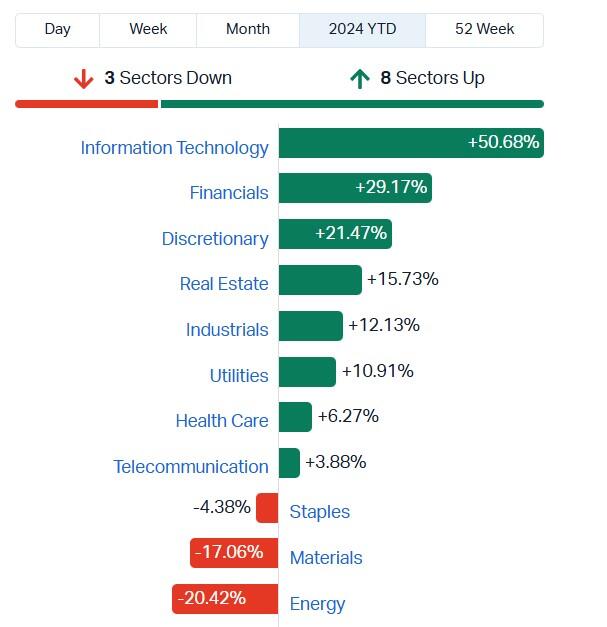

December may end up being ‘mensis horribilis’ for the local share market with only staples, discretionary, healthcare and industrials managing to post weak single-digit growth of 2%, 1.7%, 1.4% and 0.51% respectively. However, calendar year 2024 was a different story with eight of the ASX’s 11 sectors looking set to end the year well up on where they started.

The S&P/ASX 200 Information Technology is the standout sector year to date (YTD), up a whopping 50%. The potential of generative AI has clearly captured investors’ imaginations, but what’s also reignited sentiment towards the sector at large is the re-election of Donald Trump, whose promising fiscal stimulus of which tech companies would be major beneficiaries.

Taking silver and bronze place were financials and discretionary sectors with gains of 29.1% and 21.4% a piece.

At the other end of the spectrum, energy and materials were the market’s two worst performing sectors, down 20% and 17% respectively. Much of this can be attributed to weak underlying demand for commodities, with the iron ore outlook being impacted by growing volumes – as new players enter the market – plus sustained weakness within the China market.

Energy also took a major hit this year on the back of market concerns over falling demand amid slowing global economies.

Overall, out of the eight [sectors] that went up (YTD), only two struggled to hit double-digit territory with health care and telecommunications posting more modest returns of 6.2% and 3.8% respectively.

A rally by the major banks contributed strongly to the heavily weighted ASX200 which along with the All Ords Index look to be turning in their best annual performance in three years, with both nudging double digits (currently 8.30% and 9.5% YTD respectively).

While all of the big-four banks up by double-digits YTD, both Commonwealth Bank (ASX: CBA) and Westpac (ASX: WBC) are up 40% and 41% respectively.

The S&P/ASX 200 is currently trading at a forward price-to-earnings of 19 times while the S&P 500 is at 25 times.