next year got better after a decline last month. Their confidence in the economy's outlook for the coming year stayed the same after a dip in December. Views about the economy five years from now improved slightly, up 0.7% in January, but this component is still below November's level.

“The Reserve Bank Board next meets on February 17–18. Recent communications indicate that the Board is becoming more confident about returning inflation to the 2–3% target band," said Luci Ellis, Chief Economist Westpac Group.

"However, the latest sentiment survey highlights some of the ‘mixed signals’ still coming from the consumer. In addition, the labour market appeared to stop easing in the second half of 2024. There is still a chance the Board moves in February or April, if inflation comes in below expectations for the December quarter. On balance, though, Westpac expects the Board to leave interest rates unchanged at its February meeting, with an easing expected to commence in May.”